Pound Sterling Price News and Forecast: GBP/USD oscillates in a range above its lowest level since June 13

GBP/USD consolidates near multi-month low, holds above mid-1.2500s on subdued USD demand

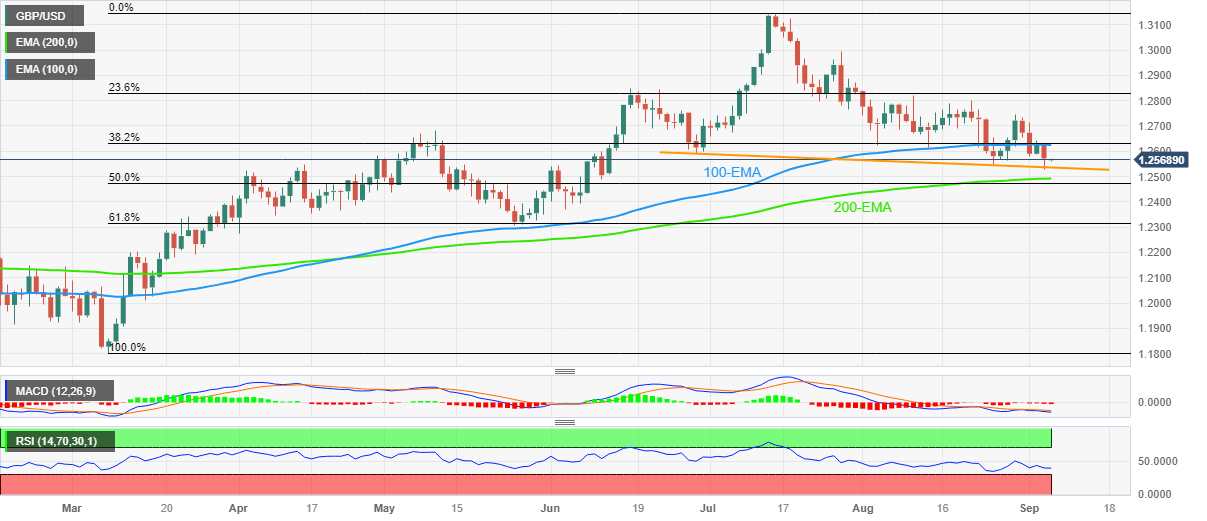

The GBP/USD pair struggles to capitalize on the overnight modest bounce from the 1.2530-1.2525 region, or its lowest level since June 13 and oscillates in a narrow trading band through the Asian session on Wednesday. Spot prices currently hover around the 1.2570 region, up less than 0.10% for the day, and remain at the mercy of the US Dollar (USD) price dynamics.

The USD Index (DXY), which tracks the Greenback against a basket of currencies, consolidate its recent move up to a nearly six-month top, which, in turn, is seen as a key factor acting as a tailwind for the GBP/USD pair. Apart from this, expectations that the Bank of England (BoE) will continue with its policy tightening cycle to combat high inflation lends some support to the British Pound (GBP). In fact, money market futures indicate over 85% chance that the BoE will hike interest rates by 25 bps, for the fifteenth time in September. Read more...

GBP/USD Price Analysis: Cable bears need validation from 1.2530 and US ISM Services PMI

GBP/USD portrays a corrective bounce off the short-term key support line while picking up bids to 1.2570 during the early hours of Wednesday’s trading.

The Cable pair dropped to the lowest level since June 13 amid broad US Dollar strength before a 2.5-month-long falling trend line joined downbeat oscillators to trigger the quote’s bounce. However, the cautious mood ahead of the US ISM Services PMI for August, expected 52.6 versus 52.7 prior, as well as the final readings of the US S&P Global PMIs for the said month, prod the Pound Sterling traders of late. Read more...

Author

FXStreet Team

FXStreet