Pound Sterling Price News and Forecast: GBP/USD is hovering for a breakout

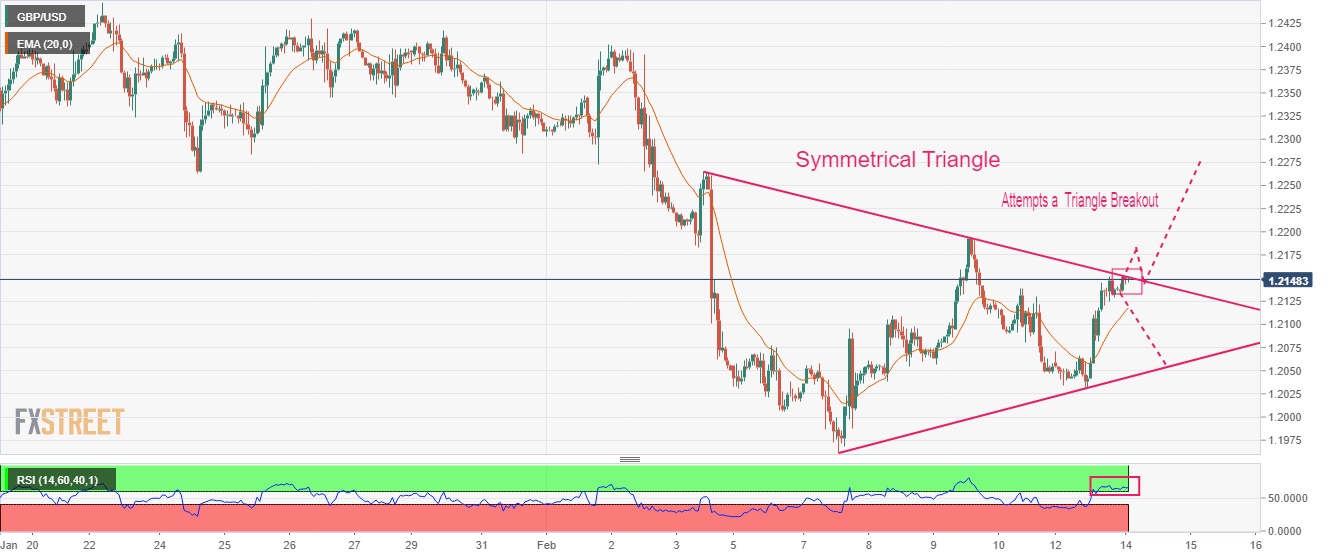

GBP/USD Price Analysis: A breakout of triangle looks likely amid positive market impulse

The GBP/USD pair has refreshed its day’s high above the critical resistance of 1.2150 in the Asian session. The Cable has picked strength amid the improved risk appetite of investors after they digested the United States inflation-inspired anxiety.

S&P500 futures are displaying a subdued performance after a bullish Monday, portraying a minor caution amid overall positive sentiment. The US Dollar Index (DXY) has further dropped below 102.85, showing a sheer decline in the safe-haven’s appeal. The Pound Sterling will display a power-pack action after the release of the United Kingdom employment data. Read more...

GBP/USD bulls approach 1.2150 ahead of UK employment, US inflation figures

GBP/USD marches towards 1.2150 while extending the week-start rebound from the key technical support to early Tuesday morning in Asia. In doing so, the Cable pair cheers the broad US Dollar pullback, as well as the risk-on mood, amid positive catalysts emanating from the UK. Adding strength to the quote’s recovery could be the trader’s preparations for the UK’s monthly employment data and the US Consumer Price Index (CPI) for January.

An end to the 20-day strikes by the London bus drivers and the British firms' readiness to inflate the workers’ pay by the most since 2012 seemed to have favored the GBP/USD buyers of late. The news becomes more important as Bank of England (BoE) policymaker Jonathan Haskel highlighted that further rate hikes will depend upon the incoming data. Read more...

Author

FXStreet Team

FXStreet