Pound Sterling Price News and Forecast: GBP/USD lurched into a fresh 29-month peak

GBP/USD scours fresh highs on Greenback weakness

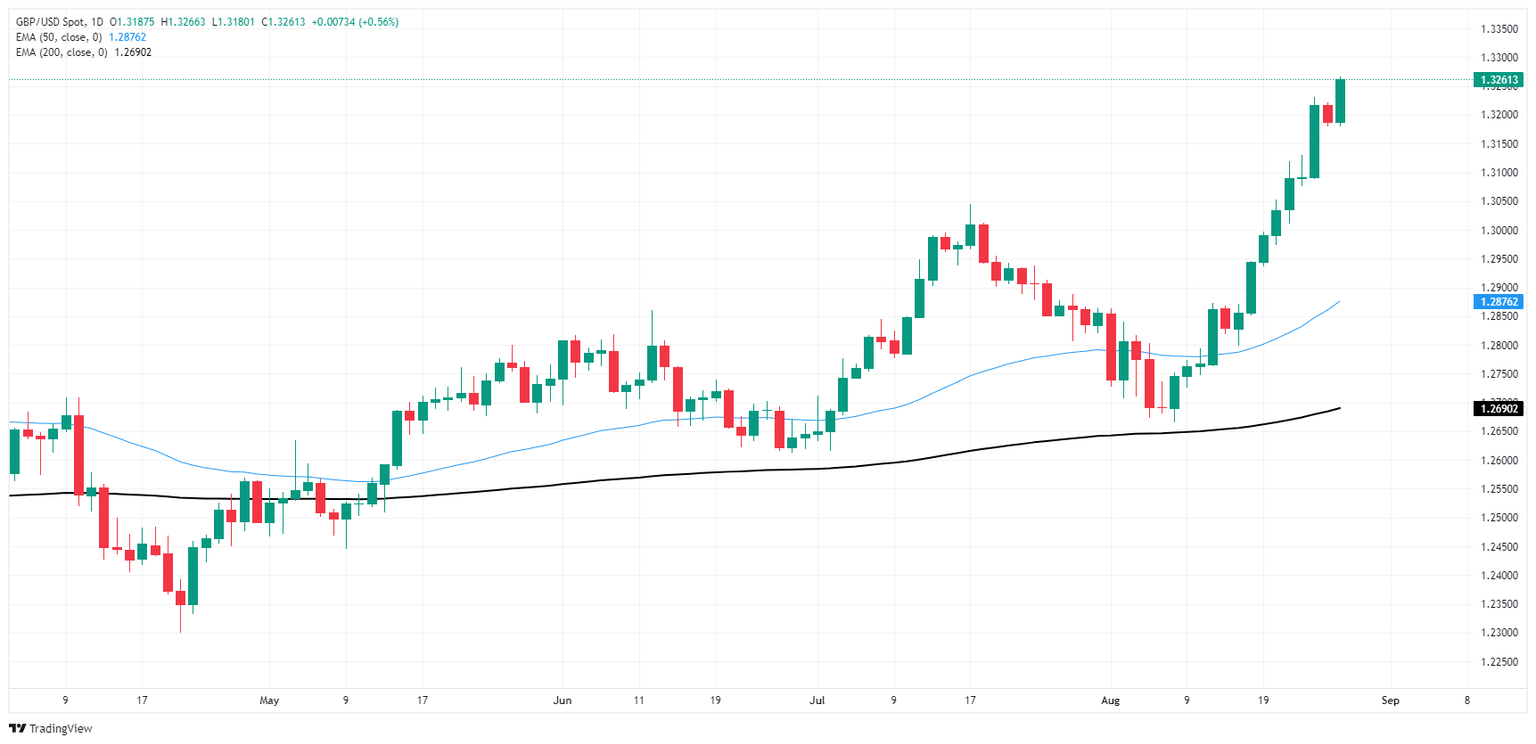

GBP/USD tested into a fresh multi-year high on Tuesday, easing into a 29-month peak of 1.3266 as the Pound Sterling continues to catch a ride on a broad-market Greenback sell wave. Investors have piled into hopes for a September rate cut from the Federal Reserve (Fed), and US Personal Consumption Expenditure Price Index (PCE) inflation figures not due until Friday leave markets with little meaningful data to chew on until then.

Fed Chair Jerome Powell all but confirmed that the central bank will pivot into a rate-cutting cycle on September 18 during an appearance at the Jackson Hole Economic Symposium last Friday, sending market appetite into the ceiling once again. Read more...

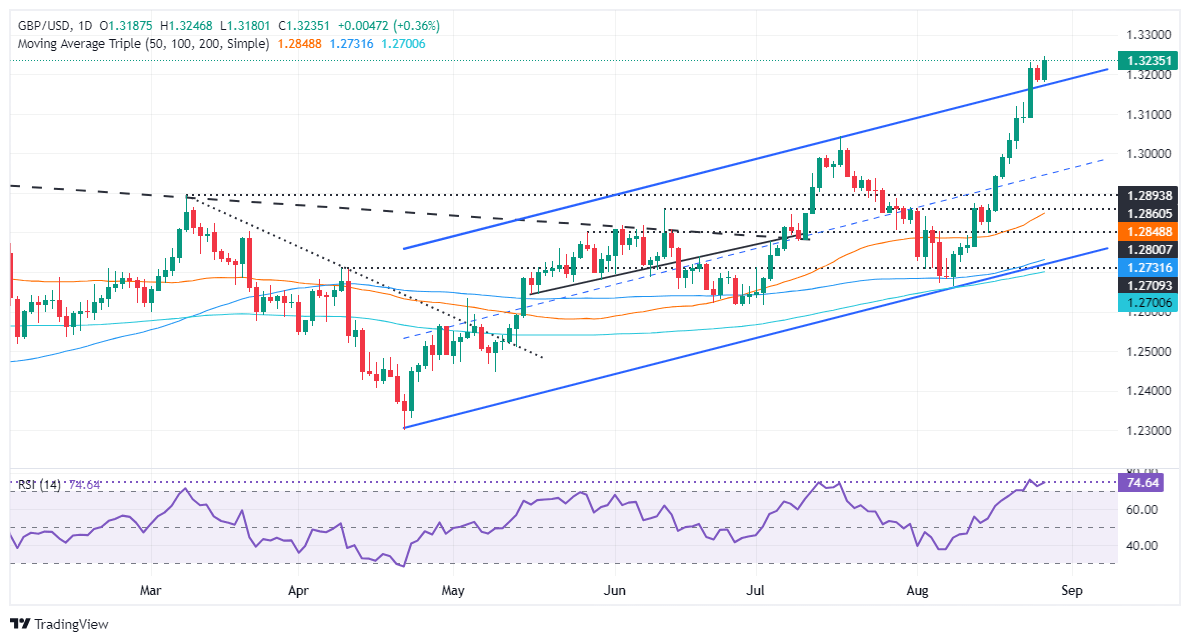

GBP/USD Price Forecast: Reaches new multi-year high above 1.3200

The Pound Sterling extended its gains and refreshed multi-year highs at around 1.3246 on Tuesday as the Greenback failed to recover following a surprisingly dovish tilt by Fed Chair Jerome Powell at his Jackson Hole speech. Investors increased their bets that the US central bank will lower rates at the September meeting, a tailwind for the GBP/USD. The pair exchanged hands at 1.3239 and is up by 0.40%.

The uptrend in the GBP/USD continues even though the Relative Strength Index (RSI) is overbought, which could cap the pair’s advance higher. Nevertheless, reclaiming the top trendline of an ascending channel could put into play the test of the March 22, 2022, peak at 1.3298 before challenging higher prices. Read more...

Author

FXStreet Team

FXStreet