Pound Sterling Price News and Forecast: GBP/USD is aiming to recover Tuesday’s losses

GBP/USD Price Analysis: Sellers attack short-term key support above 1.2500

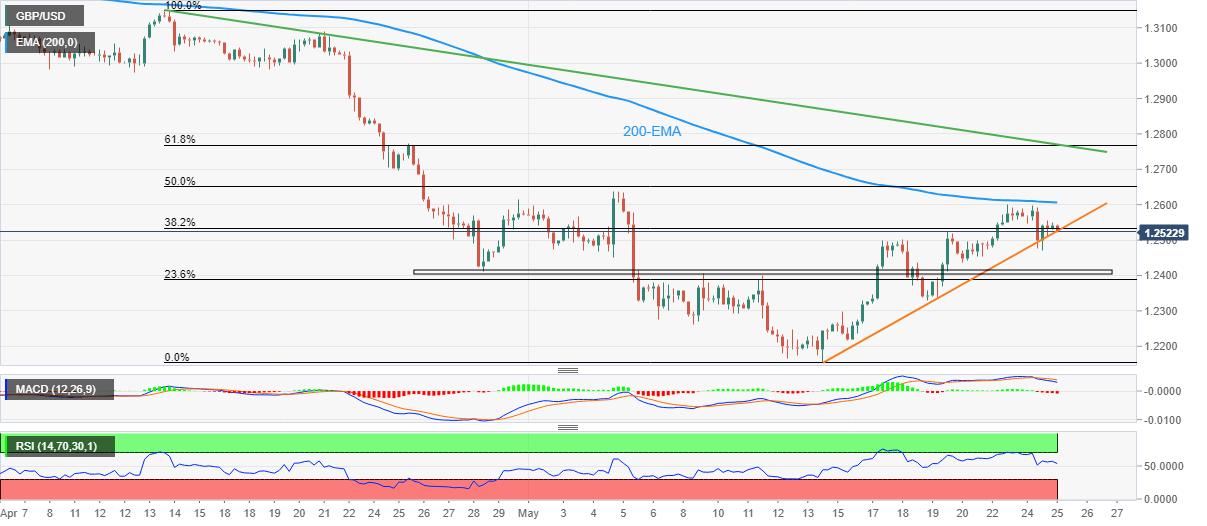

GBP/USD takes offers to refresh intraday low around 1.2520, extending the U-turn from the 200-EMA towards breaking a one-week-old support line during Wednesday’s Asian session. Given the cable pair’s inability to cross the 200-EMA, coupled with the bearish MACD signals, the quote is likely to break the immediate support near 1.2520.

GBP/USD eyes to recapture 1.2600 on positive market mood, FOMC eyed

The GBP/USD pair has rebounded gradually from a low of 1.2475 as positive market sentiment has underpinned the risk-sensitive currencies. The cable witnessed a steep fall on Tuesday after failing to overstep the round level resistance of 1.2600. The asset was offered on Tuesday amid poor S&P Global Purchase Managers Index (PMI) numbers.

Read More ...

Author

FXStreet Team

FXStreet