Pound Sterling Price News and Forecast: GBP/USD may extend its gains due to improved risk sentiment

GBP/USD hovers around 1.2900, upside seems possible due to risk-on sentiment

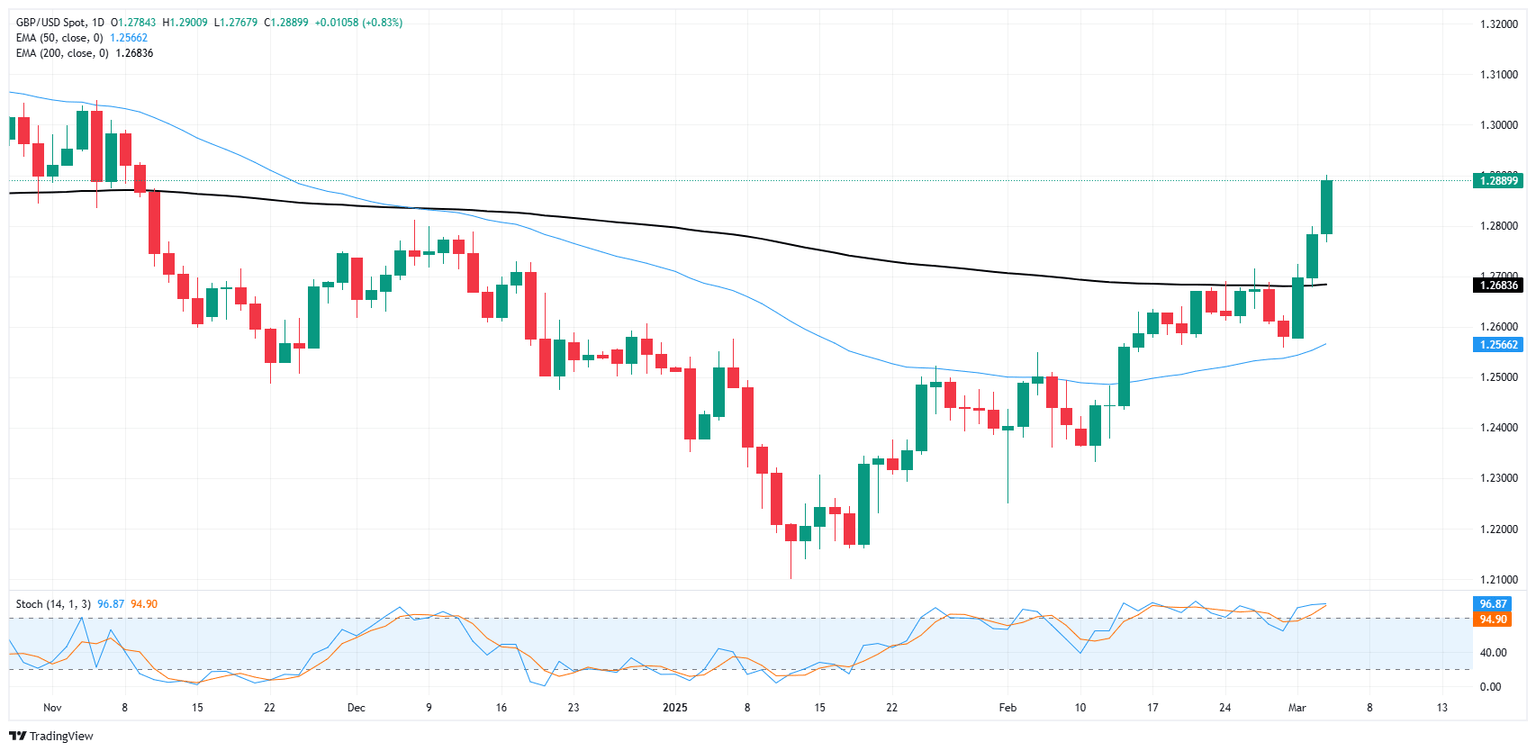

GBP/USD edges lower after registering gains for the last three consecutive days, trading around 1.2890 during the Asian hours on Thursday. The US Dollar remains under pressure following weaker-than-expected US private payroll data, raising concerns about slowing economic momentum in the United States (US). Additionally, improved risk sentiment puts downward pressure on the Greenback, driven by another shift in US President Donald Trump’s tariff strategy.

The ADP Employment Change report for February showed just 77K new jobs, significantly below the 140K forecast and well under March’s 186K reading. Market participants are now focused on Friday’s US Nonfarm Payrolls (NFP) report, which is expected to indicate a moderate recovery in job growth. Forecasts suggest net job additions will rise to 160K in February, up from January’s 143K. Read more...

GBP/USD continues to rally, searching for 1.2900

GBP/USD hit the gas pedal and pumped out another strong session on Wednesday, lurching higher by another 0.85% and notching in a third straight session of firmly bullish gains. Pound markets are firmly recovering after weeks of uneasy risk appetite, pushing GBP/USD to 16-week highs.

Despite warnings that the UK economy is overall weakening, Cable markets rallied following Wednesday’s Monetary Policy Hearings from the Bank of England (BoE). According to BoE Governor Andrew Bailey, A modest uptick in inflation is expected despite weaker growth figures, causing markets to readjust their rate-cut expectations for the rest of 2025. Rate markets now see less than 50 bps of total interest rate trims for the remainder of the year. Read more...

GBP/USD surges as weak US data fuels Fed rate-cut bets

The Pound Sterling (GBP) extended its gains versus the US Dollar (USD) on Wednesday, as market participants punished the latter. Market participants priced in additional monetary policy easing by the Federal Reserve (Fed). United States (US) data shows the economy is weakening, with businesses and consumers turning pessimistic, mostly on trade policies. GBP/USD is trading at 1.2864, up over 0.55%.

The US jobs market continues to slow down, as depicted by the ADP Employment Change for February. Companies added 77K people to the workforce, missing estimates of 140K and well below the 188K hired in January. Read more...

Author

FXStreet Team

FXStreet