Pound Sterling Price News and Forecast: GBP/USD holds above 1.2900 as traders brace of US CPI data

GBP/USD holds above 1.2900 as traders brace of US CPI data

The Pound Sterling consolidates within familiar levels against the US Dollar amid a scarce economic docket on Monday. Key US inflation data and the UK’s Gross Domestic Product (GDP) figures are due later in the week. The GBP/USD trades at 1.2915, up 0.04%. Read More...

Pound Sterling shows strength against US Dollar as investors doubt US economic strength

The Pound Sterling (GBP) stays firm above 1.2900 against the US Dollar (USD) in Monday’s North American session. The GBP/USD pair strengthens as the US Dollar struggles to gain ground amid growing concerns over the United States (US) economic outlook. The US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, trades cautiously near the four-month low of 103.50. Read More...

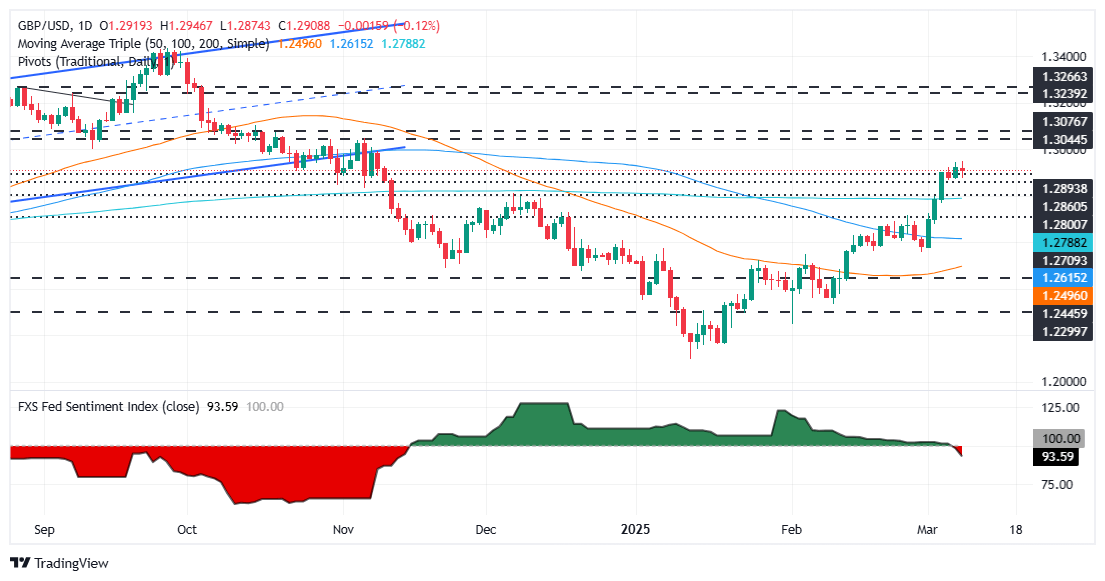

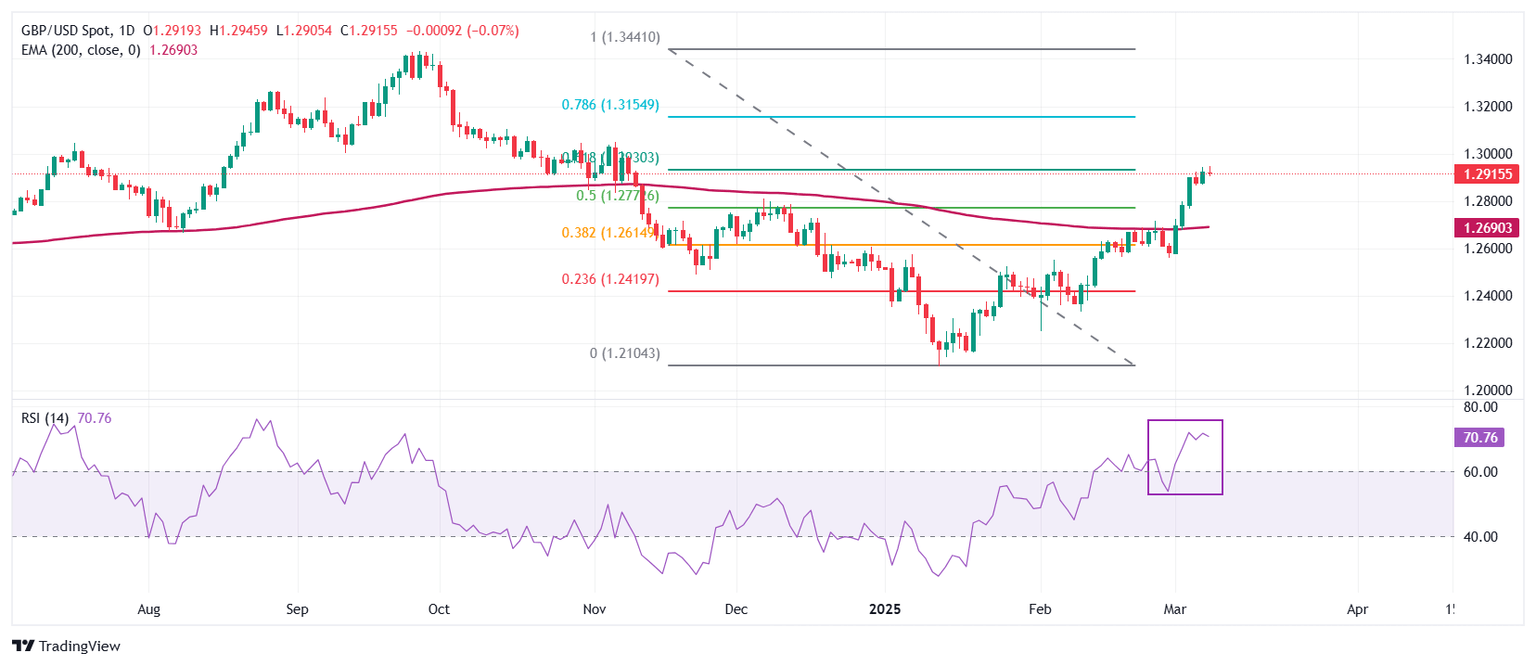

GBP/USD stands firm near multi-month peak, just below mid-1.2900s on weaker USD

The GBP/USD pair kicks off the new week on a positive move and trades around the 1.2940-1.2945 region during the Asian session, or a four-month high touched on Friday. Moreover, the bearish sentiment surrounding the US Dollar (USD) supports prospects for an extension of last week's breakout momentum above the very important 200-day Simple Moving Average (SMA). Read More...

Author

FXStreet Team

FXStreet