GBP/USD holds above 1.2900 as traders brace of US CPI data

- Trump warns of economic turbulence due to ongoing "period of transition."

- US recession fears rise, fueling bets for 80 bps of Fed rate cuts in 2025.

- DXY weakens to 103.76 as investors shift to safe-haven currencies.

- Traders eye US CPI on Wednesday and UK GDP figures on Friday for direction.

The Pound Sterling (GBP) consolidates within familiar levels against the US Dollar (USD) amid a scarce economic docket on Monday. Key United States (US) inflation data and the United Kingdom's (UK) Gross Domestic Product (GDP) figures are due later in the week. GBP/USD trades at 1.2915, up 0.04%.

Sterling steady amid US inflation concerns and UK GDP anticipation

Sentiment remains dismal due to concerns about US President Donald Trump's trade policies. On Friday, he said that his policies could lead to economic turbulence in the short term due to undergoing a “period of transition” because what he’s doing is very “big.”

In the meantime, fears that the US economy could be tipped into a recession or, worse, a stagflationary scenario, keep investors leaning into safe-haven currencies like the Swiss Franc (CHF) and the Japanese Yen (JPY). Consequently, expectations that the Federal Reserve (Fed) could ease policy have risen, with market participants estimating 80 basis points of easing towards year-end, revealed data from the Chicago Board of Trade (CBOT).

Meanwhile, the Greenback extended its losses, with the US Dollar Index (DXY), which tracks the performance of the buck against a basket of six other currencies, down 0.14% at 103.76.

The New York Fed Consumer Sentiment Survey revealed that inflation expectations for one year in February increased from 3% to 3.1%. For the three—and five-year periods, they remained unchanged at 3%. Americans expect price increases in gas, rent, and food.

This week, the US economic docket will feature the JOLTs Job Opening on Tuesday, followed by the release of the Consumer Price Index (CPI) on Wednesday. Across the pond, GBP/USD traders will eye GDP figures on Friday.

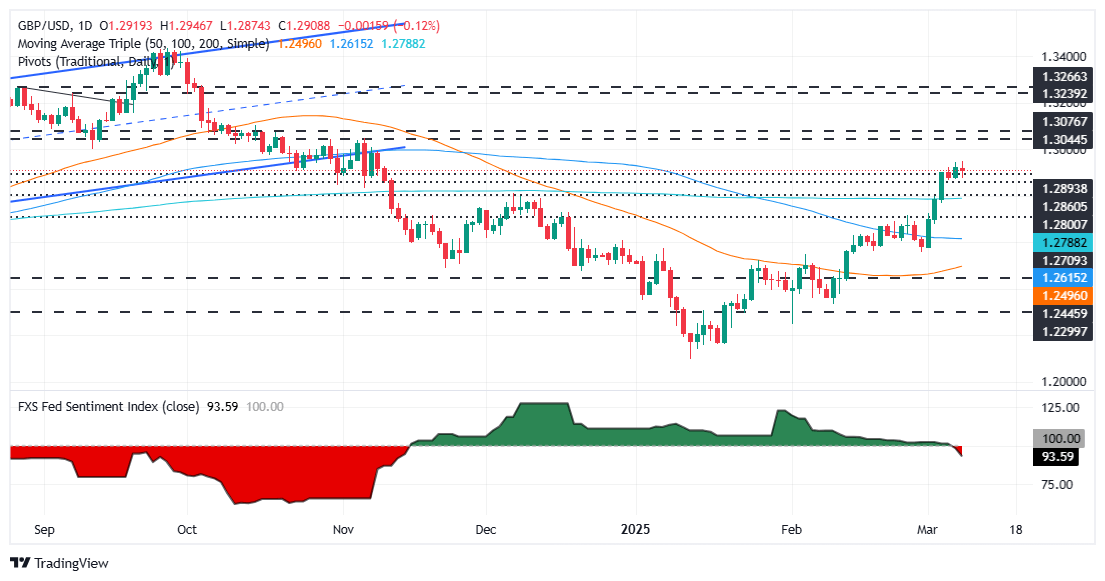

GBP/USD Price Forecast: Technical outlook

The GBP/USD pair trades sideways for the second straight day, unable to decisively crack the 1.2950 figure. The price action suggests that the pair is poised to edge higher. Nevertheless, the Relative Strength Index (RSI) indicates that the pair is overbought and an appreciation of the US Dollar could drive GBP/USD to challenge the 200-day Simple Moving Average (SMA) at 1.2788.

Conversely, if GBP/USD climbs past 1.2950, expect a test of the 1.3000 mark.

British Pound PRICE Today

The table below shows the percentage change of British Pound (GBP) against listed major currencies today. British Pound was the strongest against the Canadian Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.00% | 0.05% | -0.68% | 0.35% | -0.07% | -0.20% | -0.06% | |

| EUR | 0.00% | 0.01% | -0.68% | 0.36% | 0.02% | -0.22% | -0.18% | |

| GBP | -0.05% | -0.01% | -0.74% | 0.32% | 0.01% | -0.29% | -0.12% | |

| JPY | 0.68% | 0.68% | 0.74% | 1.02% | 0.67% | 0.39% | 0.69% | |

| CAD | -0.35% | -0.36% | -0.32% | -1.02% | -0.45% | -0.54% | -0.44% | |

| AUD | 0.07% | -0.02% | -0.01% | -0.67% | 0.45% | -0.24% | -0.17% | |

| NZD | 0.20% | 0.22% | 0.29% | -0.39% | 0.54% | 0.24% | 0.21% | |

| CHF | 0.06% | 0.18% | 0.12% | -0.69% | 0.44% | 0.17% | -0.21% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

Author

Christian Borjon Valencia

FXStreet

Christian Borjon began his career as a retail trader in 2010, mainly focused on technical analysis and strategies around it. He started as a swing trader, as he used to work in another industry unrelated to the financial markets.