Pound Sterling Price News and Forecast: GBP/USD has managed to sustain its auction above 1.2100

GBP/USD defends 1.2100 as skepticism for Fed policy escalates

The GBP/USD pair has sensed a buying interest after a corrective move to near 1.2100 in the early Asian session. The Cable is attempting to extend further above the immediate resistance of 1.2130 as investors are getting anxious for mixed views on Federal Reserve’s (Fed) monetary policy outlook, scheduled for next week.

S&P500 futures ended Thursday’s trading session on a promising note as various financial institutions came forward to provide liquidity into the US-based First Republic Bank and the Swiss National Bank (SNB) infused a new lifeline into Credit Suisse, portraying an improvement in investors’ risk appetite. The US Dollar Index (DXY) is hovering near 104.40 as investors are skeptical about the interest rate decision by the Federal Reserve (Fed), which will be announced next week. Read more...

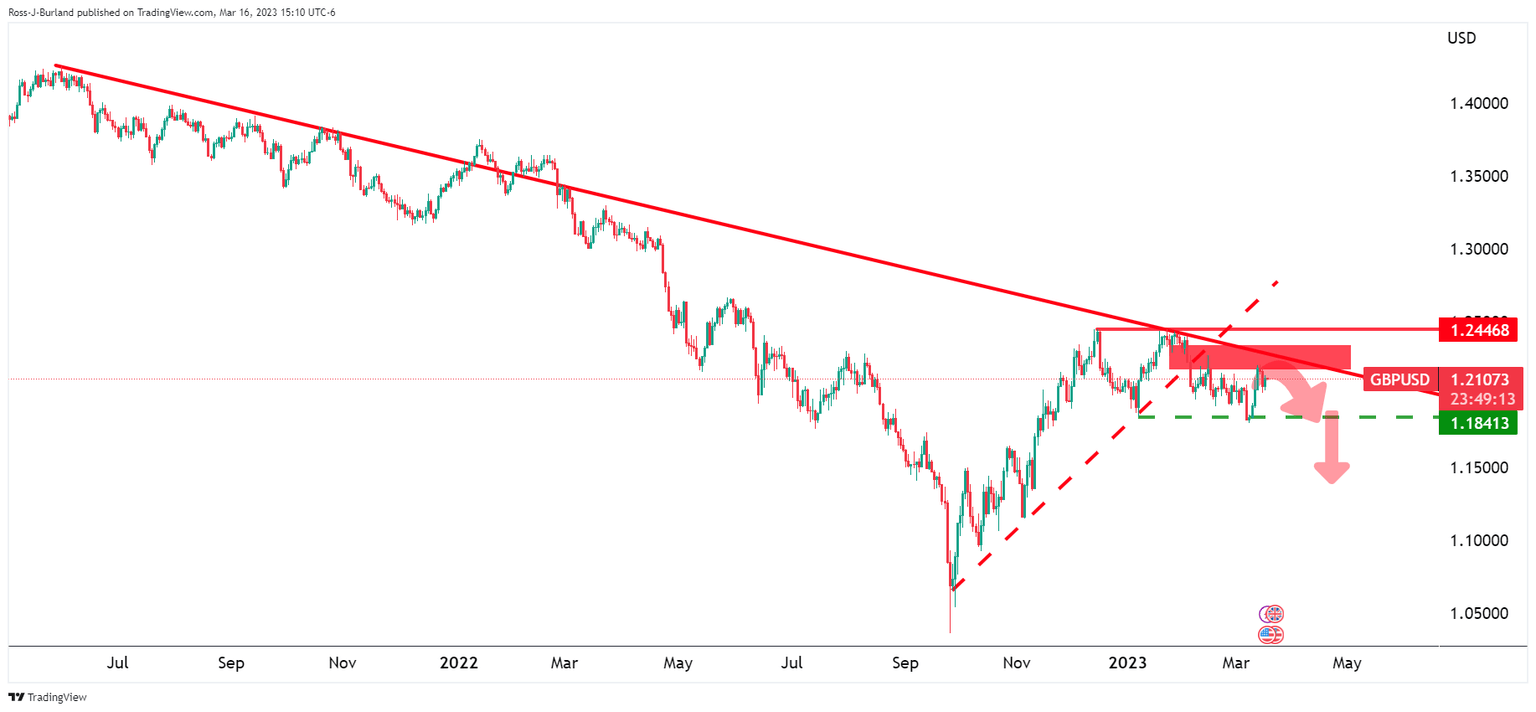

GBP/USD Price Analysis: Bears prowl and eye a break below of 1.2050 again

GBP/USD is meeting resistance near 1.2100 while traders assess the risks associated with the banking system crisis and weigh the prospects of a hawkish Federal Reserve and the Bank of England that both meet next week to decide on their interest rate paths.

From a technical perspective, a multi-timeframe analysis arrives at a bearish bias while GBP/USD remains pressured on the front side of the dominant bear trend. Read more...

Author

FXStreet Team

FXStreet