Pound Sterling Price News and Forecast: GBP/USD holds ground ahead of UK labor market data release

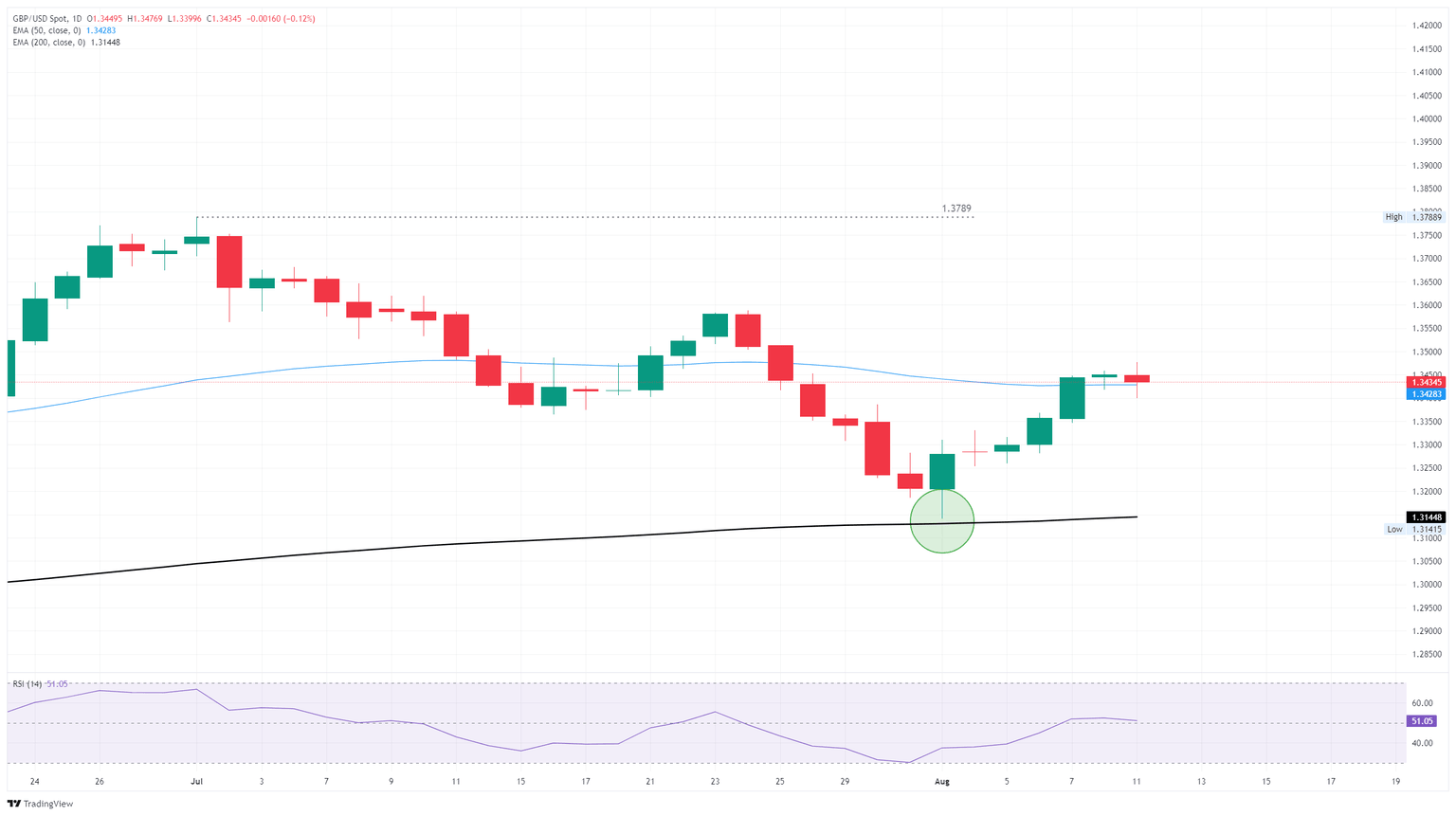

GBP/USD steadies below 1.3450 following BRC Like-For-Like Retail Sales, UK labor data eyed

GBP/USD moves little after the release of Like-For-Like Retail Sales by the British Retail Consortium, hovering around 1.3430 during the Asian hours on Tuesday. Focus is shifted toward the United Kingdom (UK) labor market data, including Claimant Count Change, Employment Change, and ILO Unemployment Rate, scheduled to be released later in the day.

BRC Like-For-Like Retail Sales rose 1.8% year-on-year in July, slowing from a 2.7% gain in June and falling short of the expected 2.1% increase. Helen Dickinson, Chief Executive of the British Retail Consortium, cautioned that current sales growth is hardly sufficient to offset the £7 billion in new costs imposed on retailers in the last Budget. Read more...

GBP/USD momentum falters ahead of hefty Tuesday docket

GBP/USD spun in a circle on Monday, wearing worry lines into the charts near 1.3430 as Cable traders buckle down ahead of a slew of key data on both sides of the Atlantic due on Tuesday. United Kingdom (UK) labor figures are due during the upcoming London market session, with United States (US) Consumer Price Index (CPI) inflation due later during the American trading window.

The latest Claimaint Count Change figures for July are due Tuesday, as well as the rolling three-month Employment Change numbers for the quarter ended in July. UK net job gains are expected to ease to 20.8K from 25.9K, while the ILO Unemployment Rate is expected to hold steady around 4.7% over the same period. Read more...

GBP/USD retreats from two-week high as US Dollar firms ahead of inflation data

The British Pound (GBP) edges lower against the US Dollar (USD) on Monday, snapping its recent advance as the Greenback firms ahead of Tuesday’s US Consumer Price Index (CPI) report. A modest rebound in the US Dollar is weighing on the Pound, with GBP/USD retreating from a two-week high reached earlier in the day.

At the time of writing, the GBP/USD pair is inching slightly lower, trading around 1.3407 during the American session. Meanwhile, the US Dollar Index (DXY), which measures the Greenback’s value against a basket of six major currencies, is rebounding modestly from near a two-week low, last seen around 98.50. Read more...

Author

FXStreet Team

FXStreet