GBP/USD Outlook: Neutral bias while above 1.3890 confluence support

- GBP/USD was seen oscillating in a range through the early European session on Monday.

- The upbeat US economic outlook underpinned the USD and capped the upside for the pair.

- The downside remains cushioned as investors wait for the UK PM Boris Johnson’s speech.

The GBP/USD pair lacked any firm directional bias on the first day of a new trading week and seesawed between tepid gains/minor losses through the early European session. The US dollar remained well supported by expectations for a relatively faster US economic recovery from the pandemic and the recent sharp rise in the US Treasury bond yields. Investors remain optimistic about the US economic outlook amid the impressive pace of COVID-19 vaccinations and the passage of a massive US fiscal stimulus.

In fact, US President Joe Biden signed a $1.9 trillion aid package into law and provided a strong boost to the near-term outlook for the US economy. The reflation trade has been fueling speculations about a possible uptick in US inflation and raised doubts that the Fed would retain ultra-low interest rates for a longer period. This, in turn, pushed the yield on the benchmark 10-year US government bond to over one-year tops, which was seen as another factor that benefitted the USD bulls and weighed on the major.

Despite the negative factor, the pair, so far, lacked any follow-through selling and was seen oscillating within Friday's broader trading range. In the absence of any major market-moving economic releases from the UK, traders now look forward to the UK Prime Minister Boris Johnson's speech for some impetus. That said, any movement in either direction is likely to remain limited as investors might refrain from any aggressive bets, rather prefer to wait on the sidelines ahead of the FOMC monetary policy meeting.

In the meantime, the US bond yields might influence the USD price dynamics and produce some trading opportunities around the major. Later during the early North American session, the only release of the Empire State Manufacturing Index from the US might dod little to impress traders or provide any meaningful impetus.

Short-term technical outlook

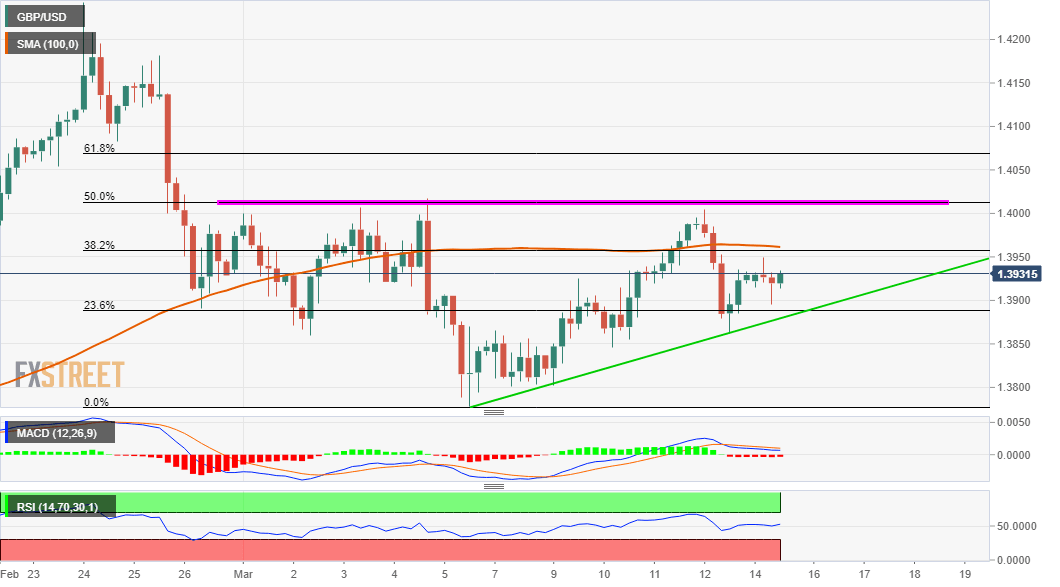

From a technical perspective, repeated failures near the key 1.4000 psychological mark constitute the formation of a bearish double-top pattern on short-term charts. However, the lack of any strong follow-through warrants some caution for aggressive bearish traders.

Hence, any decline is likely to find decent support near the 1.3890-85 confluence region, comprising of over one-week-old ascending trend-line and the 23.6% Fibonacci level of the 1.4243-1.3779 corrective slide. A convincing break below will be seen as a fresh trigger for bearish traders and turn the pair vulnerable to accelerate the slide back towards testing monthly lows, around the 1.3780 region.

On the flip side, the 38.2% Fibo. level, around the 1.3955-60 region now seems to act as immediate strong resistance. A sustained strength beyond might assist bulls to make a fresh attempt towards conquering the 1.4000 mark. The latter coincides with the 50% Fibo. level, which if cleared decisively has the potential to push the pair further towards the 1.4070 region (61.8% Fibo.) en-route the 1.4100 mark.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.