GBP/USD slips modestly from weekly high as traders await UK GDP

- The Sterling retreats slightly amid a quiet session as traders eye upcoming UK GDP figures.

- DXY softens to 100.77 after early week rally on US-China tariff truce; easing bets hold at 52 bps for 2025.

- Fed’s Jefferson flags tariff-driven inflation uncertainty; BoE’s Mann leans cautious on labor market resilience.

The Pound Sterling (GBP) erases some of its earlier gains on Wednesday after reaching a weekly high of 1.3359, and edges down 0.03% amid a lack of catalysts as traders brace for the release of GDP figures for the United Kingdom (UK). At the time of writing, GBP/USD trades at 1.3293.

GBP/USD eases to 1.3293 after peaking at 1.3359, with BoE and Fed policy outlooks in focus ahead of key data releases

The Greenback has trimmed its gains from Monday, as depicted by the US Dollar Index (DXY). The DXY, which tracks the performance of the US Dollar (USD) against a basket of six currencies, rose sharply after news of the de-escalation of the China-US trade war. Nevertheless, as market participants had already factored the news into their expectations, the DXY fell by 0.15% to 100.77.

An absent economic docket on both sides of the Atlantic keeps investors entertained on Tuesday's data. Although US inflation dipped modestly, market participants are expecting 52 basis points of easing, according to the swaps markets.

US Federal Reserve Vice Chair Philip Jefferson stated that the current moderately restrictive policy rate is well-positioned to respond to economic developments. He added that tariffs could lead to high inflation, but he’s still uncertain if the impact would be temporary or persistent.

In the UK, job figures cooled further, a relief for the Bank of England (BoE), which has been vocal about wages exerting upward inflationary pressure. Earlier, BOE’s Catherine Mann said that she wanted to hold rates unchanged because she saw the labor market more resilient than expected.

The BoE is expected to ease policy by around 50 basis points by the end of the year, with the subsequent reduction expected in August.

Meanwhile, the US economic docket will feature the Producer Price Index (PPI), Retail Sales data, and Fed Chair Jerome Powell's speech on Thursday.

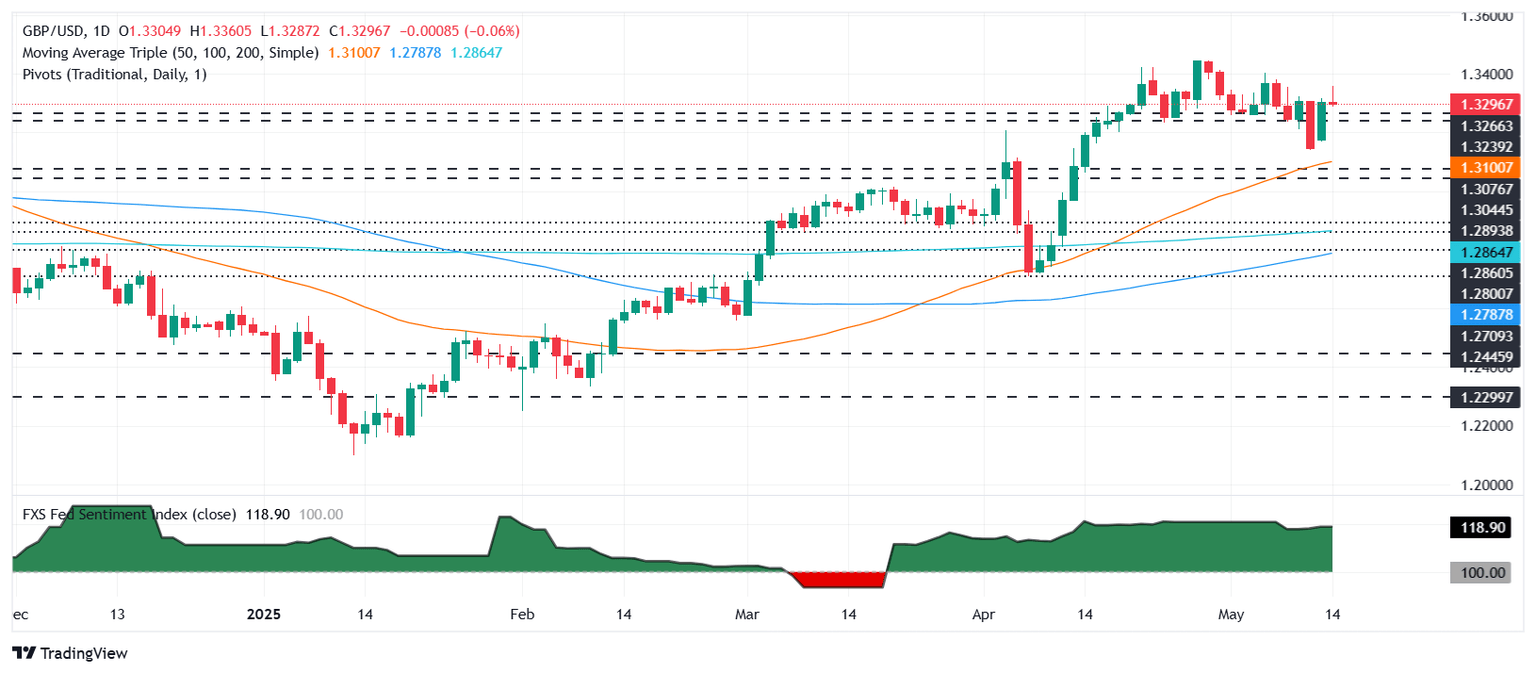

GBP/USD Price Forecast: Technical outlook

From a technical perspective, GBP/USD is neutral to upward bias, but buyers must keep the exchange rate above 1.33. If they achieve it, they need to drive the exchange rate past 1.3350 towards challenging the year-to-date (YTD) high of 1.3443.

Conversely, a daily close below 1.33 clears the path for a pullback, with the next key support being the 1.3200 figure. A breach of the latter will expose the current week's low of 1.3139.

Pound Sterling FAQs

The Pound Sterling (GBP) is the oldest currency in the world (886 AD) and the official currency of the United Kingdom. It is the fourth most traded unit for foreign exchange (FX) in the world, accounting for 12% of all transactions, averaging $630 billion a day, according to 2022 data. Its key trading pairs are GBP/USD, also known as ‘Cable’, which accounts for 11% of FX, GBP/JPY, or the ‘Dragon’ as it is known by traders (3%), and EUR/GBP (2%). The Pound Sterling is issued by the Bank of England (BoE).

The single most important factor influencing the value of the Pound Sterling is monetary policy decided by the Bank of England. The BoE bases its decisions on whether it has achieved its primary goal of “price stability” – a steady inflation rate of around 2%. Its primary tool for achieving this is the adjustment of interest rates. When inflation is too high, the BoE will try to rein it in by raising interest rates, making it more expensive for people and businesses to access credit. This is generally positive for GBP, as higher interest rates make the UK a more attractive place for global investors to park their money. When inflation falls too low it is a sign economic growth is slowing. In this scenario, the BoE will consider lowering interest rates to cheapen credit so businesses will borrow more to invest in growth-generating projects.

Data releases gauge the health of the economy and can impact the value of the Pound Sterling. Indicators such as GDP, Manufacturing and Services PMIs, and employment can all influence the direction of the GBP. A strong economy is good for Sterling. Not only does it attract more foreign investment but it may encourage the BoE to put up interest rates, which will directly strengthen GBP. Otherwise, if economic data is weak, the Pound Sterling is likely to fall.

Another significant data release for the Pound Sterling is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period. If a country produces highly sought-after exports, its currency will benefit purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.