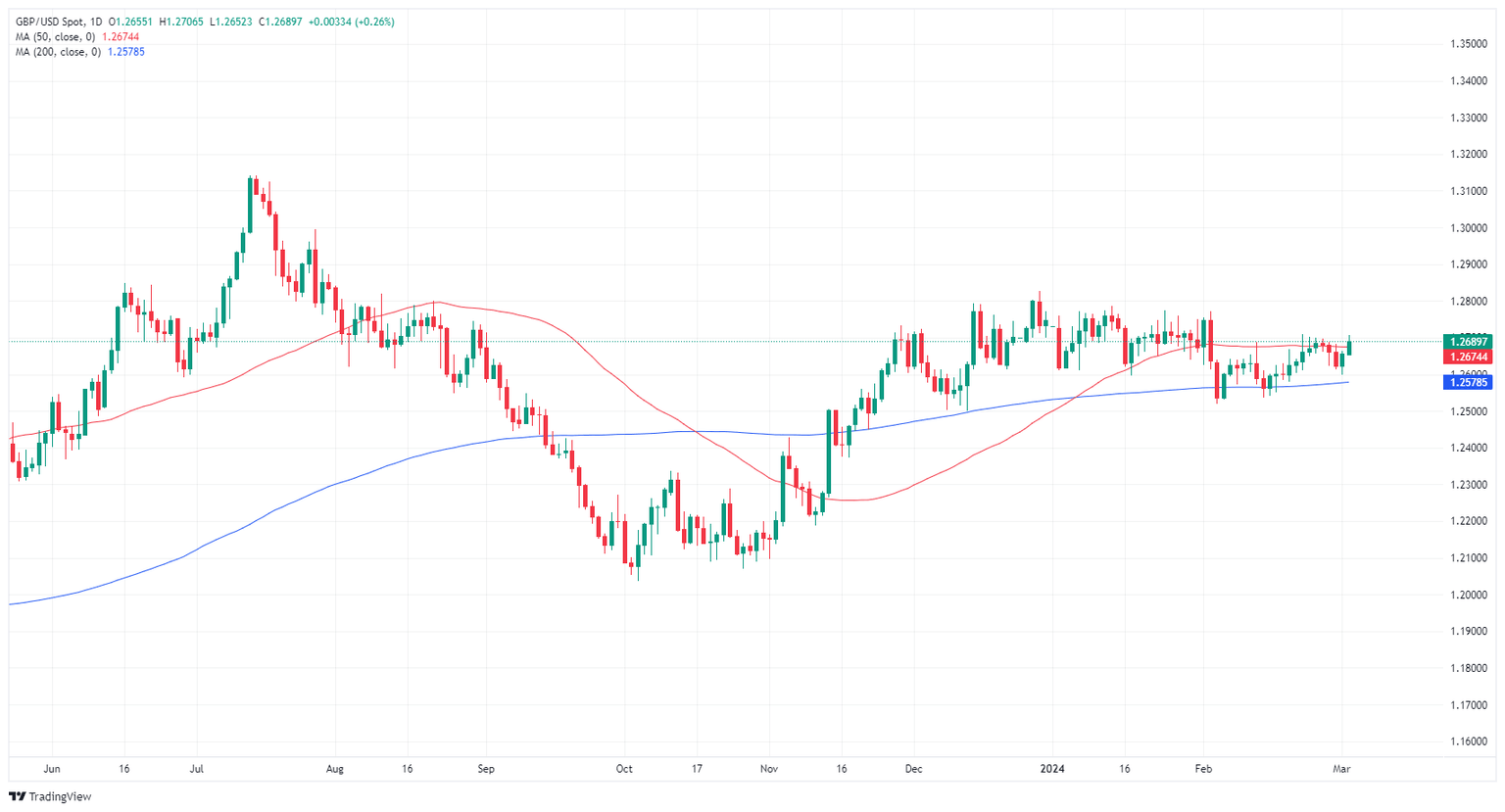

Pound Sterling Price News and Forecast: GBP/USD grapples with 1.2700 handle

GBP/USD grapples with 1.2700 handle as markets bid into a hefty trading week

GBP/USD climbed into the 1.2700 handle on Monday before falling back, paring away some of the day’s gains but hitting the rollover higher than it started.

The UK sees only a thin showing on the economic calendar this week, and another US Nonfarm Payrolls (NFP) labor print on Friday sees investors gearing up for another kick at the can on how soon the Federal Reserve (Fed) will begin cutting interest rates. Read More...

Pound Sterling exhibits strength against US Dollar ahead of Fed Powell’s testimony

GBP/USD sticks to modest intraday gains above mid-1.2600s amid softer USD

Author

FXStreet Team

FXStreet