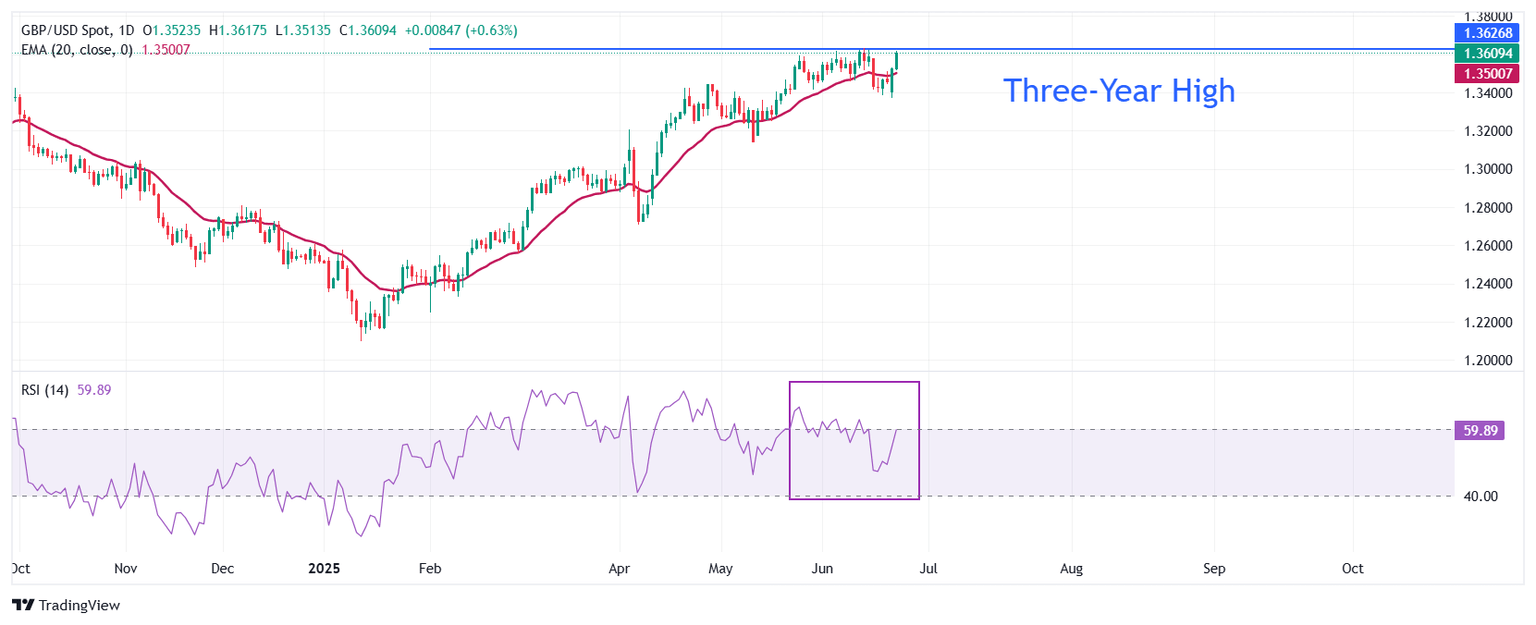

Pound Sterling Price News and Forecast: GBP/USD overtakes 1.3600

GBP/USD overtakes 1.3600 as ceasefire uncertain, Powell tempers rate cut hopes

The Pound Sterling extended its gains versus the US Dollar on Tuesday, as the proposed ceasefire between Israel and Iran was violated by both parties, despite US President Donald Trump's warning. Nevertheless, the risk appetite remains strong, despite the ongoing developments in the Middle East. The GBP/USD trades above 1.3600, gaining over 0.65%, after printing a weekly high of 1.3626. Read More...

Pound Sterling reclaims three-year high against USD after Israel-Iran ceasefire

The Pound Sterling (GBP) extends its Monday’s upside move to near 1.3630 against the US Dollar (USD) during European trading hours on Tuesday. The GBP/USD pair strengthens as a global risk rally driven by the ceasefire between Israel and Iran has dampened demand for safe-haven assets such as the US Dollar. Read More...

GBP/USD attracts some buyers above 1.3550 after Middle East ceasefire

The GBP/USD pair gains traction to around 1.3560 during the early European session on Tuesday, bolstered by the weaker US Dollar (USD). Traders will closely watch the Bank of England's (BoE) Governor Bailey speech, along with the Federal Reserve's (Fed) Chair Jerome Powell’s semiannual testimonies later on Tuesday. Read More...

Author

FXStreet Team

FXStreet