GBP/USD outlook: Limited correction may precede bearish continuation

GBP/USD

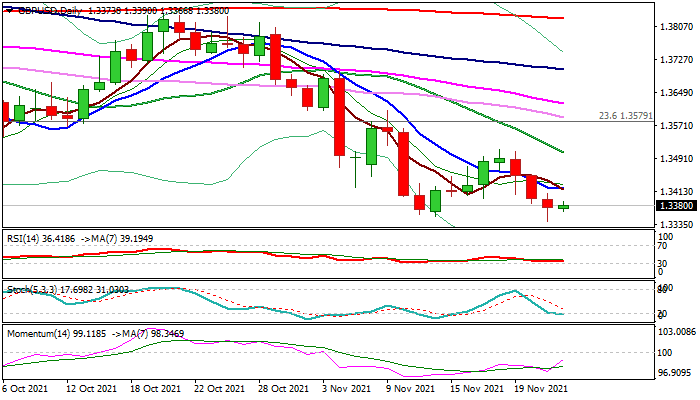

Cable is trading within a narrow range in early Wednesday after hitting new 2021 low (1.3342) on Tuesday but failing to sustain break below previous low of Nov 12 (1.3353).

Overall structure remains bearish but long tail of Tuesday’s candle, accompanied with fading negative momentum and oversold stochastic on daily chart, suggest that bears may take a breather before larger downtrend resumes.

Initial resistance lays at 1.3420 (converged 5/10DMA, attempting to form a bear-cross) with extended upticks expected to remain below 1.3500 zone (Nov 18 lower top / falling 20DMA) to keep bears in play for extension towards 1.3288 (100WMA) and more significant support at 1.3164 (Fibo 38.2% of 1.1409/1.4249/200WMA).

Caution on firm break of 1.3500 zone that would confirm a double bottom and generate reversal signal.

Traders focus on release of US data (weekly jobless claims; Q3 GDP estimation; durable goods orders and FOMC minutes) which would provide some signals, but also consider a lower volume on Thursday as the US will be shut for a Thanksgiving Day.

Res: 1.3400; 1.3420; 1.3454; 1.3513.

Sup: 1.3342; 1.3288; 1.3200; 1.3164.

Interested in GBP/USD technicals? Check out the key levels

Author

Slobodan Drvenica

Windsor Brokers

Industry veteran with over 22 years’ experience, Slobodan Drvenica joined Windsor Brokers in 1995 when he was an active trader for more than 10 years, managing the trading desk and own account departments.