Pound Sterling Price News and Forecast: GBP/USD extends to four consecutive days its losses

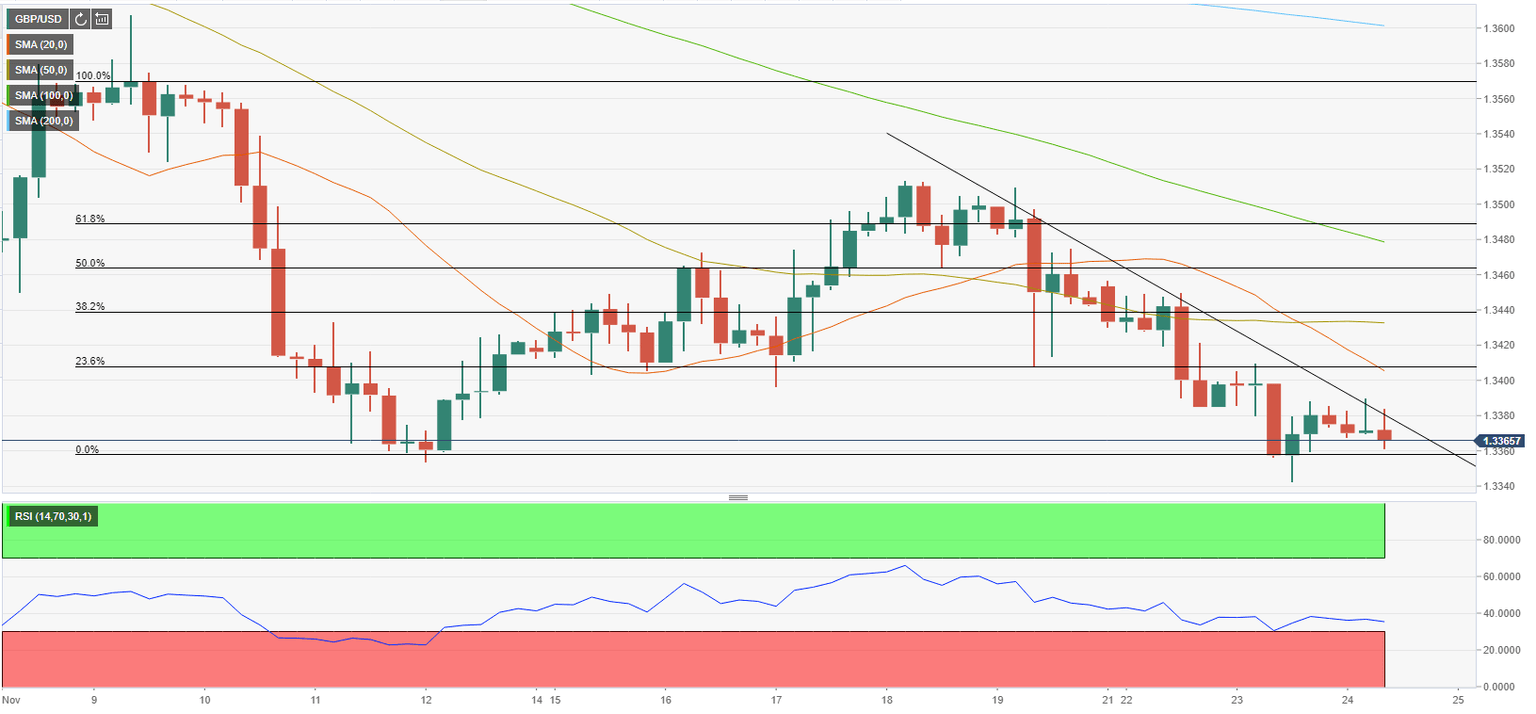

GBP/USD extends to four consecutive days its losses, hovers around 1.3330s ahead of FOMC minutes

The British pound continues its free-fall, down for the fourth consecutive day, reaching a new year-to-date low around 1.3324, down some 0.34%, trading at 1.3334 during the New York session at the time of writing. On Wednesday, the market sentiment is downbeat, as portrayed by US equity indices falling. In turn, FX risk-sensitive currencies like the GBP, the AUD, and the NZD, record losses in the day against the greenback. Read more...

GBP/USD Forecast: Bears could target 1.3300 if 10-year US yield gains traction

After failing to break above 1.3400, GBP/USD has met fresh selling pressure and touched its lowest level of 2021 at 1.3341 on Tuesday. The technical picture doesn't point to a recovery in the near term and the pair will remain at the mercy of the dollar's valuation, which has been driven by US Treasury bond yields. The benchmark 10-year US Treasury bond yield climbed to a monthly high near 1.7% on Tuesday and helped the greenback continue to outperform its rivals. Read more...

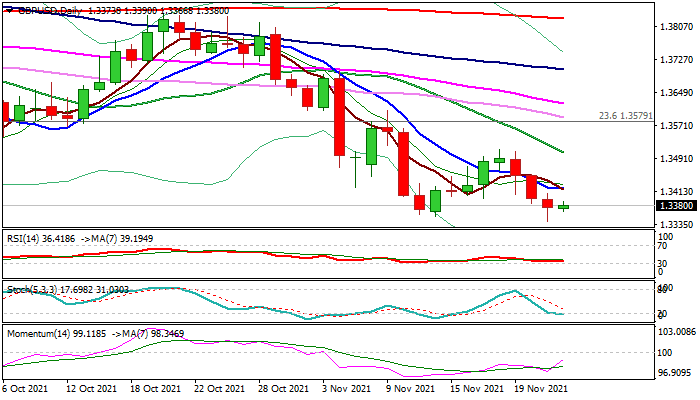

GBP/USD outlook: Limited correction may precede bearish continuation

Cable is trading within a narrow range in early Wednesday after hitting new 2021 low (1.3342) on Tuesday but failing to sustain break below previous low of Nov 12 (1.3353). Overall structure remains bearish but long tail of Tuesday’s candle, accompanied with fading negative momentum and oversold stochastic on daily chart, suggest that bears may take a breather before larger downtrend resumes. Read more...

Author

FXStreet Team

FXStreet

-637733697529023038-637733868064866843.png&w=1536&q=95)