Pound Sterling Price News and Forecast: GBP/USD looks to stretch higher above 1.2250

GBP/USD Outlook: Bulls likely to retain control ahead of this week’s BoE meeting and NFP

The GBP/USD pair witnessed good two-way price moves on Friday and the intraday volatility was sponsored by the US dollar price dynamics amid some quarter-end position-squaring. The USD initially rose in reaction to the stronger US Personal Consumption Expenditures (PCE) price index, which accelerated to 6.8% YoY in June - the largest increase since January 1982. Excluding the volatile food and energy components, the core PCE price index - the Fed's preferred inflation gauge - shot up 0.6% and edged higher to the 4.8% YoY rate. The data reinforced bets that the Fed would stick to its policy tightening path as it deems necessary. This, in turn, provided a goodish lift to the greenback and exerted heavy downward pressure on the major.

The USD uptick, however, fizzled out quickly after the final University of Michigan report revealed that inflation expectations slipped to 5.2% in July. Furthermore, the Chicago PMI dropped to a 23-month low of 52.1 in July, which revived concerns about recession and overshadowed inflation worries. Read more ...

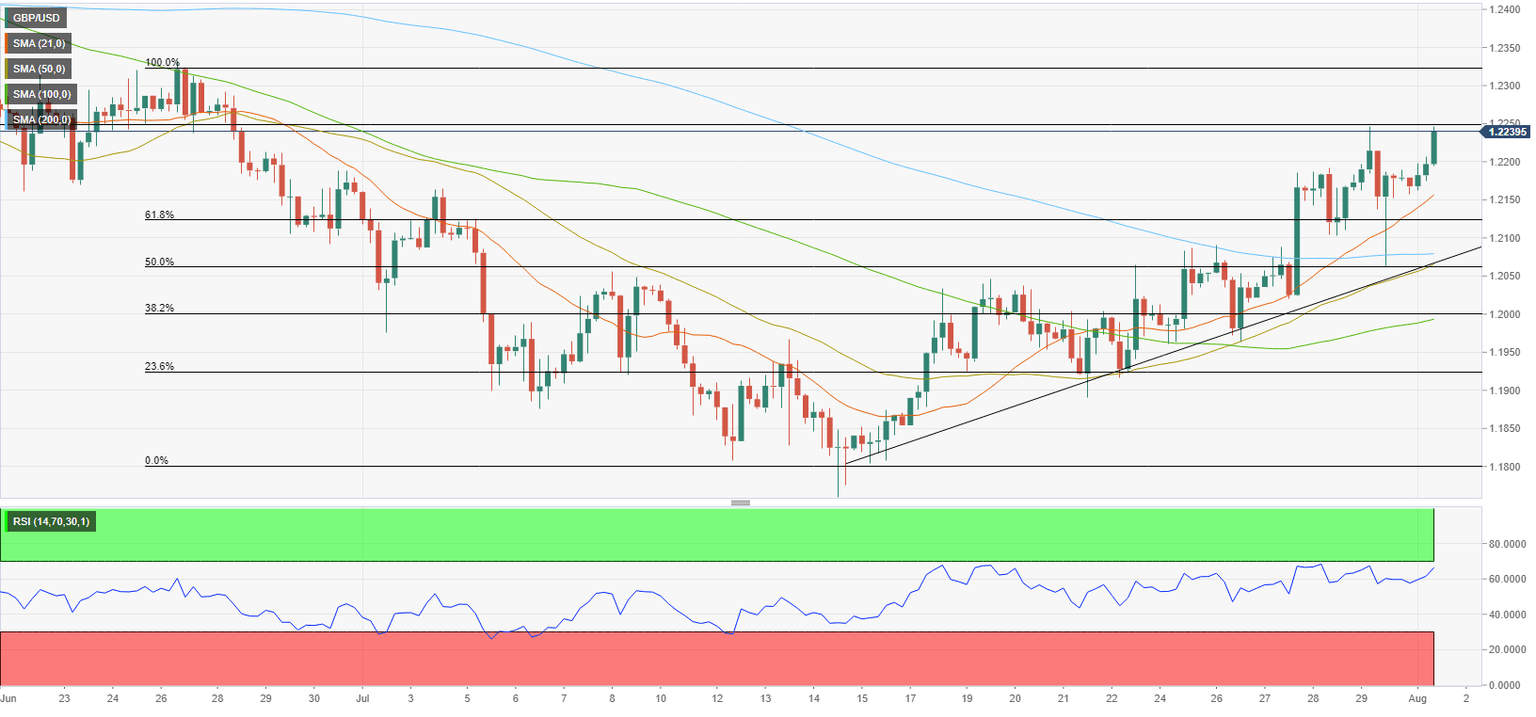

GBP/USD Forecast: Pound looks to stretch higher above 1.2250

GBP/USD has preserved its bullish momentum and climbed above 1.2200 after having gained more than 150 pips last week. The pair remains on track to test 1.2250 and a four-hour close above that level could open the door for additional gains.

Despite the hot inflation data from the US on Friday, the CME Group FedWatch Tool shows that markets are pricing in a 30% probability of a 75 basis points (bps) Fed rate hike in September. On the other hand, the market positioning shows that the Bank of England (BoE) is now widely expected to raise its key rate by 50 bps on Thursday. Hawkish BOE bets and the Fed's cautious stance seem to be helping GBP/USD edge higher but it's too early to say that the policy gap has started to narrow. Read more ...

GBP/USD climbs to fresh daily high, further beyond 1.2200 amid sustained USD selling

The GBP/USD pair jumps back above the 1.2200 mark during the early part of the European session, attracting fresh buying on the first day of a new week. Spot prices, however, still remain well below a one-month high at around the 1.2245 touched on Friday.

The US dollar languishes near its lowest level since July 5, which is turning out to be a key factor lending support to the GBP/USD pair. Market participants continue to scale back their expectations for more aggressive rate hikes by the Federal Reserve amid worries about an economic downturn. This, to a larger extent, overshadows Friday's stronger US Personal Consumption Expenditures (PCE) and continues to weigh on the greenback. Read more ...

Author

FXStreet Team

FXStreet

-637949281449283639-637949496805634626.png&w=1536&q=95)