GBP/USD Forecast: Bears could target 1.3300 if 10-year US yield gains traction

- GBP/USD has failed to stage a convincing rebound this week.

- Tehnical outlook suggests that there is more room on the downside before the pair turns oversold.

- Investors keep a close eye on US Treasury bond yields.

After failing to break above 1.3400, GBP/USD has met fresh selling pressure and touched its lowest level of 2021 at 1.3341 on Tuesday. The technical picture doesn't point to a recovery in the near term and the pair will remain at the mercy of the dollar's valuation, which has been driven by US Treasury bond yields.

The benchmark 10-year US Treasury bond yield climbed to a monthly high near 1.7% on Tuesday and helped the greenback continue to outperform its rivals.

The US Dollar Index has stayed in a consolidation phase around mid-96.00s as investors await key data releases from the US. The US Bureau of Economic Analysis will publish the second estimate of the third-quarter GDP growth and the Personal Consumption Expenditure (PCE) Price Index for October. Markets expect core PCE inflation to rise to 4.1% on a yearly basis from 3.6% in September. A stronger-than-forecast print could pave the way for another leg up in yields and weigh on GBP/USD.

The FOMC will also release the minutes of its November meeting but investors are likely to ignore this publication ahead of the Thanksgiving break.

Meanwhile, Brexit headlines are having no noticeable impact on the British pound with sides looking to drag negotiations on the Northern Ireland protocol into the new year.

GBP/USD Technical Analysis

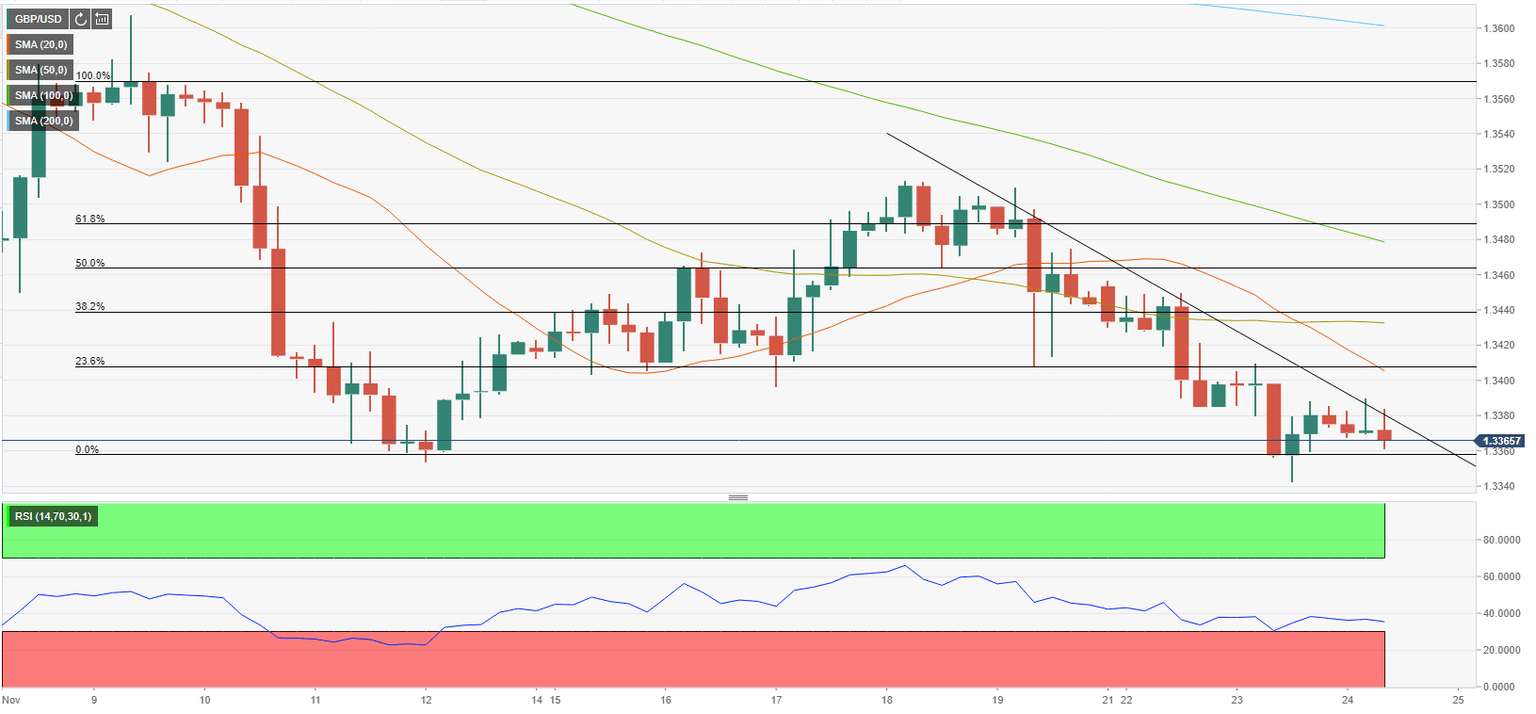

The Relative Strength Index on the four-hour chart has stayed above 30, suggesting that there is more room on the downside before the pair turns oversold. Additionally, GBP/USD continues to trade below the descending trend line coming from November 18, confirming the view that buyers are struggling to dominate the action.

In case a four-hour candle closes below the 1.3350/40 support area (static level, 2021-low), additional losses toward 1.3300 (psychological level) could be witnessed.

On the upside, 1.3380 (descending trendline) aligns as first resistance before 1.3400 (Fibonacci 23.6% retracement of the November 9-12 drop, psychological level, 20-period SMA) and 1.3440 (Fibonacci 38.2% retracement, 50-period SMA).

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.