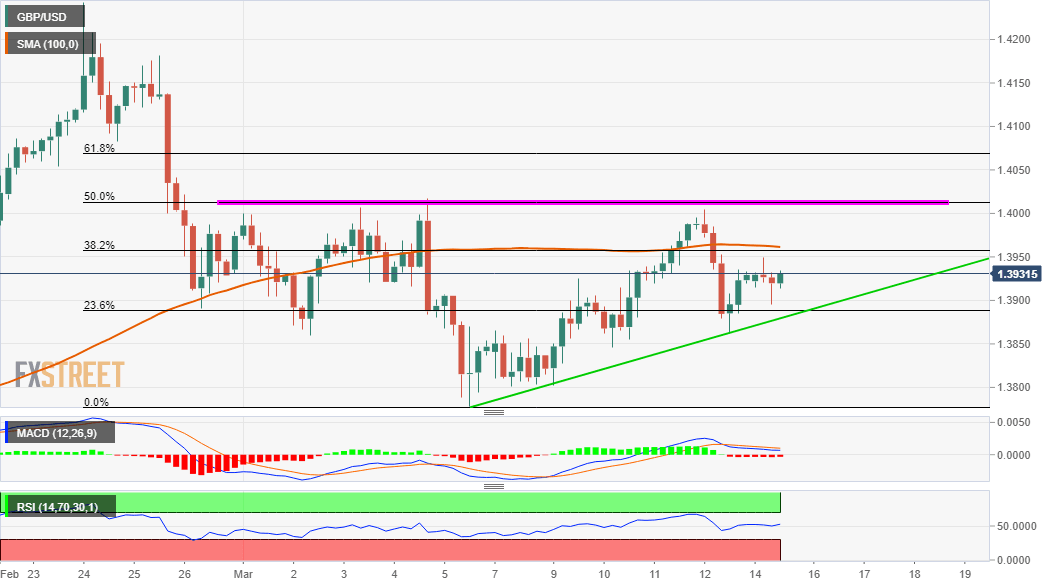

Pound Sterling Price News and Forecast: GBP/USD neutral bias while above 1.3890 confluence support

Weekly technical and trading outlook – GBP/USD

GBP/USD - 1.3930.. Despite initial choppy swings abv Mar's 1.3779 low last week, price ratcheted higher fm 1.3801 (Mon) to 1.4005 on Fri due to active buying of sterling b4 retreating to 1.3864 in NY morning on profit taking.

On the bigger picture, despite cable's brief break of 2016 post-Brexit low of 1.1491 to a near 35-year trough of 1.1412 in mid-Mar 2020 on safe-haven usd's demand following free fall in global stocks, sterling's rally to as high as 1.2812 (Jun) on broad-based usd's weakness, then to an 8-month peak of 1.3482 in Sep suggests a major bottom is in place. Although cable rallied strongly to 1.3686 on the last trading day of 2020 following a last-minute EU-UK trade deal, then to a 34-month peak at 1.4241 in late Feb, subsequent fall to 1.3779 in Mar signals top is made n stronger retracement to 1.3636, then twd 1.3566 is envisasaged. Only abv 1.4017 signals 1st leg of correction over, risks 1.4120/30. Read more...

GBP/USD Outlook: Neutral bias while above 1.3890 confluence support

The GBP/USD pair lacked any firm directional bias on the first day of a new trading week and seesawed between tepid gains/minor losses through the early European session. The US dollar remained well supported by expectations for a relatively faster US economic recovery from the pandemic and the recent sharp rise in the US Treasury bond yields. Investors remain optimistic about the US economic outlook amid the impressive pace of COVID-19 vaccinations and the passage of a massive US fiscal stimulus.

In fact, US President Joe Biden signed a $1.9 trillion aid package into law and provided a strong boost to the near-term outlook for the US economy. The reflation trade has been fueling speculations about a possible uptick in US inflation and raised doubts that the Fed would retain ultra-low interest rates for a longer period. Read more...

GBP/USD: Steady above 1.3900 with eyes on UK PM Johnson

GBP/USD wavers around 1.3925-30 while heading into Monday’s London open. In doing so, the cable struggles for a clear direction after Friday’s pullback from the one-week top. Although a light calendar and the US dollar strength could be cited as catalysts behind the moves, the pair traders’ cautious mood ahead of UK PM Boris Johnson’s speech seems to be the main factor for the recent inactivity.

The Times came out with the news, during the weekend, suggesting vaccines for all British adults by early June. This becomes, “an achievement forecast to be worth tens of billions of pounds,” as per the analysis from The Times. Read more...

Author

FXStreet Team

FXStreet

-637513927867090933-637514054025403088.png&w=1536&q=95)