Pound Sterling Price News and Forecast: GBP/USD depreciates due to heightened safe-haven demand

GBP/USD holds losses near 1.3400 ahead of BoE’s policy decision

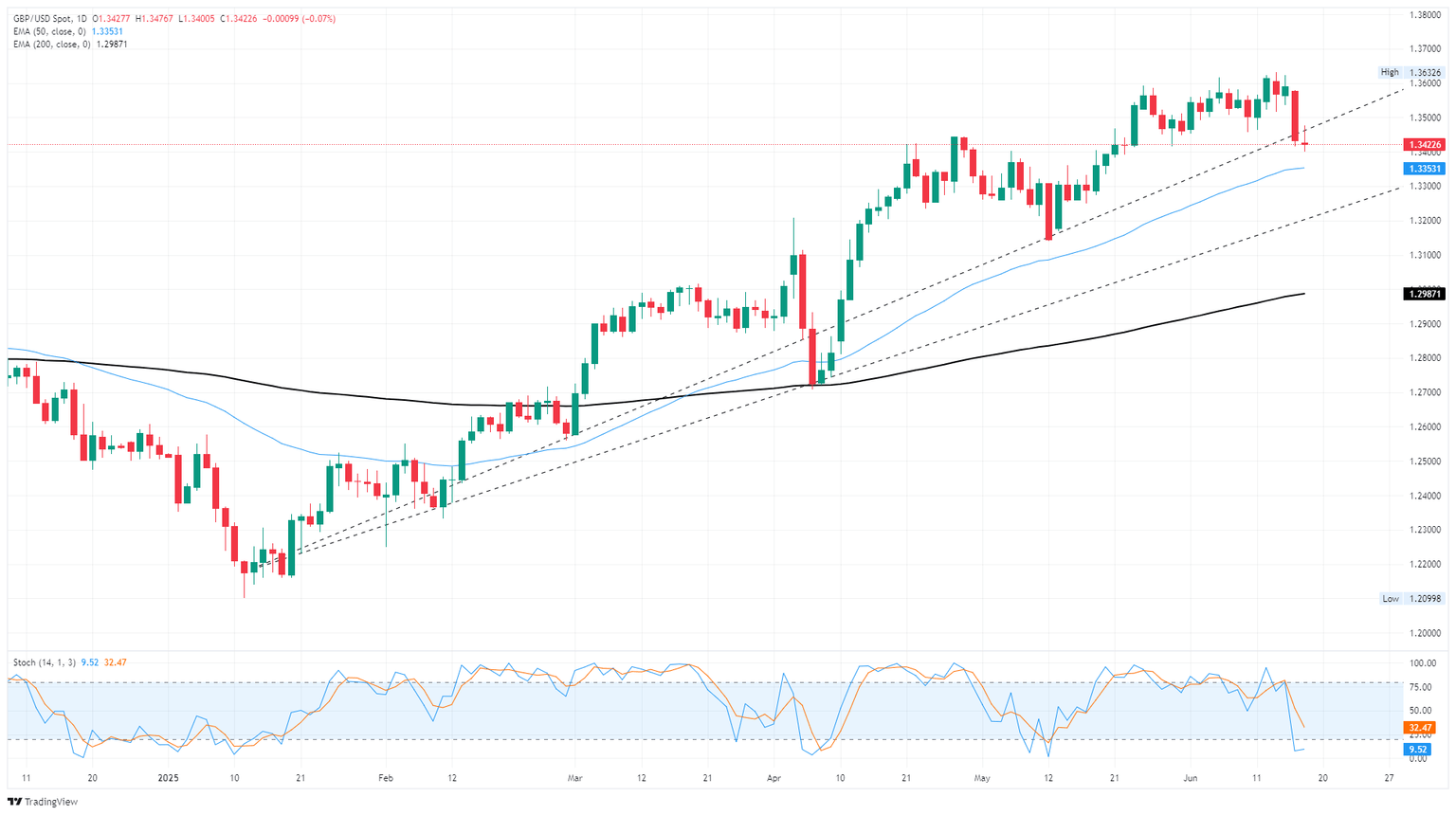

GBP/USD remains subdued for the third consecutive session, trading around 1.3410 during the Asian hours on Thursday. The pair faces challenges as the US Dollar (USD) gains ground amid increased safe-haven demand, driven by escalating tensions between Israel and Iran. Moreover, the Bank of England (BoE) is widely anticipated to keep its interest rates steady at 4.25% at its June meeting scheduled later in the day.

In the United Kingdom (UK), CPI inflation eased to 3.4% year-over-year in May, as expected from the 3.5% in April. However, the reading remains well above the BoE’s 2% target. However, markets are still pricing in around 48 basis points of rate cuts through the end of the year. Read more...

GBP/USD holds steady post-FOMC, BoE on deck

GBP/USD spun a circle on Wednesday, rising and falling through the Federal Reserve’s (Fed) latest rate hold. Cable is caught in intraday consolidation near the 1.3400 handle, as Pound Sterling traders gear up for the Bank of England’s (BoE) own interest rate decision, due early Thursday.

The Federal Reserve (Fed) hit the mark on Wednesday and kept interest rates on hold, as most investors expected. Traders are still pricing in around 50 basis points in interest rate cuts through the end of 2025, and the Federal Open Market Committee (FOMC) generally seems to agree with that assessment. However, Fed Chair Jerome Powell warned that ongoing policy uncertainty will keep the Fed in a rate-hold stance, and any rate cuts will be contingent on further improvement in labor and inflation data. Read more...

GBP/USD inches higher as Fed holds rates, maintains 2025 cut outlook

GBP/USD trades within a 40-pip range, exhibiting mild volatility on Wednesday, after the Federal Reserve (Fed) stood pat on rates and hinted that it is still expecting two rate cuts this year. At the time of writing, the pair trades near 1.3450, posting modest gains of 0.20%, as traders await the Fed Chair Powell's press conference.

As expected, the Federal Reserve kept the target range for the fed funds rate unchanged at 4.25%–4.50%, reaffirming that the U.S. economy continues to expand at a solid pace, with strong labor market conditions. The Federal Open Market Committee (FOMC) reiterated its commitment to monitoring risks associated with both sides of its dual mandate and confirmed plans to further reduce its Treasury holdings. Read more...

Author

FXStreet Team

FXStreet