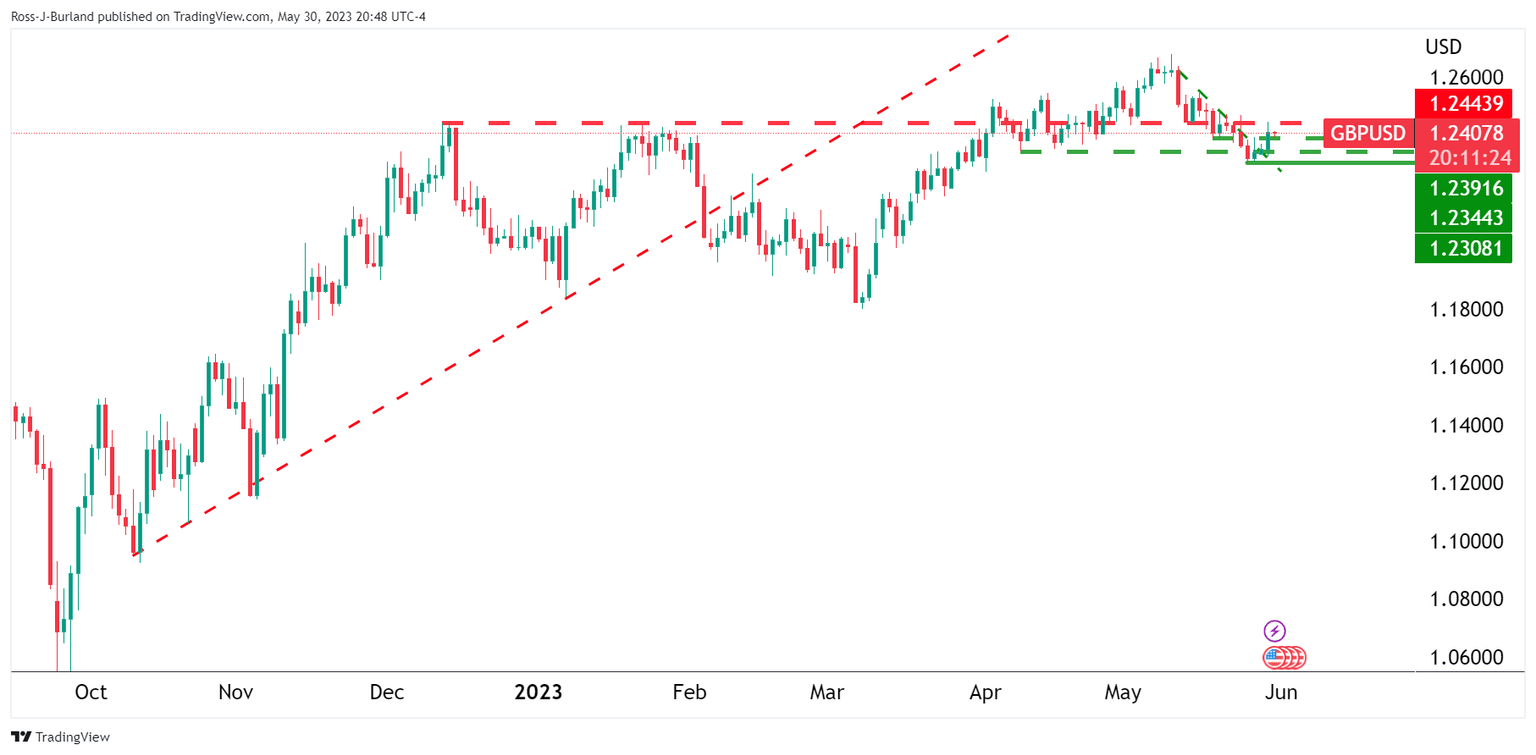

Pound Sterling Price News and Forecast: GBP/USD has climbed back above 1.2400

GBP/USD bulls meet key resistance, bears lurking

GBP/USD bulls are stepping in at support and eye an upside continuation to test daily resistance again. The following illustrates a scenario whereby we could see a shorter-term bearish correction playout before the next bullish impulse.

The price is sideways with a bearish bias in the main, longer-term. Read more...

GBP/USD returns above 1.2400 as USD Index retreats ahead of US Employment/Fed’s Beige Book

The GBP/USD pair has rebounded above the round-level resistance of 1.2400 after a steep correction in the early Tokyo session. The Cable has climbed back above 1.2400 as the US Dollar Index (DXY) has retreated from 104.20.

S&P500 futures are showing minor losses in early Asia after a choppy Tuesday, portraying a caution in the overall market mood. US equities remained flat on Tuesday despite opening after an extended weekend. Read more...

Author

FXStreet Team

FXStreet