Pound Sterling Price News and Forecast: GBP/USD gains ground as the US Dollar remains under pressure

GBP/USD edges higher to near 1.3300 ahead of Q1 GDP data from UK

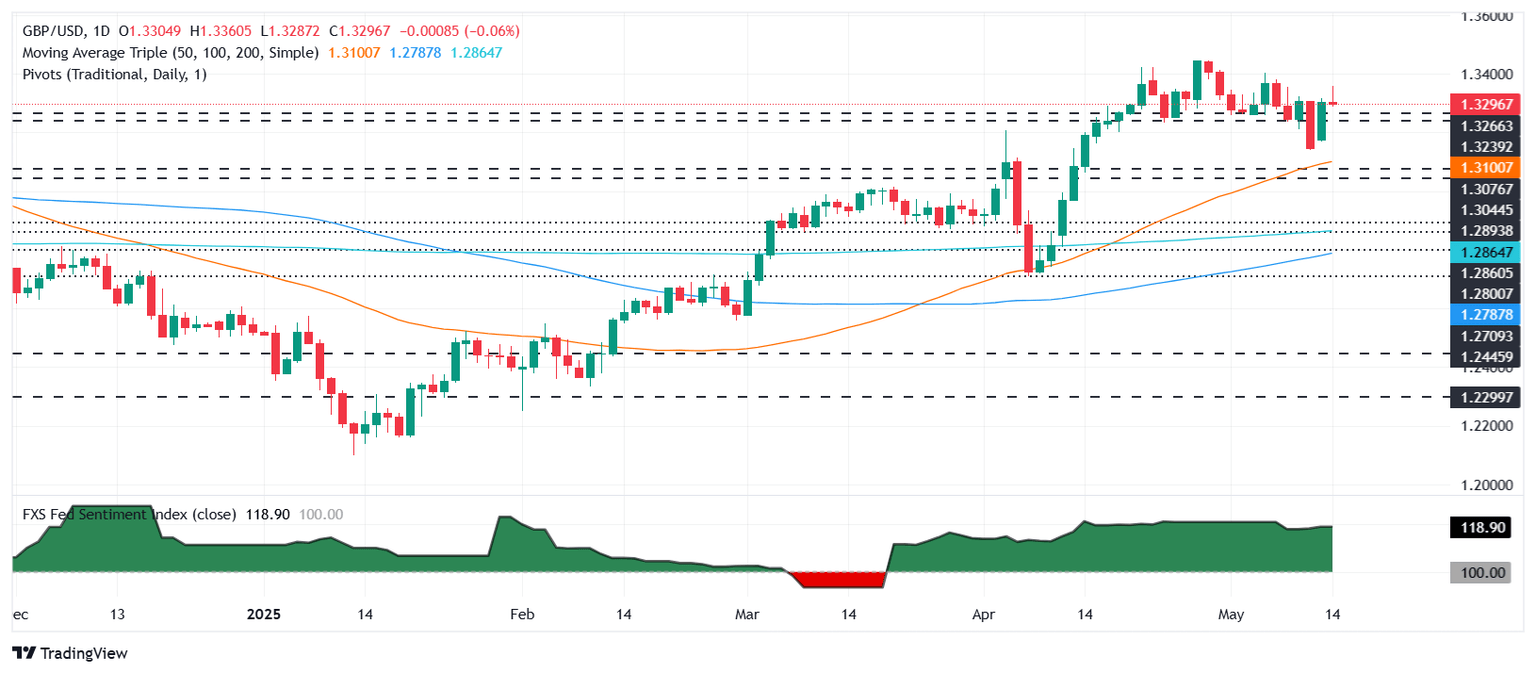

GBP/USD is rebounding from recent losses, trading near 1.3280 during the Asian session on Thursday. The pair is supported by a softer US Dollar (USD), as investors weigh ongoing trade-related uncertainties despite a slight easing in tensions. Market focus now shifts to the release of US Retail Sales and Producer Price Index (PPI) data later in the day.

Speculation is building that Washington may prefer a weaker dollar to bolster its trade position. The Trump administration has argued that a strong Greenback, relative to weaker regional currencies, disadvantages US exporters. Read more...

GBP/USD contracts into near-term midrange ahead of key UK and US data

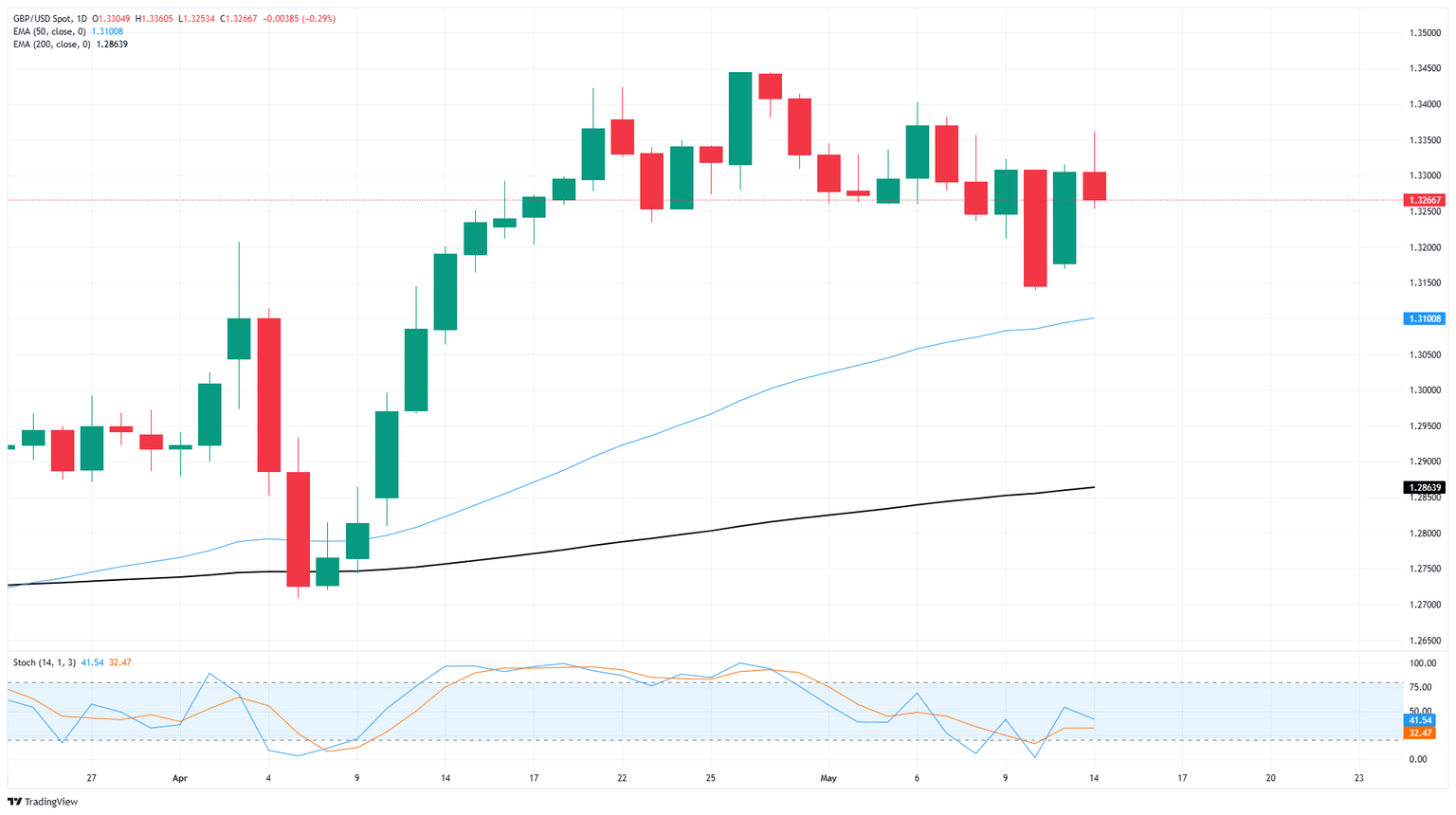

GBP/USD pared recent gains on Wednesday, trimming back to the low side of the 1.3300 handle and falling back into a choppy near-term consolidation phase as investors buckle down for Thursday’s double feature of key data prints from both the United Kingdom (UK) and the United States (US).

First up on Thursday will be UK Gross Domestic Product (GDP) figures for the first quarter. UK Q1 GDP is expected to give a mixed print, with QoQ growth forecast to tick up, but annualized GDP to fall back slightly as a slump in domestic economic activity falls to the tail end of the curve. Q1 GDP is expected to rise to 0.6% QoQ from 0.1%, while Q1 GDP is forecast to ease to 1.2% YoY from 2024 Q4’s 1.5%. Read more...

GBP/USD slips modestly from weekly high as traders await UK GDP

The Pound Sterling (GBP) erases some of its earlier gains on Wednesday after reaching a weekly high of 1.3359, and edges down 0.03% amid a lack of catalysts as traders brace for the release of GDP figures for the United Kingdom (UK). At the time of writing, GBP/USD trades at 1.3293.

The Greenback has trimmed its gains from Monday, as depicted by the US Dollar Index (DXY). The DXY, which tracks the performance of the US Dollar (USD) against a basket of six currencies, rose sharply after news of the de-escalation of the China-US trade war. Nevertheless, as market participants had already factored the news into their expectations, the DXY fell by 0.15% to 100.77. Read more...

Author

FXStreet Team

FXStreet