Pound Sterling Price News and Forecast: GBP/USD gains ground to around 1.3305 during Asian session.

GBP/USD strengthens above 1.3305 as investors await Fed board appointee

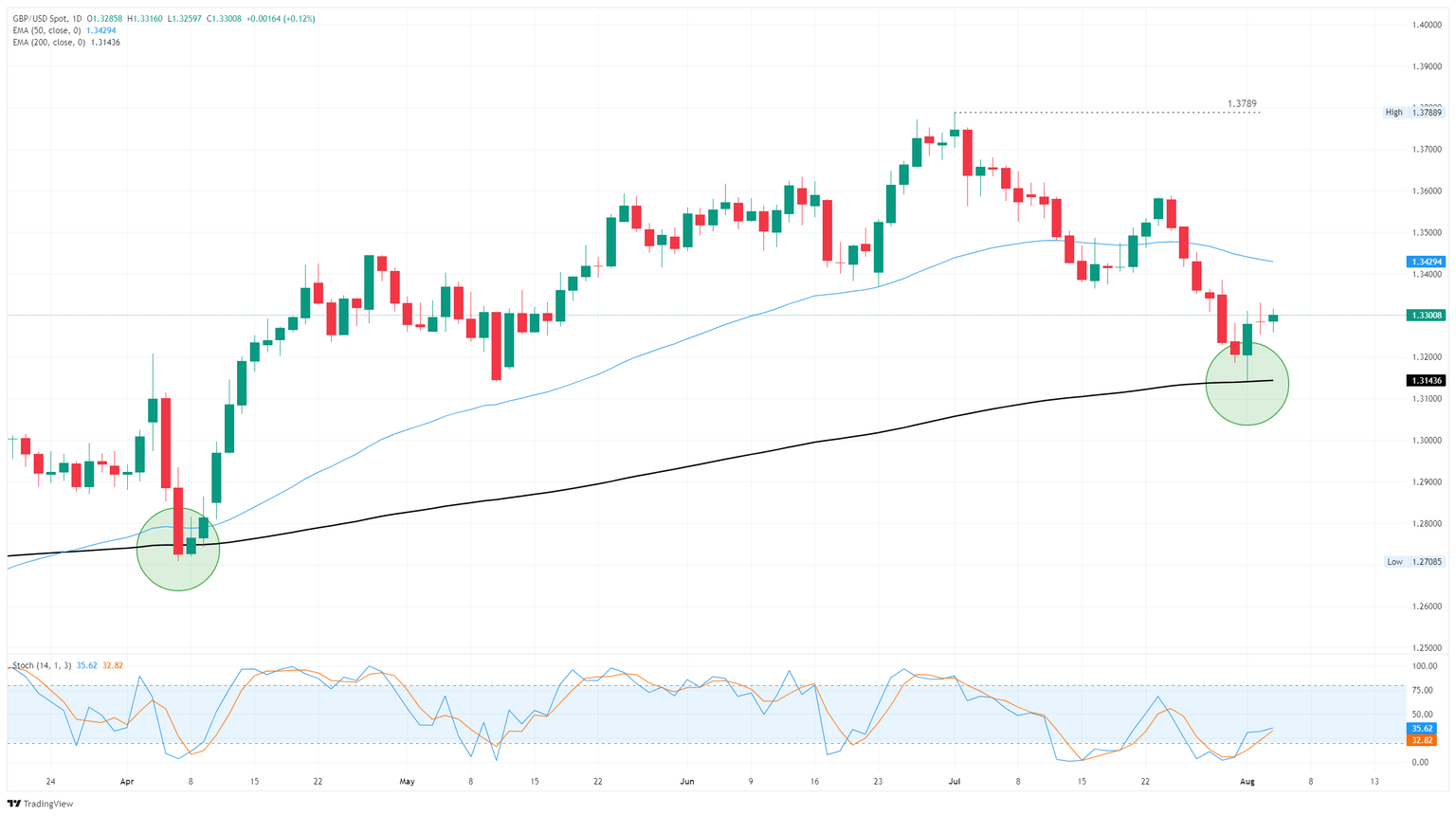

The GBP/USD pair trades on a positive note near 1.3305 during the Asian trading hours on Wednesday. The Greenback softens against the Pound Sterling (GBP) as traders await US President Donald Trump's pick for a vacancy on the Federal Reserve's (Fed) Board of Governors.

The US July jobs report showed weaker-than-expected job growth, increasing the likelihood of a Fed rate reduction in September. According to the CME FedWatch tool, rate futures are now pricing in nearly a 91% possibility of the Fed cutting rates at the September meeting, compared with 35% a week earlier. They also indicate 60 basis points (bps) of reductions by end-December and 130 bps in rate cuts by October 2026. Read more...

GBP/USD flatlines, Pound Sterling churns the waters as BoE rate call looms

GBP/USD continues to chalk in a middling pattern through the week as investor sentiment takes a breather following a sharp readjustment of economic expectations last week. US labor data saw steep downside revisions through the second quarter, reigniting both hopes for Federal Reserve (Fed) rate cuts and fears of a widening recession.

Now that a Fed rate cut on September 17 is priced in as a sure thing, Cable markets are shifting focus to the Bank of England’s (BoE) upcoming interest rate decision on Thursday. The BoE’s Monetary Policy Committee (MPC) is likewise expected to vote seven-to-three in favor of a quarter-point interest rate cut. Read more...

GBP/USD edges higher as US data weakens, Fed credibility questioned

The GBP/USD advances during the North American session, registers modest gains of over 0.07% following last week’s dismal jobs report and soft data reported earlier. At the time of writing, the pair trades at 1.3305.

Economic data from the United States (US) revealed that business activity in the services sector, as reported by the Institute for Supply Management (ISM). The Services PMI dipped to 50.1 in July from 50.8 in Jun, below forecasts of a rise of 51.6. Earlier reported data showed that the US trade deficit reached nearly a 2-year low. Read more...

Author

FXStreet Team

FXStreet