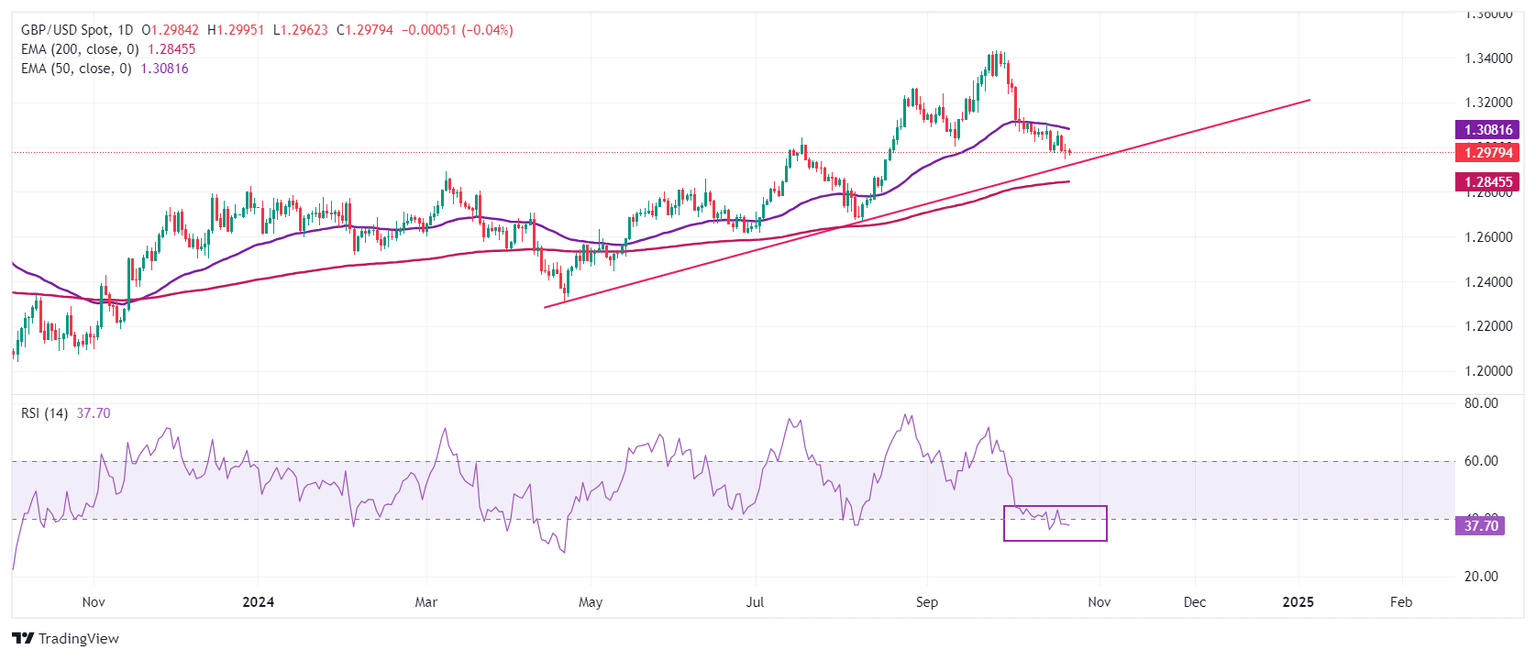

GBP/USD Price Forecast: Dips below 100-day SMA, sellers target 1.2900

The Pound Sterling extended its losses for the third straight day against the Greenback amid a scarce economic docket in the UK that will feature remarks of

Bank of England (BoE) Governor Andrew Bailey. At the time of writing, the GBP/USD trades at 1.2954, down 0.22%.

Read More...

Pound Sterling retreats as BoE seems to cut interest rates next month

The Pound Sterling (GBP) retreats against the majority of its peers on Wednesday. The British currency falls despite BoE Monetary Policy Committee member Megan Greene delivered a slightly hawkish interest rate guidance in a discussion with the Atlantic Council think-tank on the sidelines of the International Monetary Fund’s (IMF) meeting on Tuesday.

Read More...

GBP/USD tests 1.3000, faces headwinds due to dovish sentiment surrounding the BoE

The GBP/USD pair edges higher toward 1.3000 during Asian trading on Wednesday. However,

the Pound Sterling (GBP) faced headwinds due to declining consumer and producer inflation figures, coupled with weak labor market data in the United Kingdom (UK). These factors are fueling expectations that the

Bank of England (BoE) may implement a 25 basis point rate cut in November, followed by another quarter-point cut in December.

Read More...