Pound Sterling Price News and Forecast: GBP/USD gathers strength to near 1.3555 on Monday

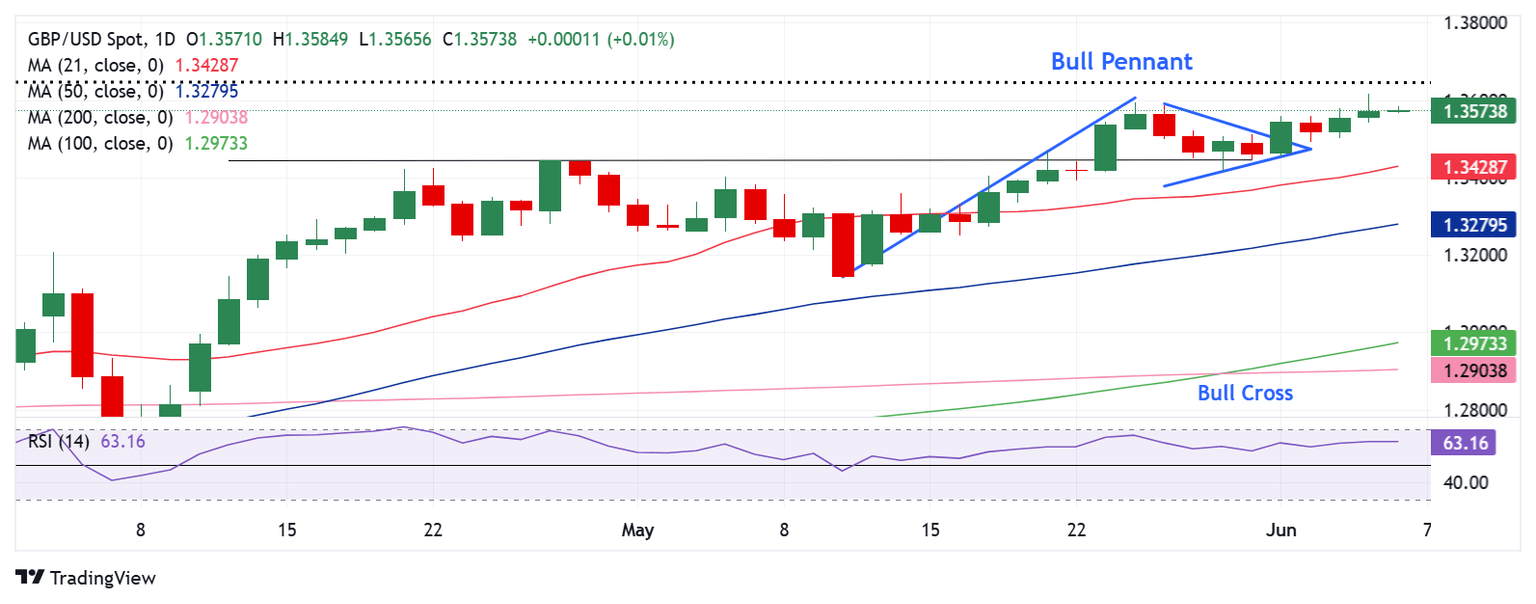

GBP/USD Price Forecast: Bullish outlook remains in play above 1.3550

The GBP/USD pair gains traction to around 1.3555 during the early European session on Monday, bolstered by a weaker US Dollar (USD). Trade uncertainty dampens sentiment among US businesses, prompting traders to reassess the Greenback's safe-haven status and act as a tailwind for the major pair. Traders await the UK employment data for fresh impetus, which is due later on Tuesday.

Technically, the constructive outlook of GBP/USD remains in place as the major pair is well-supported above the key 100-day Exponential Moving Average (EMA) on the daily chart. The upward momentum is reinforced by the Relative Strength Index (RSI), which stands above the midline near 60.50, displaying bullish momentum in the near term. Read more...

GBP/USD Weekly Outlook: Pound Sterling bulls eye break above 1.3600 amid data-driven week

The Pound Sterling (GBP) crawled higher against the US Dollar (USD) as the GBP/USD pair hit the highest level since February 2022, briefly above the 1.3600 mark. GBP/USD entered a phase of upside consolidation in the first half of the week, following the previous week’s advance to 39-month highs of 1.3593.

The major capitalized on broad-based US Dollar weakness at the start of the week amid renewed fears over the US economy and trade policy uncertainty. US President Donald Trump announced on Friday that he would double import tariffs on steel and aluminium to 50% in a bid to “even further secure the steel industry in the United States (US)”. Read more...

GBP/USD trades with positive bias around 1.3530-1.3535 area, lacks bullish conviction

The GBP/USD pair edges higher during the Asian session on Monday and for now, seems to have stalled its retracement slide from the highest level since February 2022, around the 1.3615 region touched last week. The uptick, however, lacks bullish, with spot prices currently trading around the 1.3530-1.3535 region, up only 0.05% for the day.

The US Dollar (USD) struggles to capitalize on Friday's upbeat US jobs data-inspired move higher and kicks off the new week on a subdued note, which, in turn, is seen as a key factor lending support to the GBP/USD pair. Moreover, Bank of England (BoE) Governor Andrew Bailey's remarks last week, saying that the central bank will stick to a gradual and careful approach to cutting interest rates amid trade uncertainties, act as a tailwind for the currency pair. Read more...

Author

FXStreet Team

FXStreet