Pound Sterling Price News and Forecast: GBP/USD holds steady near 1.3700

GBP/USD holds steady near 1.3700 as Bostic tempers Fed cut bets, solid UK GDP

GBP/USD is virtually unchanged during the North American session on Monday amid hawkish comments by Atlanta’s Federal Reserve (Fed) President Raphael Bostic, even though United Kingdom (UK) data revealed that the economy grew at its fastest pace in one year. At the moment, the pair is trading at 1.3707, virtually unchanged. Read More...

GBP/USD eases from multi-year highs as market digests mixed UK macro data

The British Pound (GBP) weakens against the US Dollar (USD) on Monday as mixed UK economic data weighs on the Sterling despite a generally subdued Greenback. The GBP/USD pair experiences slight selling pressure after the release of GDP Q1 figures, declining from near its multi-year high as investor sentiment turns cautious. Traders reposition ahead of key macroeconomic events, seeking clearer signals on the UK’s growth outlook and the Federal Reserve’s (Fed) policy stance. Read More...

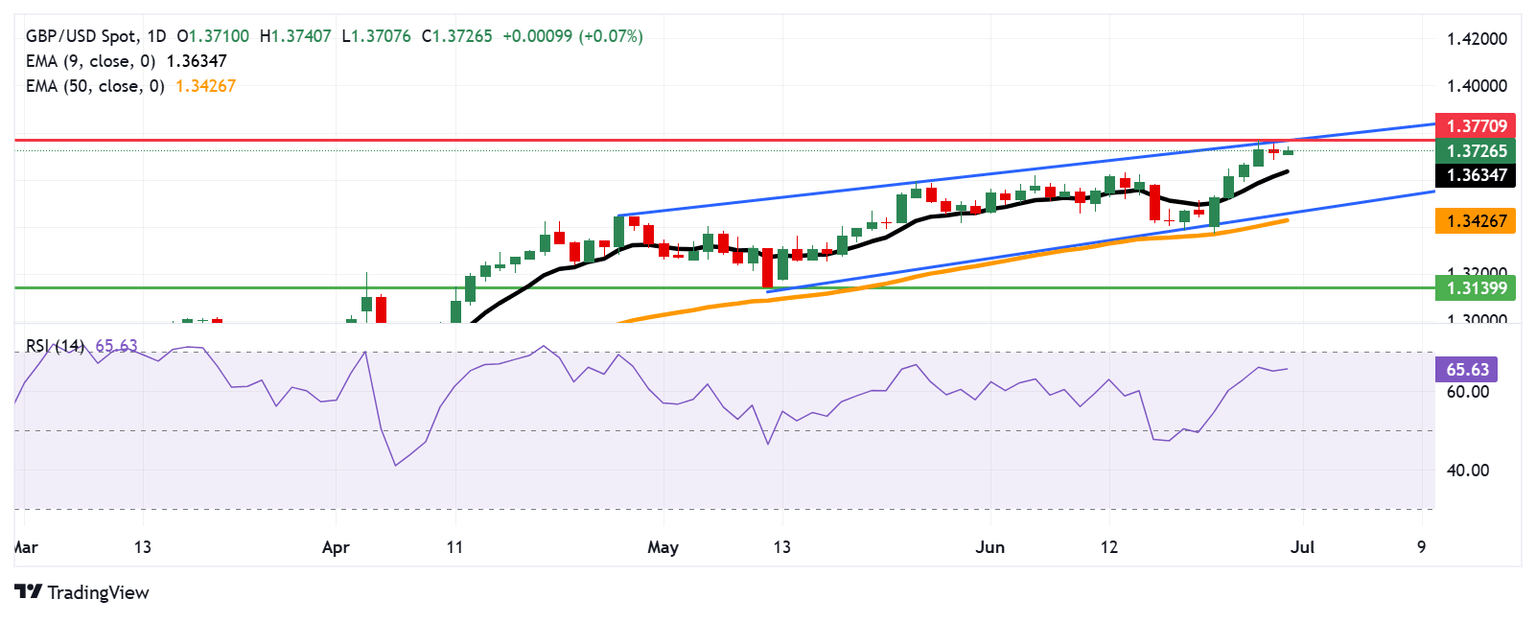

GBP/USD Price Forecast: Rebounds toward 1.3750 near multi-year highs

The GBP/USD pair retraces its recent losses from the previous session, trading around 1.3730 during the Asian hours on Monday. The bullish bias persists as the daily chart’s technical analysis indicates that the pair moves upwards within the ascending channel pattern. Read More...

Author

FXStreet Team

FXStreet