Pound Sterling Price News and Forecast: GBP/USD consolidates above 1.3450

GBP/USD consolidates above 1.3450 with muted reaction to US inflation data

The British Pound (GBP) trades under pressure against the US Dollar (USD) on Friday, snapping a three-day winning streak as the Greenback holds firm. GBP/USD is finding a footing above 1.3450 during the American session, stabilizing after the release of the US Personal Consumption Expenditures (PCE) Price Index for July, which came broadly in line with expectations. Read More...

Pound Sterling trades lower against US Dollar ahead of US PCE inflation

The Pound Sterling (GBP) corrects to near 1.3455 against the US Dollar (USD) during the European trading session on Friday. The GBP/USD pair retreats after a three-day winning streak as the US Dollar trades marginally higher ahead of the United States (US) Personal Consumption Expenditure Price Index (PCE) data for July, which will be published at 12:30 GMT. Read More...

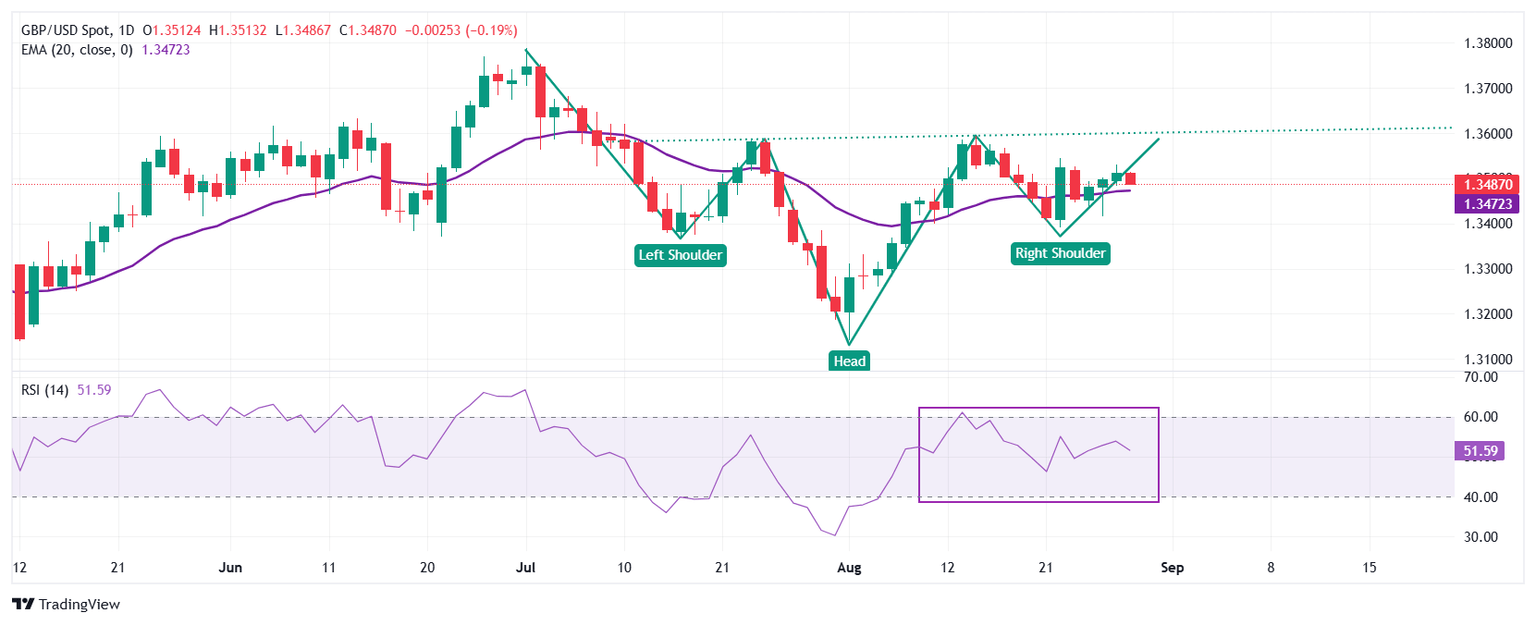

GBP/USD Price Forecast: Tests the confluence zone around 1.3500, nine-day EMA support

The GBP/USD pair halts its three-day winning streak, trading around 1.3500 during the Asian hours on Friday. The bullish bias prevails as the daily chart’s technical analysis suggests that the pair remains within the ascending channel pattern. Read More...

Author

FXStreet Team

FXStreet