Pound Sterling Price News and Forecast: GBP/USD grinds higher following the biggest daily jump

GBP/USD: Softer USD cover Brexit wounds near 1.3800, focus on US Core PCE Inflation

GBP/USD reacts to Brexit jitters with a cold heart, despite easing a bit from weekly top to 1.3800 by the press time of the initial Asian session on Friday. That being said, the cable pair seems to cheer the US dollar weakness amid risk-on mood. Risk catalysts can entertain ahead of Fed’s preferred inflation gauge’s release.

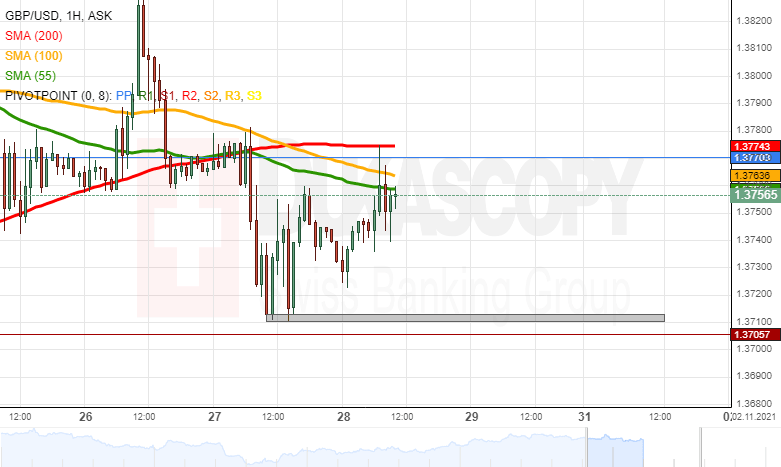

GBP/USD analysis: Retraces to resistance near 1.3770

On Wednesday, the GBP/USD found support at 1.3710 and started a recovery. By the middle of Thursday's trading hours, the GBP/USD had reached the 1.3770 level. From 1.3760 up to 1.3777, the pair faced the resistance of the 55, 100 and 200-hour simple moving averages and the weekly simple pivot point.

Author

FXStreet Team

FXStreet