Pound Sterling Price News and Forecast GBP/USD: More pain for the pound? Delta, data and future Fed moves all eyed

GBP/USD Weekly Forecast: More pain for the pound? Delta, data and future Fed moves all eyed

Flight to safety – that has been the main theme boosting the dollar as coronavirus cases have continued rising, and data has been mediocre at best. Will the Federal Reserve come to the rescue by pushing back against tapering its bond-buying scheme? That is the main question for investors who are also watching covid figures on both sides of the pond. Read more...

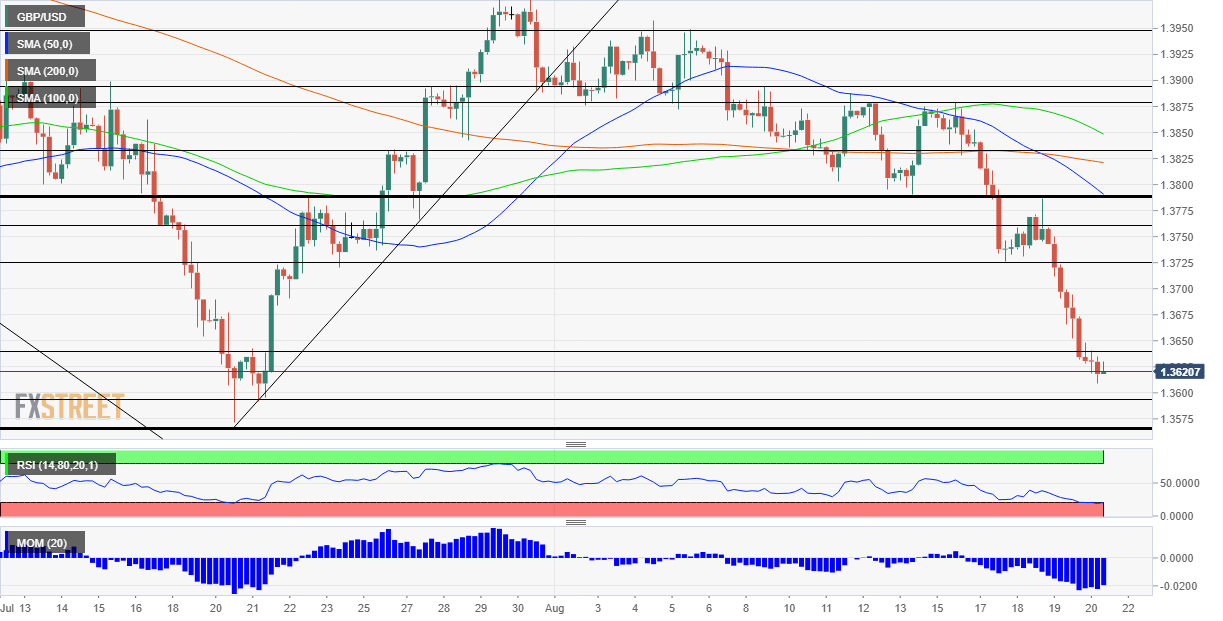

GBP/USD Price Analysis: 1.3570 is the next relevant target for bears

The GBP/USD pair added to the previous day's heavy losses and witnessed some follow-through selling on the last day of the week. This marked the fourth day of a negative move in the previous five and dragged the pair to the 1.3600 neighbourhood, or one-month lows during the mid-European session. Read more...

GBP/USD Forecast: Sterling is oversold, could find a bottom and then bounce

How low can sterling go? Further than many had thought, it seems. GBP/USD is down some 200 pips on the week in a sharp move mostly recorded after the Federal Reserve's meeting minutes raised expectations of tapering. If the Fed prints fewer dollars, the currency is worth more. Read more...

Author

FXStreet Team

FXStreet