Pound Sterling Price News and Forecast: GBP/USD could target the immediate barrier at 1.2724

GBP/USD Price Forecast: Hovers below 1.2700 barrier near three-month highs

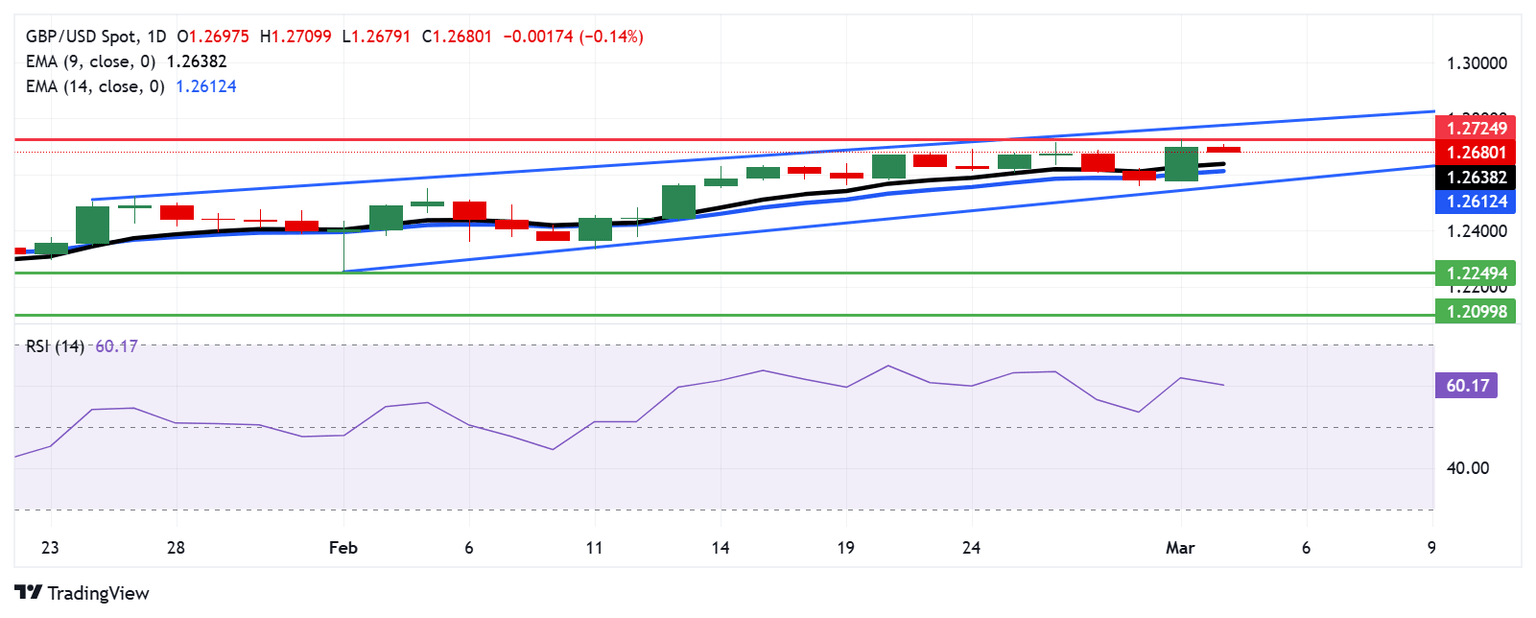

The GBP/USD pair edges lower after registering gains in the previous session, hovering around 1.2680 during Tuesday’s Asian hours. Technical analysis of the daily chart suggests a continued bullish bias, with the pair maintaining its position within an ascending channel pattern.

The 14-day Relative Strength Index (RSI) remains above 50, indicating strengthened bullish momentum. Moreover, the GBP/USD pair continues to trade above the nine- and 14-day Exponential Moving Averages (EMAs), reinforcing strong short-term price dynamics and confirming the ongoing upward trend. Read more...

GBP/USD rallies on a moment of Greenback weakness, but tensions remains high

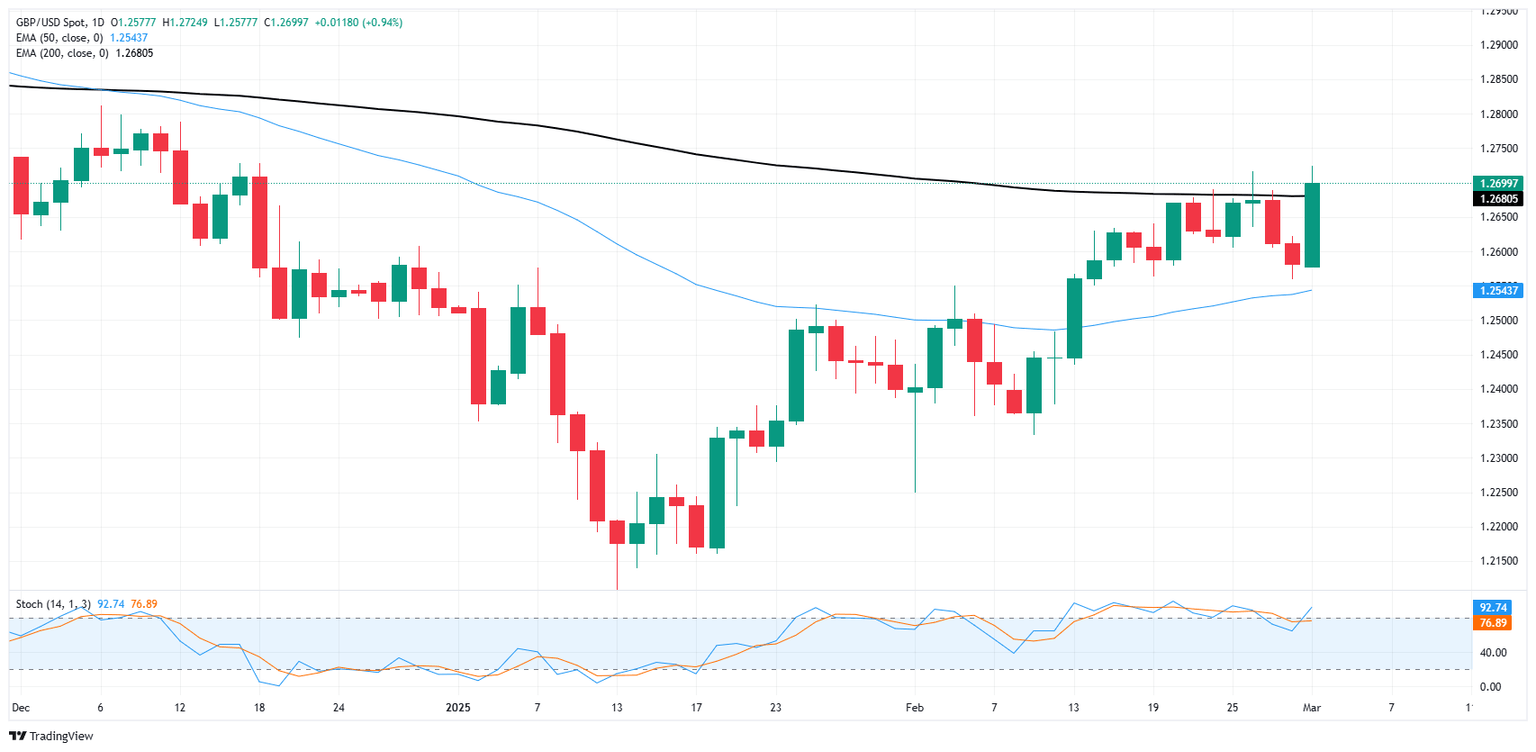

GBP/USD rose on Monday, buoyed by a broadly-underbid US Dollar and a latent recovery in Pound Sterling flows. The pair is knocking back into the 1.2700 handle, with price action continuing to get mired in the 200-day Exponential Moving Average (EMA).

US President Donald Trump reiterated his threats to impose a 25% tariff package on Canada and Mexico on Monday, which are set to automatically go into effect at midnight EST Tuesday morning. Markets have gotten used to President Trump kicking the can on his own policy threats since taking office in January, but this time may turn out to be different and general market sentiment is wobbling. Read more...

GBP/USD rallies on soft US ISM data, falling US yields

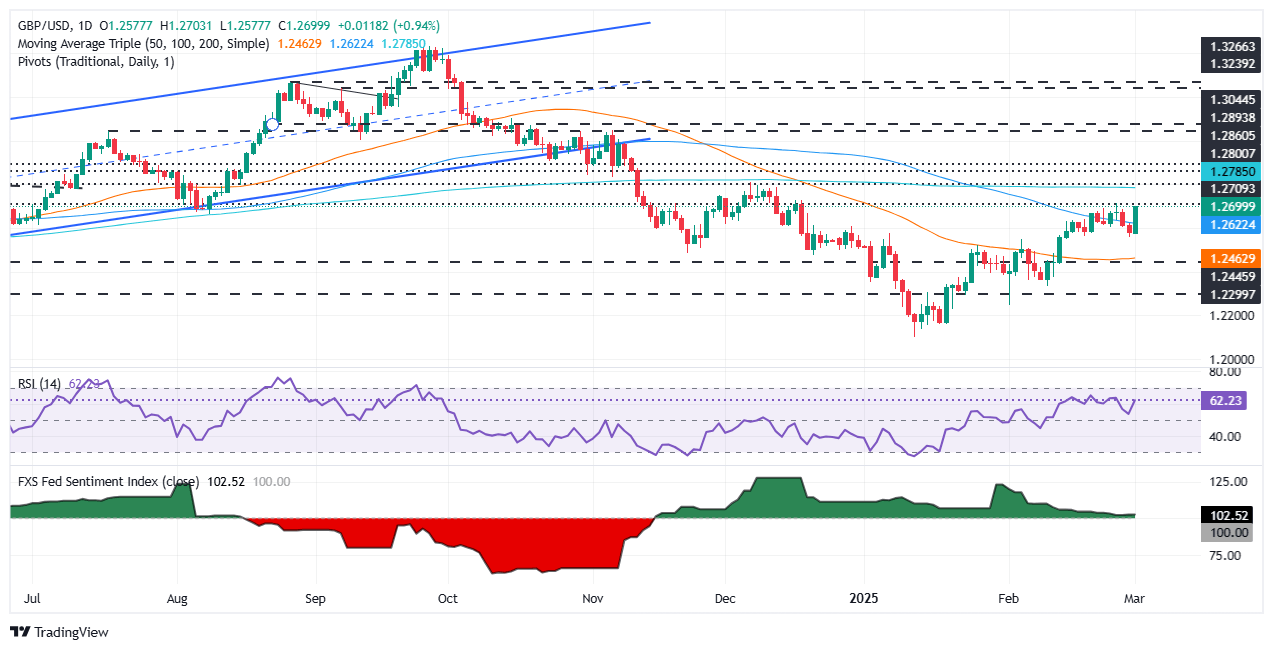

The Pound Sterling (GBP) snaps two days of losses and is rising over 0.89% amid a weaker US Dollar (DXY), which appreciated on Friday following a weaker-than-expected Atlanta GDP Now forecast for Q1 2025. At the time of writing, the GBP/USD is trading at 1.2694 after hitting a daily low of 1.2577.

Last week’s data suggested the United States (US) economy is undergoing an economic slowdown. As of writing, the ISM Manufacturing PMI showed that business activity in February remained steady at 50.3, down from the previous 50.9 and below economists’ estimates of 50.5. According to the ISM poll, the decline in other subcomponents of the PMI was fueled by US President Donald Trump’s tariff threats on imported goods. Read more...

Author

FXStreet Team

FXStreet