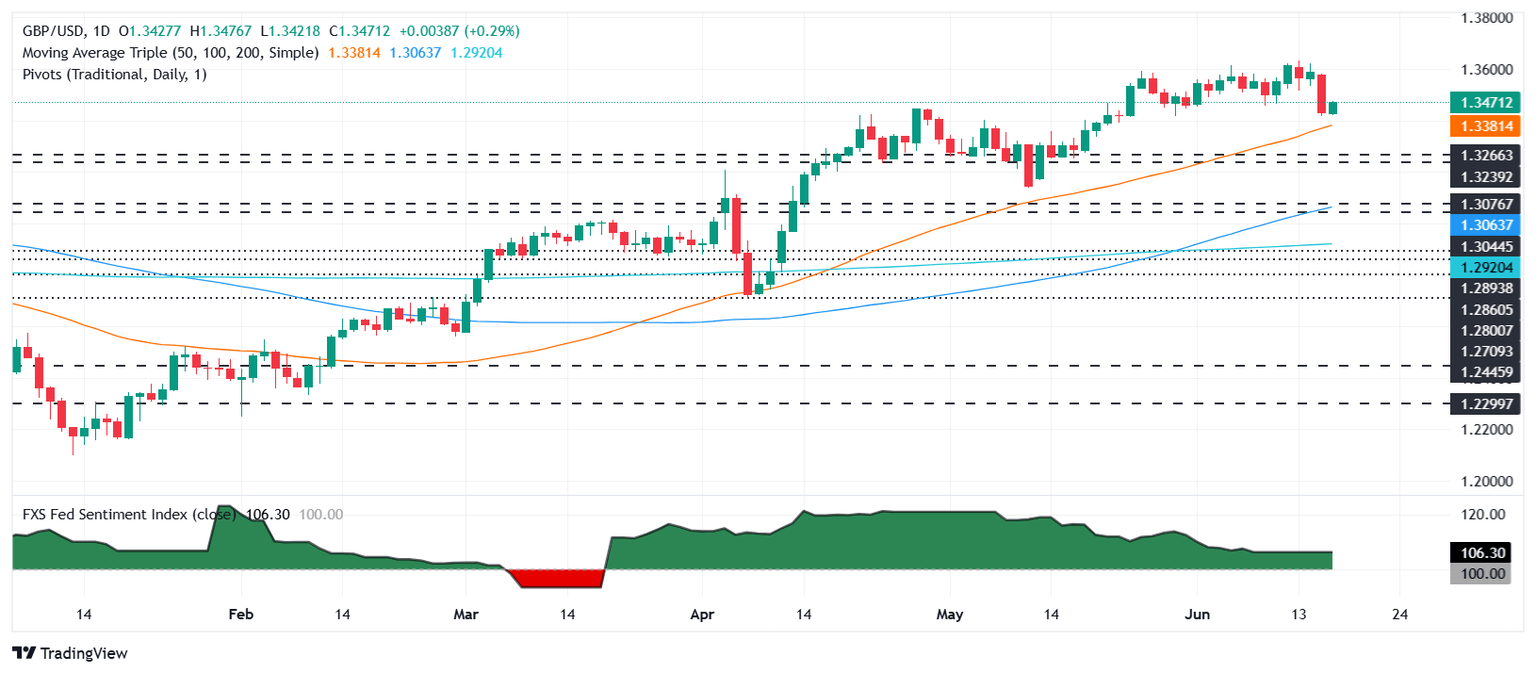

Pound Sterling Price News and Forecast: GBP/USD inches higher as Fed holds rates, maintains 2025 cut outlook

GBP/USD inches higher as Fed holds rates, maintains 2025 cut outlook

GBP/USD trades within a 40-pip range, exhibiting mild volatility on Wednesday, after the Federal Reserve (Fed) stood pat on rates and hinted that it is still expecting two rate cuts this year. At the time of writing, the pair trades near 1.3450, posting modest gains of 0.20%, as traders await the Fed Chair Powell's press conference. Read More...

GBP/USD rebounds as Fed, BoE decisions loom amid geopolitical jitters

The GBP/USD recovers some ground on Wednesday as traders await the Federal Reserve's (Fed) monetary policy decision, amid heightened tensions in the Middle East and the release of jobless claims data in the US. At the time of writing, the pair trades at 1.3452, up 0.19%. Read More...

GBP/USD holds positive ground above 1.3450 after UK CPI data, Fed rate decision eyed

The GBP/USD pair strengthens near 1.3460 during the early European trading hours on Wednesday. The Pound Sterling (GBP) remains firm against the Greenback after the UK Consumer Price Index (CPI) inflation report. The attention will shift to the US Federal Reserve (Fed) interest rate decision later on Wednesday. Read More...

Author

FXStreet Team

FXStreet