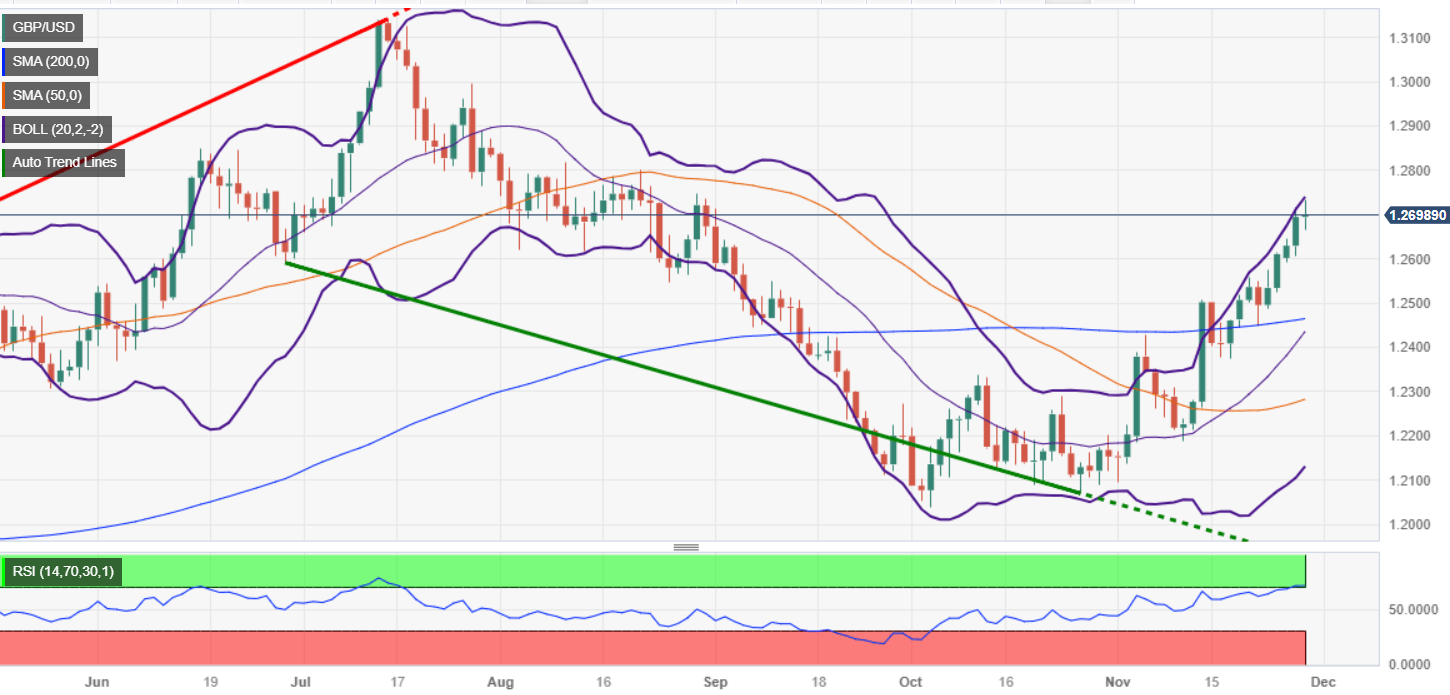

Pound Sterling Price News and Forecast: GBP/USD outlook remains bullish in light of Fed's Waller comments

GBP/USD holds gains above 1.2700 amid Fed divergent views

The British Pound (GBP) clings to minimal gains vs. the Greenback (USD) in the mid-North American session after data from the United States (US) showed the economy remains resilient and growing above trend. Nevertheless, some Federal Reserve (Fed) officials remained dovish, while investors began to price in a dovish Fed. The GBP/USD is trading at 1.2703, slightly above the 1.2700 figure.

Pound Sterling remains underpinned by expectations for more than 100 bps of rate cuts by the Fed in 2024. Read more...

GBP/USD: Losses likely to remain limited in the near-term – Scotiabank

GBP/USD tests retracement resistance in the low 1.27s. Economists at Scotiabank analyze the pair’s outlook. Read more...

Author

FXStreet Team

FXStreet