Pound Sterling Price News and Forecast: GBP/USD from overbought to oversold

What’s next after GBP/USD bearish pullback reaches 1.39?

The GBP/USD made a bearish reversal as expected in our video analysis. The main question is whether the uptrend is over or is it just a retracement?

This article analyses what future price patterns are critical for answering this key question. The GBP/USD bearish retracement was expected. But the impulsiveness of the decline is very strong, which is 1 of the main reasons for the potential end of the uptrend. Read more ...

GBP/USD Forecast: From overbought to oversold, sterling has room to lick its wounds

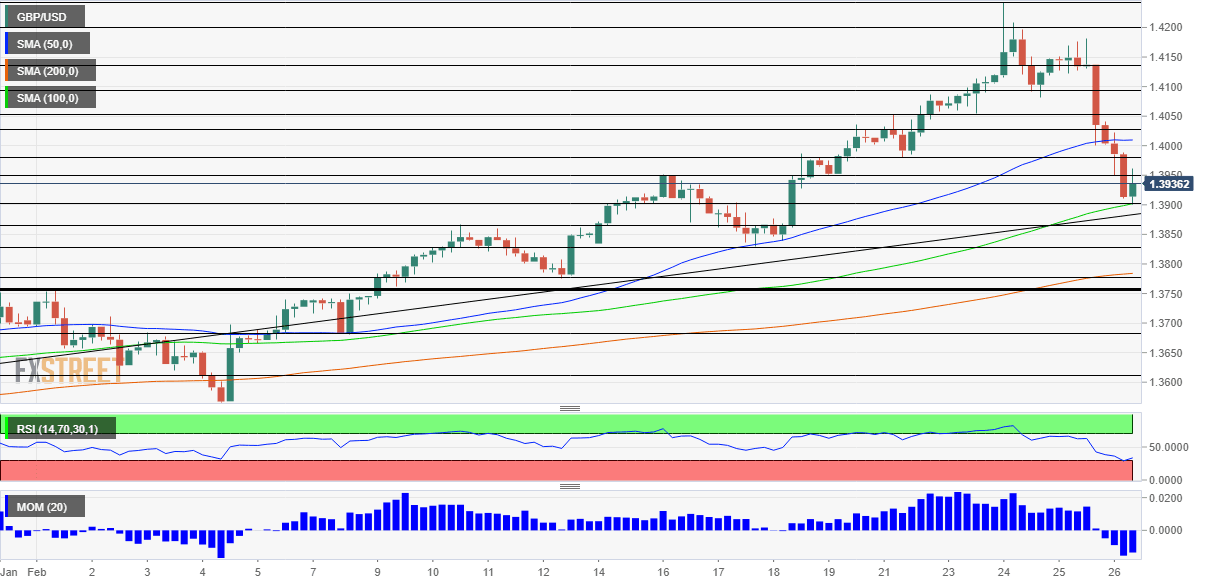

On the fast lane – GBP/USD has reversed all its gains and some more, in a 300-pips+ slide. Apart from profit-taking, the fall was driven by the rout in bond markets, especially in the US. Prospects of stronger growth and perhaps overheating inflation – that Federal Reserve officials dismissed – have finally triggered a sharper move.

Higher returns on solid US debt make the dollar more attractive and the fall in stocks pushed additional funds toward the safe-haven greenback. Central banks in Europe, Australia, and Japan are uncomfortable with higher returns on debt and the Fed has yet to react. Will yields continue rising and pushing the dollar higher? Read more...

GBP/USD Price Analysis: Break below 1.3900 mark should pave way for further losses

The GBP/USD pair witnessed some heavy selling for the second consecutive session on Friday and dropped to over one-week lows during the early European session.

The sharp corrective slide from almost three-year tops stalled near the 1.3900 confluence support amid oversold RSI on intraday charts. The mentioned level comprises the 50% Fibonacci level of the post-BoE strong positive move and 100-period SMA on the 4-hourly chart. This should now act as a key pivotal point for intraday traders. Read more...

Author

FXStreet Team

FXStreet

-637499326021608977.png&w=1536&q=95)