Pound Sterling Price News and Forecast: GBP/USD gains after upbeat UK data, hot US PPI

Pound Sterling gains after upbeat UK data, hot US PPI

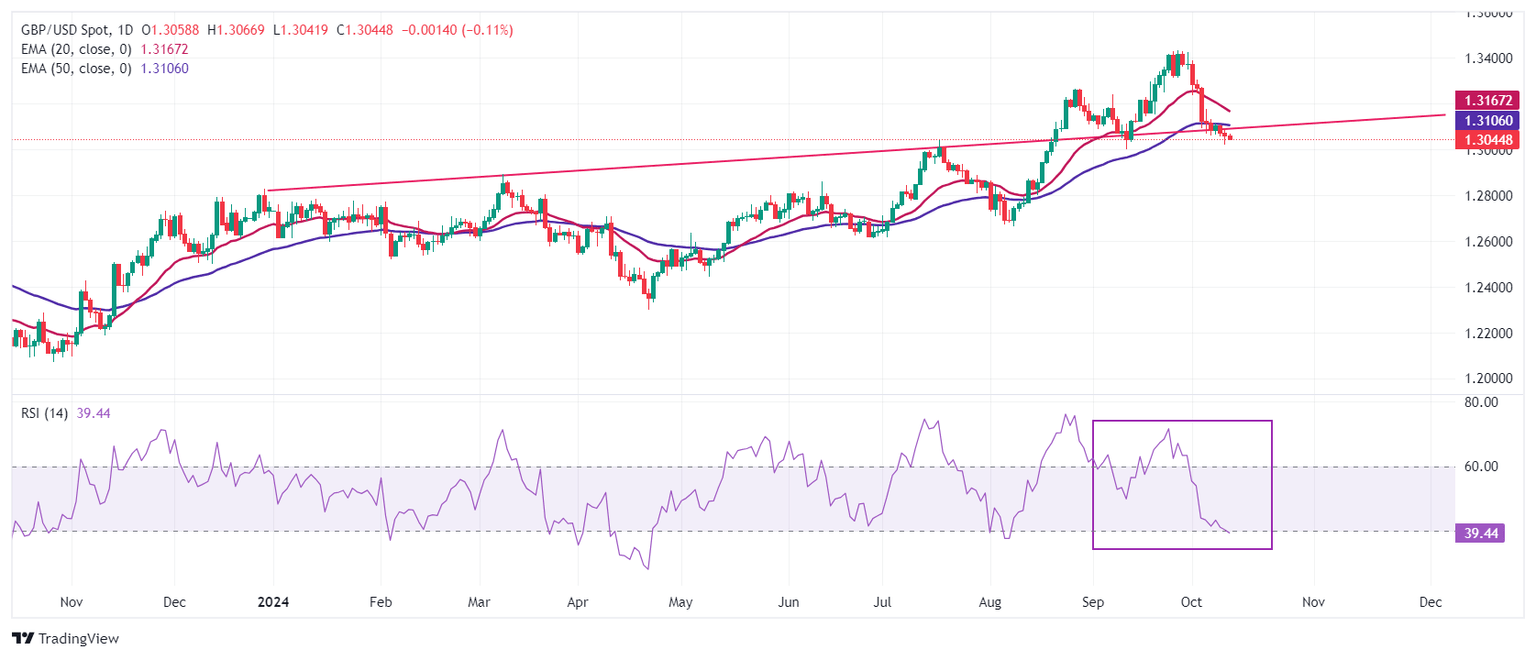

The Pound Sterling (GBP) gyrates in a tight range near 1.3060 against the US Dollar (USD) in Friday's North American session. The GBP/USD pair remains sideways despite the release of the hotter-than-expected United States (US) annual US Producer Price Index (PPI) data for September. Read More...

UK GDP rises 0.2% MoM in August, as expected

The UK economy expanded by 0.2% over the month in August, having stagnated for the second consecutive month in July, the latest data published by the Office for National Statistics (ONS) showed on Friday. The reading matched the market consensus of 0.2% growth in the reported period. Read More...

GBP/USD consolidates around mid-1.3000s, seems vulnerable ahead of UK data

The GBP/USD pair struggles to capitalize on the previous day's modest bounce from the 1.3020 area or a one-month low and oscillates in a narrow band during the Asian session on Friday. Spot prices currently hover around mid-1.3000s, unchanged for the day, and seem vulnerable to prolonging the recent retracement slide from the highest level since March 2022 touched last month. Read More...

Author

FXStreet Team

FXStreet