Pound Sterling Price News and Forecast: GBP/USD gains on steady UK PMI growth, Fed-BoE policy in spotlight

Pound Sterling gains on steady UK PMI growth, Fed-BoE policy in spotlight

The Pound Sterling (GBP) jumps sharply to near 1.2670 against the US Dollar (USD) in Monday’s North American session after the release of the flash United Kingdom (UK) S&P Global/ CIPS Purchasing Managers’ Index (PMI) data. The PMI report showed that the overall business activity expanded at a steady pace to 50.5. The impact of a surprise faster-than-expected decline in the manufacturing sector activity was offset by a robust expansion in the service sector output. Read More...

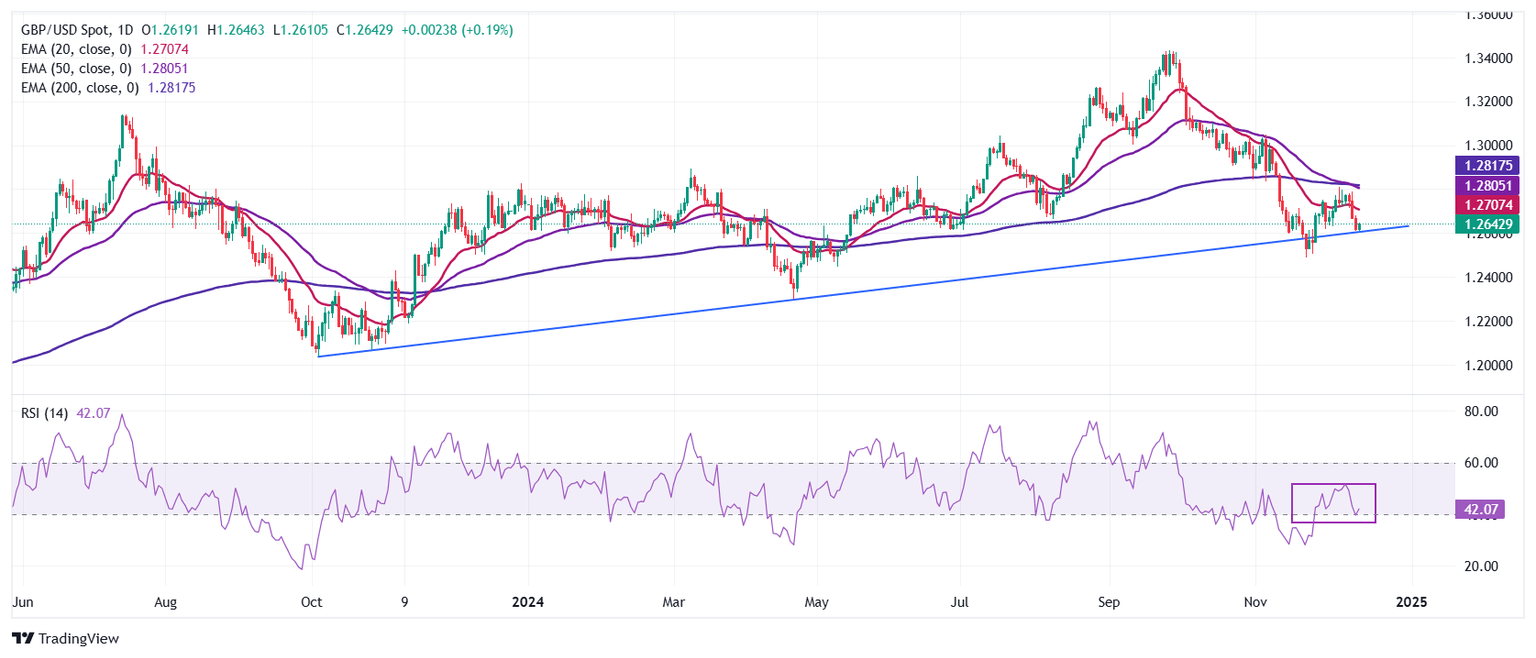

GBP/USD Price Forecast: Hovers below 1.2650, descending channel’s upper boundary

GBP/USD breaks its three-day losing streak, trading around 1.2640 during the early European hours on Monday. The daily chart analysis shows an ongoing bearish bias as the pair is confined within the descending channel pattern. Read More...

GBP/USD edges higher to 1.2630, looks to UK/US PMIs for some impetus

The GBP/USD pair ticks higher at the start of a busy week and for now, seems to have snapped a three-day losing streak to the 1.2600 neighborhood, or over a two-week low touched on Friday. Spot prices currency trade around the 1.2630-1.2635 region, up 0.10% for the day, though any meaningful appreciation seems elusive ahead of this week's key central bank event risks. Read More...

Author

FXStreet Team

FXStreet