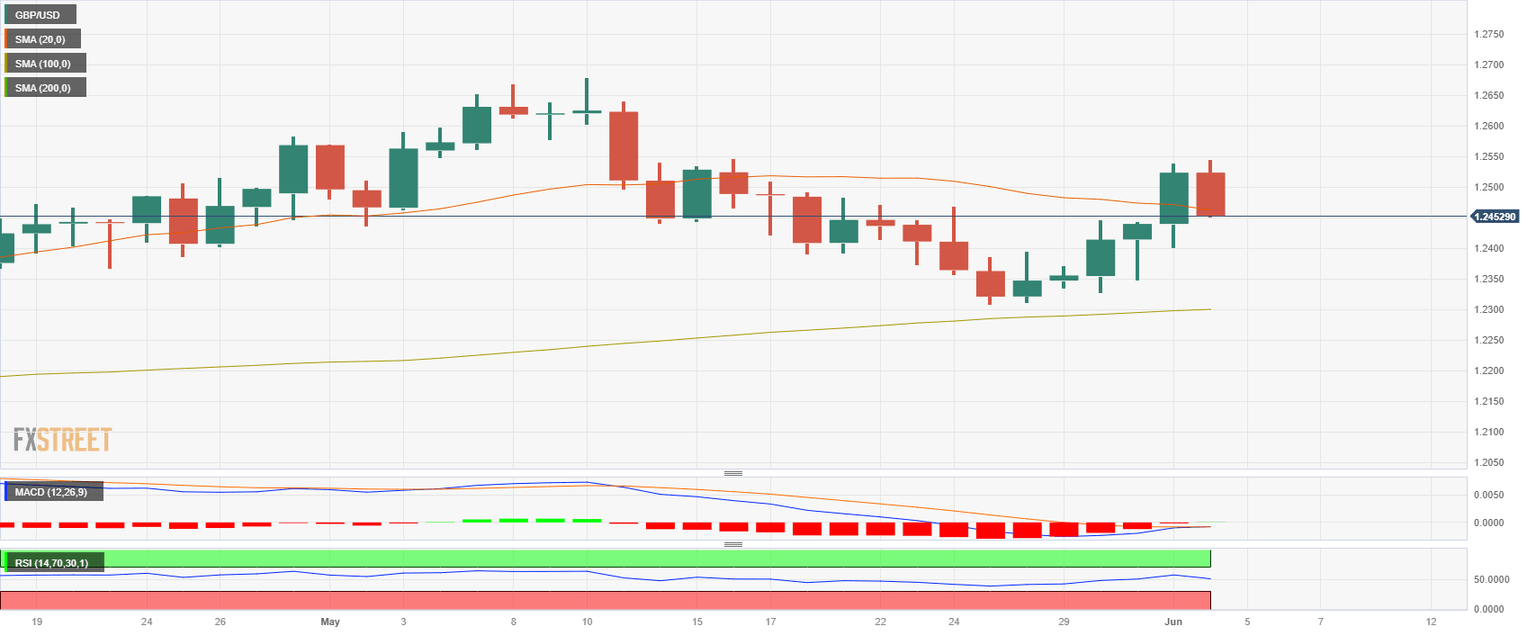

GBP/USD loses the 20-day SMA post US NFP

The GBP/USD fell more than 0.50% to a daily low of 1.2453 at the end of the week, following robust labor market data from the US, indicating a possible reconsideration of further rate hikes by the Federal Reserve (Fed). As a result, the

US Dollar strengthened due to rising US bond yields, while the Sterling Pound continued to face selling pressure while the British economic

calendar had nothing relevant to offer.

Read More...

GBP/USD reverses the post-NFP dip, flat-lines above 1.2500 amid subdued USD price action

The GBP/USD pair pulls back from a two-and-half-week high, around the 1.2545 region, touched this Friday and extends its steady intraday descent through the early North American session. Spot prices slip below the 1.2500 psychological mark, hitting a fresh daily low in reaction to the mixed US employment details, albeit lacks follow-through and recovers a few pips in the last hour.

Read More...

GBP/USD consolidates its recent gains to nearly three-week peak, US NFP report awaited

The GBP/USD pair enters a bullish consolidation phase near a two-and-half-week high touched on Friday and oscillates in a narrow band, around the 1.2530-1.2535 region through the first half of the European session.

Read More....