Pound Sterling Price News and Forecast: GBP/USD fails to stabilize above 1.2500

GBP/USD Forecast: Pound Sterling fails to stabilize above 1.2500

GBP/USD climbed to its highest level in three weeks above 1.2500 on Monday and posted gains for the third consecutive day. Early Tuesday, however, the pair reversed its direction and declined below 1.2450.

In the absence of high-tier data releases, investors continue to react to headlines surrounding US President Donald Trump's trade policy. US Treasury Secretary Scott Bessent said late Monday that he is pushing for universal tariffs on imports to start at 2.5% and rise gradually, per the Financial Times. While speaking to reporters in the early Asian session on Tuesday, President Trump responded to these remarks, saying that he wants tariffs “much bigger than 2.5%.” Moreover, Trump noted they are going to be placing tariffs on foreign production of computer chips, semiconductors and pharmaceuticals “in the very near future," to return production of these essential goods to the US. Read more...

GBP/USD: A false bullish breakout?

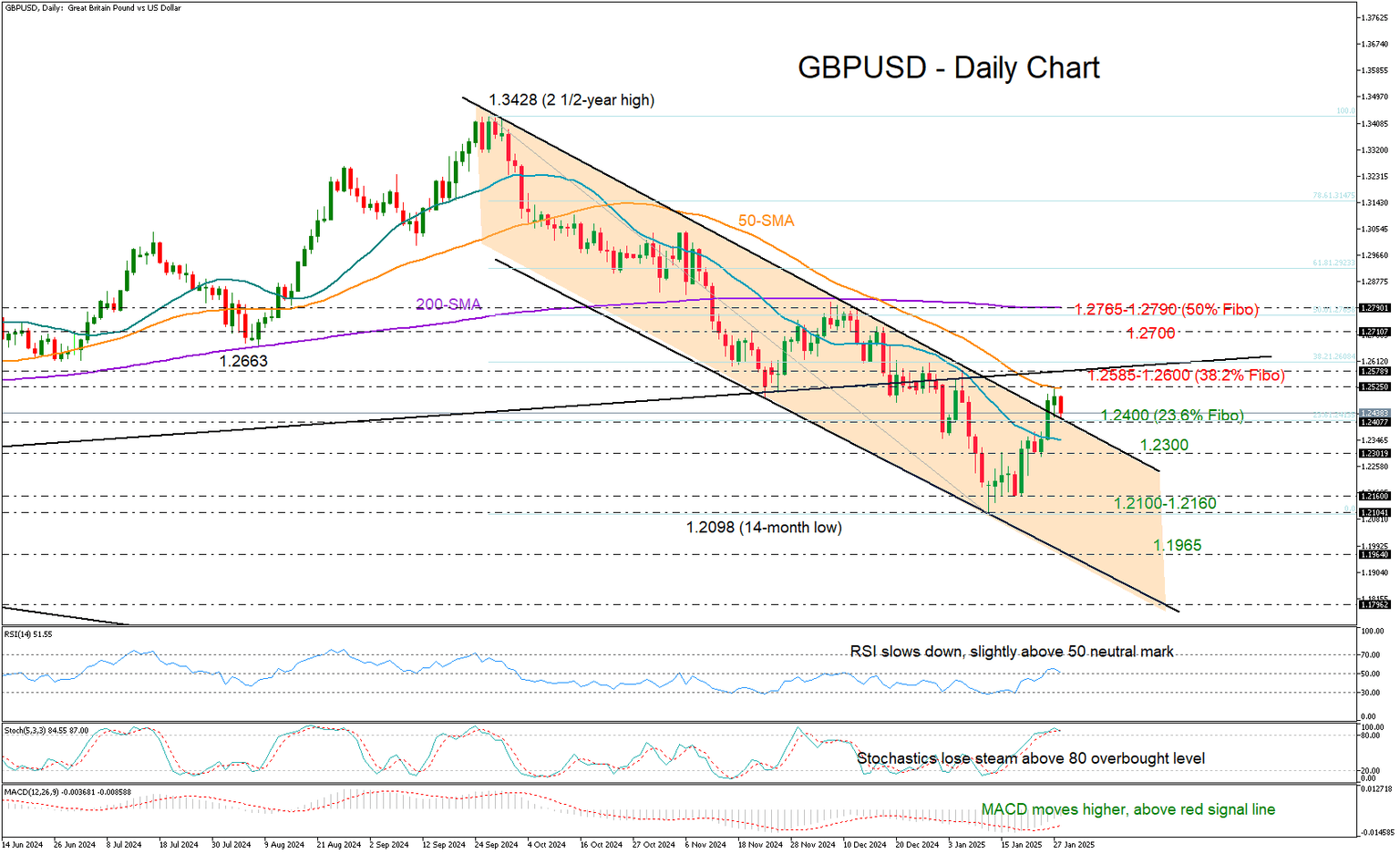

GBP/USD stalled around the falling 50-day simple moving average (SMA) at 1.2525 soon after exiting the bearish channel on the upside.

Was this a false bullish breakout? No, not as long as the price continues to trade above the channel’s upper boundary seen near 1.2400. The area is currently under examination along with the 23.6% Fibonacci retracement of the latest downtrend. Hence, failure to pivot there could disappoint traders, bringing the 1.2300 round level next into view, while a deeper fall might aim for a bearish extension below the crucial support area of 1.2100-1.2160. Read more...

Author

FXStreet Team

FXStreet