GBP/USD rallies on a moment of Greenback weakness, but tensions remains high

- GBP/USD rose nearly a full percent on Monday.

- US President Donald Trump continues to explore tariff threats, but lacks action.

- ANother NFP Friday looms ahead as markets hope for more tariff walkbacks.

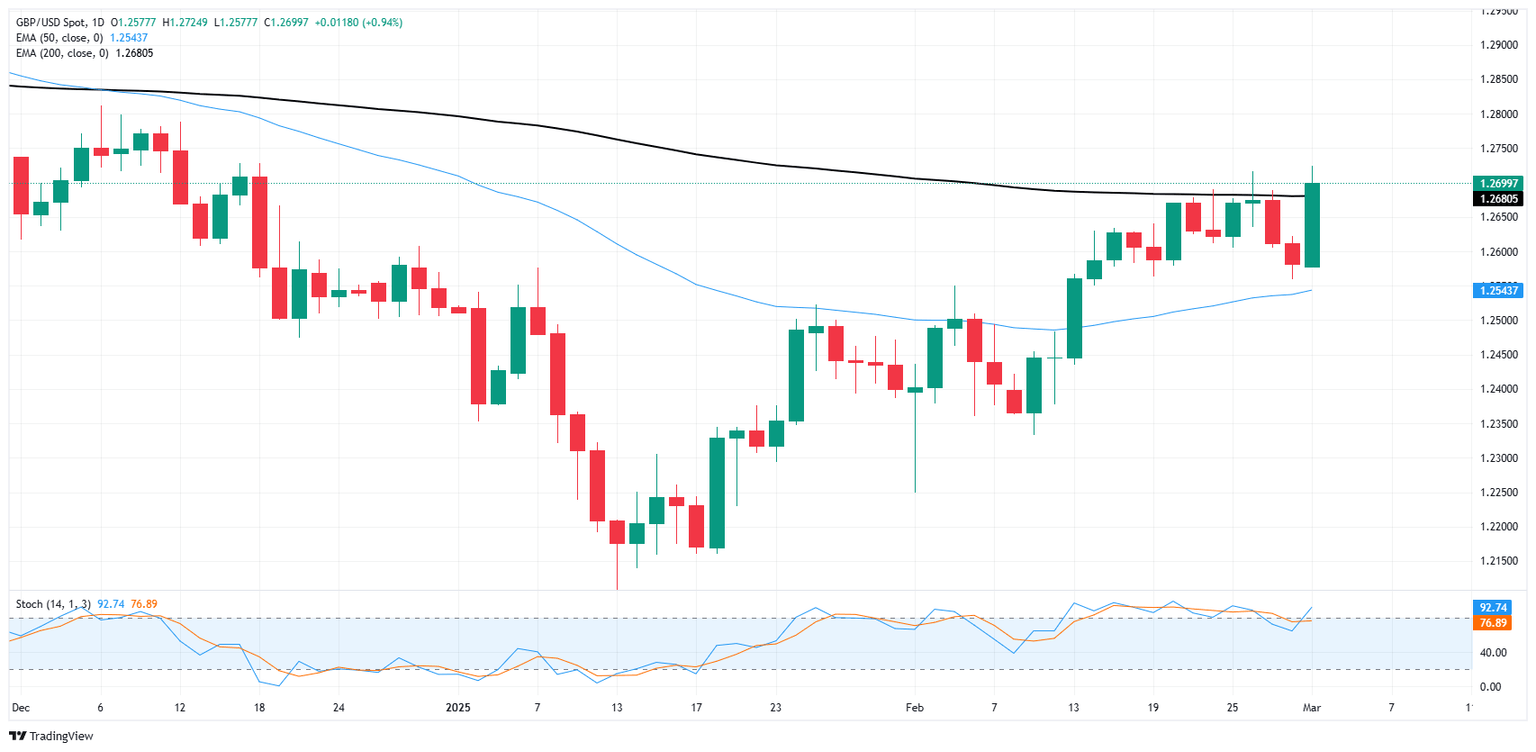

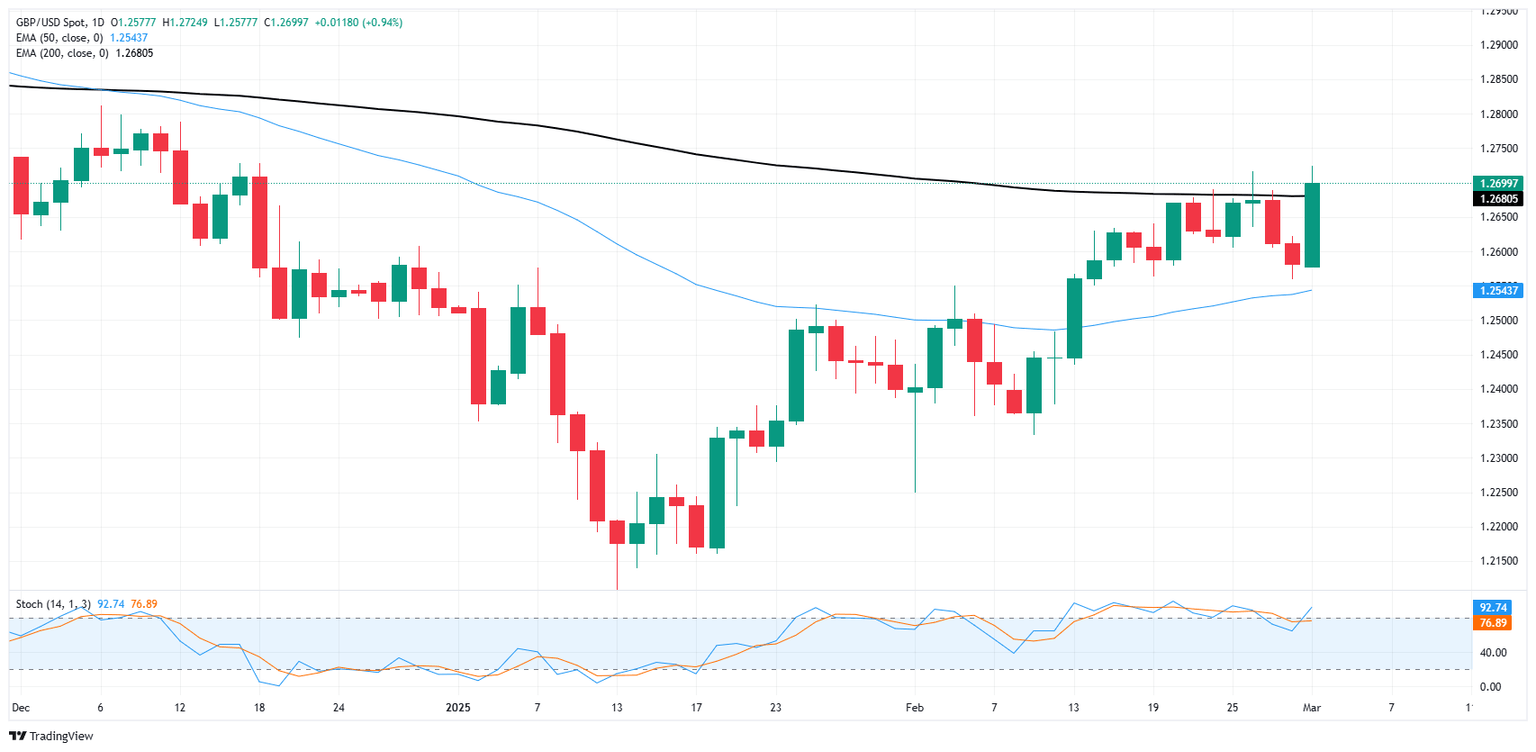

GBP/USD rose on Monday, buoyed by a broadly-underbid US Dollar and a latent recovery in Pound Sterling flows. The pair is knocking back into the 1.2700 handle, with price action continuing to get mired in the 200-day Exponential Moving Average (EMA).

US President Donald Trump reiterated his threats to impose a 25% tariff package on Canada and Mexico on Monday, which are set to automatically go into effect at midnight EST Tuesday morning. Markets have gotten used to President Trump kicking the can on his own policy threats since taking office in January, but this time may turn out to be different and general market sentiment is wobbling.

Data remains limited this week on the UK side of the economic data docket, leaving markets to toil under the burden of tariff threats, as well as a looming Friday Nonfarm Payrolls (NFP) print due at the end of the week.

Trader confidence in the US economy has grown shaky quite quickly, and investors will be watching this week’s NFP jobs print with a keen eye. However, a smattering of Federal Reserve (Fed) policymakers will be making public appearances throughout the week, and US ISM Services Purchasing Managers Index (PMI) Services figures are due on Wednesday. According to a sampling of key business operators, business activity expectations for March shrank slightly, with the ISM Manufacturing PMI falling to 50.3. The economic indicator is still holding above the key 50.0 level that typically separates contraction versus expansion expectations, but the one-month fall from February’s 50.9 accelerated through median market forecasts of a slight trim to 50.5.

GBP/USD price forecast

GBP/USD is trading back into the 200-day EMA once again, testing chart paper near the 1.2700 handle. Cable has skidded sideways recently, with price action getting squeezed between the 200-day EMA and the 50-day EMA near 1.2540.

Bullish momentum has been a steady force since GBP/USD bottomed out at 1.2100 in January, but topside momentum looks about over. Cable traders remain unwilling to sell off enough to kick off a fresh leg lower, but a fresh push into bull country looks unlikely with technical oscillators stuck in overbought territory.

GBP/USD daily chart

Pound Sterling FAQs

The Pound Sterling (GBP) is the oldest currency in the world (886 AD) and the official currency of the United Kingdom. It is the fourth most traded unit for foreign exchange (FX) in the world, accounting for 12% of all transactions, averaging $630 billion a day, according to 2022 data. Its key trading pairs are GBP/USD, also known as ‘Cable’, which accounts for 11% of FX, GBP/JPY, or the ‘Dragon’ as it is known by traders (3%), and EUR/GBP (2%). The Pound Sterling is issued by the Bank of England (BoE).

The single most important factor influencing the value of the Pound Sterling is monetary policy decided by the Bank of England. The BoE bases its decisions on whether it has achieved its primary goal of “price stability” – a steady inflation rate of around 2%. Its primary tool for achieving this is the adjustment of interest rates. When inflation is too high, the BoE will try to rein it in by raising interest rates, making it more expensive for people and businesses to access credit. This is generally positive for GBP, as higher interest rates make the UK a more attractive place for global investors to park their money. When inflation falls too low it is a sign economic growth is slowing. In this scenario, the BoE will consider lowering interest rates to cheapen credit so businesses will borrow more to invest in growth-generating projects.

Data releases gauge the health of the economy and can impact the value of the Pound Sterling. Indicators such as GDP, Manufacturing and Services PMIs, and employment can all influence the direction of the GBP. A strong economy is good for Sterling. Not only does it attract more foreign investment but it may encourage the BoE to put up interest rates, which will directly strengthen GBP. Otherwise, if economic data is weak, the Pound Sterling is likely to fall.

Another significant data release for the Pound Sterling is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period. If a country produces highly sought-after exports, its currency will benefit purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.