Pound Sterling Price News and Forecast: GBP/USD gains as investors ignore mild acceleration in BoE dovish bets

Pound Sterling gains as investors ignore mild acceleration in BoE dovish bets

The Pound Sterling (GBP) gains against its major peers on Friday, with investors looking for fresh cues about how the Bank of England (BoE) will follow the interest rate cut path in 2025. The latest BoE policy announcement in mid-December indicated a dovish buildup as the nine Monetary Policy Committee (MPC) voted 6-3 to keep interest rates on hold, a bigger split than the 8-1 economists had predicted. Read More...

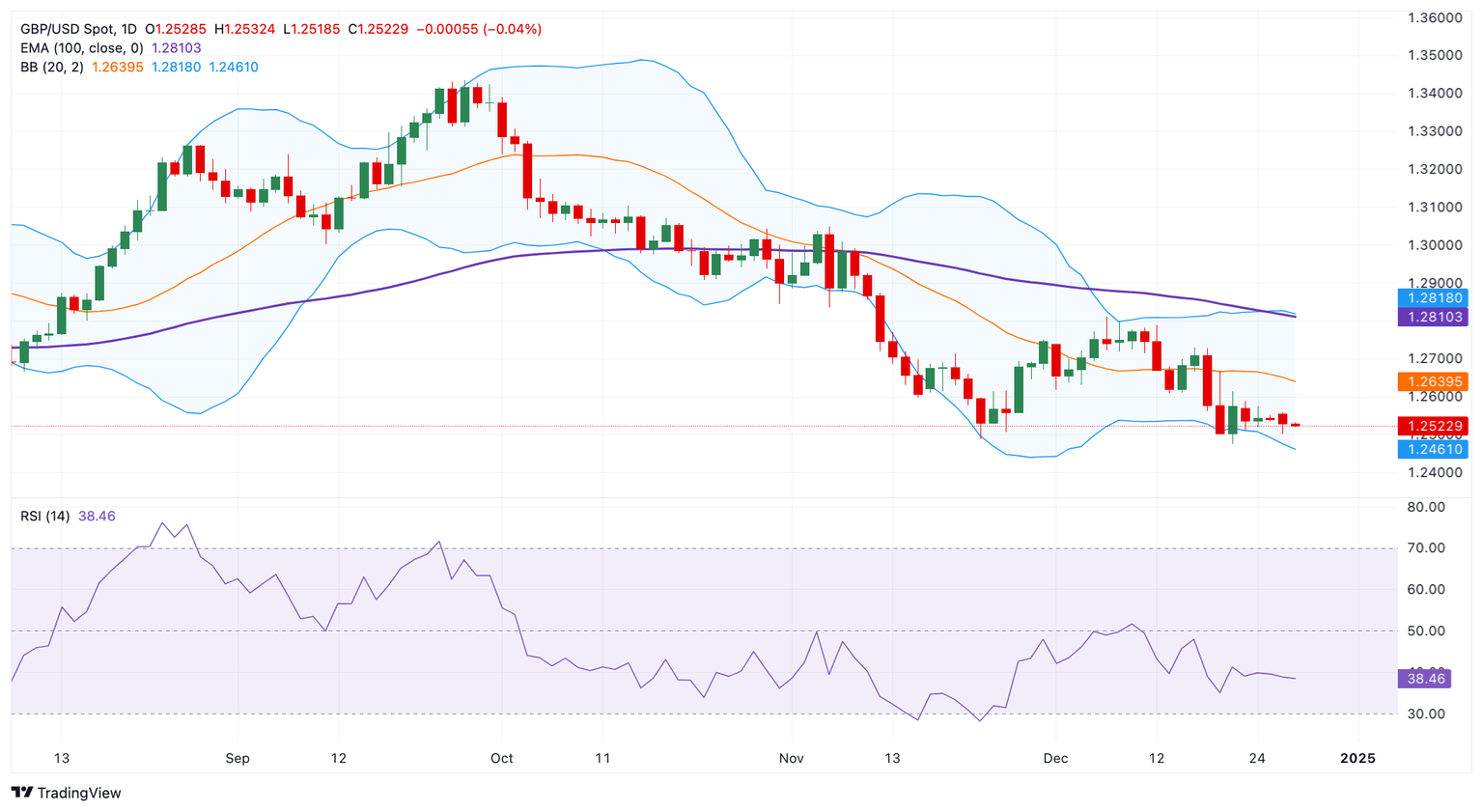

GBP/USD Price Forecast: The bearish outlook remains in place below 1.2550

GBP/USD remains subdued near 1.2500 due to increased odds of fewer Fed rate cuts

GBP/USD remains subdued for the third successive day, trading around 1.2520 during the Asian hours on Friday. The downside can be attributed to thin trading activity following the Christmas holiday and a stronger US Dollar (USD), driven by growing expectations of fewer rate cuts by the US Federal Reserve (Fed). Read More...

Author

FXStreet Team

FXStreet