GBP/USD rallies on soft US ISM data, falling US yields

- Atlanta Fed GDP Now forecast weakens, fueling recession concerns.

- ISM Manufacturing PMI drops to 50.3 as Trump tariffs dent outlook.

- UK 10-year GILTS yield rises, while US 10-year T-note yield declines.

The Pound Sterling (GBP) snaps two days of losses and is rising over 0.89% amid a weaker US Dollar (DXY), which appreciated on Friday following a weaker-than-expected Atlanta GDP Now forecast for Q1 2025. At the time of writing, the GBP/USD is trading at 1.2694 after hitting a daily low of 1.2577.

Pound rebounds toward 1.2700 as US slowdown fears weigh on USD

Last week’s data suggested the United States (US) economy is undergoing an economic slowdown. As of writing, the ISM Manufacturing PMI showed that business activity in February remained steady at 50.3, down from the previous 50.9 and below economists’ estimates of 50.5. According to the ISM poll, the decline in other subcomponents of the PMI was fueled by US President Donald Trump’s tariff threats on imported goods.

Meanwhile, S&P Global revealed that manufacturing activity in February expanded by 52.7, up from 51.2 and exceeding forecasts of 51.6.

Across the pond, the economic docket in the United Kingdom (UK) remains light, though Bank of England (BoE) Governor Andrew Bailey could set the tone on Wednesday during his appearance before the Treasury Select Committee.

Another reason for GBP/USD upside is that the 10-year GILTS yield is pushing higher, while the yield of the US 10-year T-note continued to decline. This sponsored a leg-up in the pair, with buyers setting their sights on the 1.2700 handle.

Up next, the US economic docket will feature a speech by St. Louis Fed President Alberto Musalem.

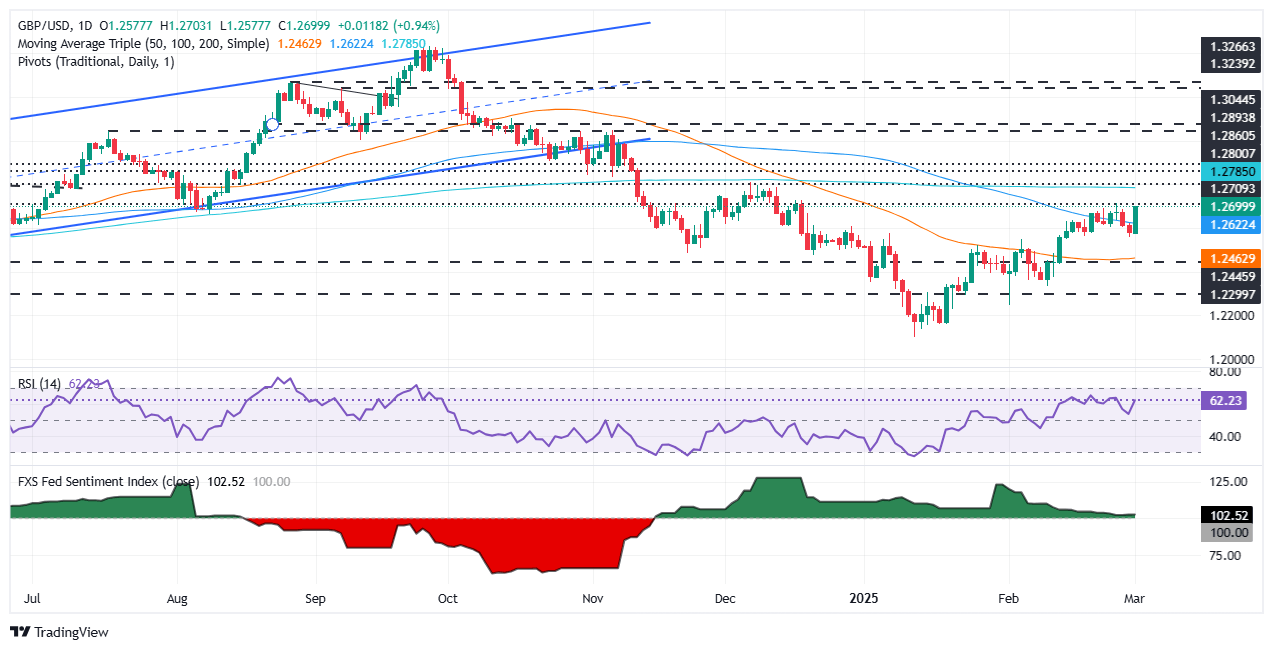

GBP/USD Price Forecast: Technical outlook

The GBP/USD pair is neutral to slightly upward biased, but to cement the uptrend buyers must clear the latest cycle peak at 1.2715. If surpassed they will be able to challenge the 200-day Simple Moving Average (SMA) at 1.2785, followed by the 1.2800 mark. On the other hand, further weakness is seen, if the pair slides beneath the 100-day SMA at 1.2631, opening the door to test 1.2600.

British Pound PRICE Today

The table below shows the percentage change of British Pound (GBP) against listed major currencies today. British Pound was the strongest against the US Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -1.11% | -0.94% | -0.21% | -0.29% | -0.60% | -0.51% | -0.59% | |

| EUR | 1.11% | 0.06% | 0.69% | 0.64% | 0.41% | 0.42% | 0.34% | |

| GBP | 0.94% | -0.06% | 0.74% | 0.59% | 0.36% | 0.36% | 0.28% | |

| JPY | 0.21% | -0.69% | -0.74% | 0.12% | -0.36% | -0.27% | -0.41% | |

| CAD | 0.29% | -0.64% | -0.59% | -0.12% | -0.17% | -0.23% | -0.30% | |

| AUD | 0.60% | -0.41% | -0.36% | 0.36% | 0.17% | 0.00% | -0.08% | |

| NZD | 0.51% | -0.42% | -0.36% | 0.27% | 0.23% | -0.00% | -0.08% | |

| CHF | 0.59% | -0.34% | -0.28% | 0.41% | 0.30% | 0.08% | 0.08% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.