Pound Sterling Price News and Forecast: GBP/USD moves little as traders remain cautious amid uncertainty

GBP/USD steadies around 1.3650 due to rising uncertainty over Trump's tariff plans

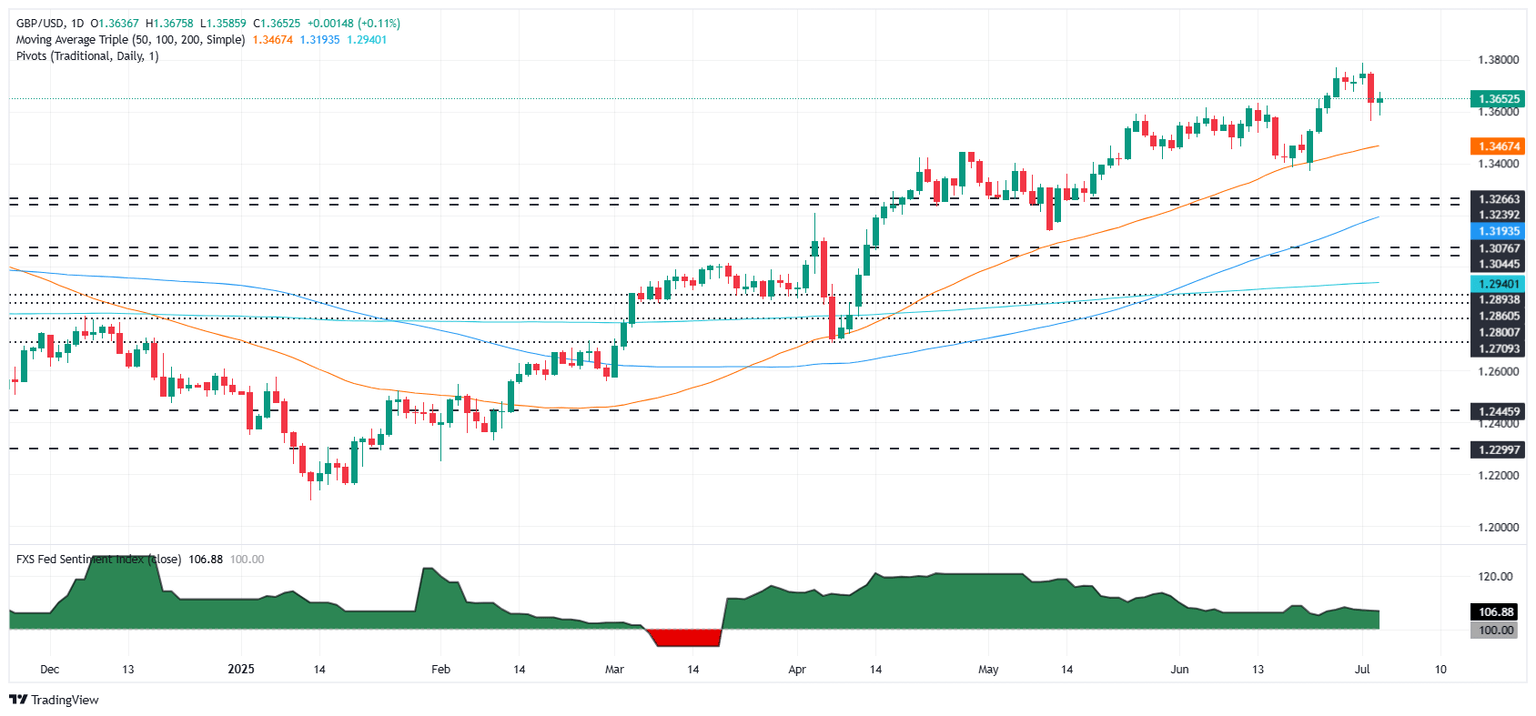

GBP/USD holds ground for the second consecutive day, trading around 1.3660 during the Asian hours on Friday. The pair remains steady as the US Dollar (USD) depreciates as traders adopt caution, while seeking clarity on US President Donald Trump's plans for tariffs on various countries. On Thursday, Trump told reporters that he “will begin sending letters on trade tariffs starting Friday.” He added that he would send letters to 10 countries at a time, laying out tariff rates of 20% to 30%, reported by Reuters.

The GBP/USD pair maintains its position as the Pound Sterling (GBP) receives support after Prime Minister (PM) Keir Starmer’s defense of Chancellor Rachel Reeves. PM Starmer affirmed that she would remain in her role of chancellor “for a very long time to come.” This helped ease market concerns that a potential replacement might adopt a looser fiscal stance with increased borrowing. Read more...

GBP/USD grapples with recovery ahead of quiet end to the week

GBP/USD churned away near the low-end of a near-term decline on Thursday, bolstered by selling pressure forcing the US Dollar lower after US Nonfarm Payrolls (NFP) jobs data came in hotter than expected. Markets were expecting a below-forecast print after this week’s ADP jobs preview showed a sharp contraction in private payrolls, but a steep increase in government-based education hiring offset declines in private sector employment.

Friday is set to fizzle in market impact terms. The US side of markets shuttered early on Thursday, and will remain closed for the US holiday on Friday. A mid-tier public appearance from Bank of England (BoE) policymaker Alan Taylor is slated for Friday, but is unlikely to move markets. There is little else of material importance on the UK side of the data docket for Friday. Read more...

GBP/USD steady despite US jobs surprise, Reeves uncertainty caps gains

The Pound Sterling (GBP) remains steady against the US Dollar (USD) on Thursday, after a solid Nonfarm Payrolls (NFP) report in the United States (US) cemented the case for the Federal Reserve (Fed) to hold rates in July, as the Unemployment Rate ticked lower. At the time of writing, GBP/USD is trading at 1.3634, virtually unchanged.

The US Bureau of Labor Statistics (BLS) reported that the US economy added 147,000 people to the workforce, exceeding estimates of 110,000 and May’s 144,000 print. The Unemployment Rate came at 4.1% down from 4.2%. The data fortifies the Fed Chair Jerome Powell's stance of wait-and-see and assesses the potential impact of tariffs on inflation. Read more...

Author

FXStreet Team

FXStreet