Pound Sterling Price News and Forecast: GBP/USD edged higher as Trump signaled a willingness in negotiations

GBP/USD appreciates to near 1.2850 due to easing trade tensions after Trump's comments

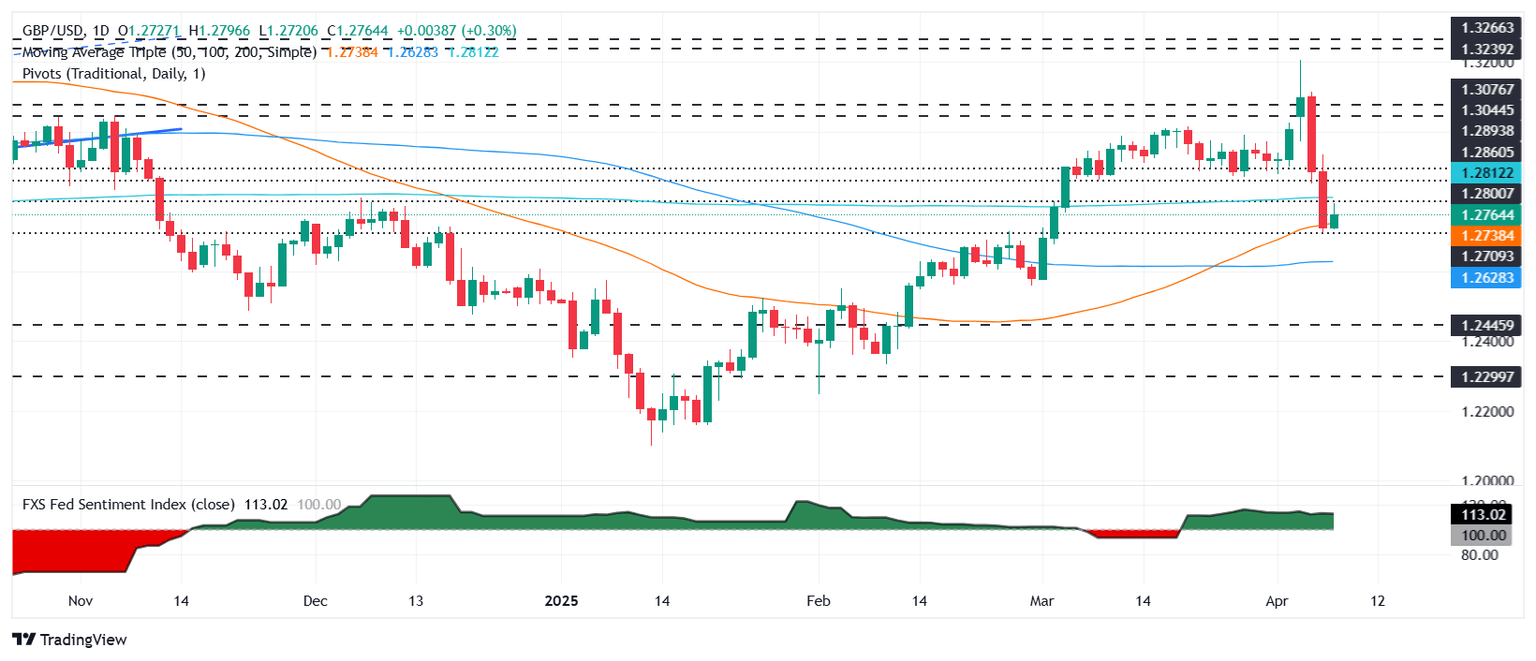

The GBP/USD pair advances for a second straight session, trading near 1.2820 during Asian hours on Wednesday. The pair’s uptick is supported by easing trade tensions after US President Donald Trump signaled openness to negotiations with global partners, fueling hopes of a potential de-escalation in trade conflicts.

US Customs and Border Protection confirmed on Tuesday that it is prepared to begin collecting country-specific tariffs from 86 trade partners. While President Trump maintained his broader tariff plans despite requests for exemptions, he indicated a willingness to engage in discussions. Read more...

GBP/USD catches much-needed bounce from key moving average as tariffs loom

GBP/USD snapped a harsh two-day losing streak on Tuesday, finding a technical bounce from the 200-day Exponential Moving Average (EMA) just north of the 1.2700 handle. Price action remains strung out in no man’s land ahead of the US’s planned tariff implementation, and investors are hunkering down with key US inflation and sentiment figures due later this week.

It remains a thin week overall on the UK side of the economic data docket, and Tuesday was a welcome reprieve from the usual deluge of geopolitical and trade headlines that have become the norm from the Trump administration in recent weeks. Still, several key policymakers from the Federal Reserve (Fed) took the opportunity to come out of the woodwork, cautioning that uncertainty and unwelcome inflationary impacts from US tariffs will make it harder, not easier, for the Fed to begin cutting rates. Read more...

GBP/USD rebounds as Trump, Bessent stoke tariff deal hopes

The Pound Sterling (GBP) is recovering some ground against the Greenback on Tuesday, edging up 0.34% amid renewed hopes that tariffs are indeed used as negotiation tools, as United States (US) President Donald Trump said that “many, many, countries are coming to negotiate deals with us.” At the time of writing, the GBP/USD trades at 1.2756 after bouncing off daily lows around 1.2700.

Hopes fueled by US Treasury Secretary Scott Bessent that trade deals would be made improved the market mood, underpinning global equities, while the US Dollar (USD) retreated somewhat. Read more...

Author

FXStreet Team

FXStreet