Pound Sterling trades lower against US Dollar ahead of US PCE inflation

- The Pound Sterling retreats to near 1.3455 against the US Dollar, ahead of key US PCE inflation data for July.

- Fed’s Waller stated that he will support interest rate cuts in the policy meeting in September.

- The British currency underperformed its peers this week.

The Pound Sterling (GBP) corrects to near 1.3455 against the US Dollar (USD) during the European trading session on Friday. The GBP/USD pair retreats after a three-day winning streak as the US Dollar trades marginally higher ahead of the United States (US) Personal Consumption Expenditure Price Index (PCE) data for July, which will be published at 12:30 GMT.

At the time of writing, the US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, ticks up to near 98.00.

Economists expect the US core PCE inflation, which is the Federal Reserve’s (Fed) preferred inflation gauge, to have risen at a faster pace of 2.9% on year against 2.8% in June, with the monthly figure rising steadily by 0.3%.

Majorly, the PCE inflation remains a key driver for market expectations for the Federal Reserve’s (Fed) monetary policy outlook. However, its impact is expected to be limited this time as rate-setting members have become more concerned about cooling labor market conditions, which stemmed after a sharp downward revision in Nonfarm Payrolls (NFP) data for May and June.

On Thursday, Fed Governor Christopher Waller also warned of downside labor market risks, while stating that he will support a 25-basis point (bps) interest rate cut in the September policy meeting. “While there are signs of a weakening labor market, I worry that conditions could deteriorate further and quite rapidly,” Waller said, Reuters reported.

Pound Sterling is set to end the week lower against its major peers

- The Pound Sterling underperforms its peers on Friday amid a light United Kingdom (UK) economic calendar week. The British currency remains lower even as market experts believe the Bank of England (BoE) will not cut interest rates for the remainder of the year.

- This week, BoE Monetary Policy Committee (MPC) member Catherine Mann also argued in favor of holding interest rates at their current levels for a longer period, with inflationary pressures turning out to be persistent.

- "A more persistent hold on Bank Rate is appropriate right now, to maintain the tight-but-not-tighter monetary policy stance needed to lean against inflation persistence persisting," Mann said, Reuters reported.

- Going forward, the major trigger for the Pound Sterling will be the United Kingdom (UK) Retail Sales data for July, which will be published next week. Economists expect the Retail Sales data, a key measure of consumer spending, to have grown at a moderate pace.

- Meanwhile, growing doubts over the dominance of the US Dollar are expected to provide support to the GBP/USD pair. Financial market participants have become concerned over the safe-haven appeal of the US Dollar due to continuous attacks by US President Donald Trump to the Fed’s independence.

- This week, US President Trump released the termination letter of Fed Governor Lisa Cook over mortgage allegations. In response, Cook has filed a lawsuit, citing them as baseless, to keep her job, and the hearing on the motion is scheduled for 14:00 GMT on Friday.

- In the past, US President Trump has attacked the Fed’s independence several times by threatening Chair Jerome Powell that he will lose his job if he does not lower interest rates. However, Trump praised Powell after his speech at the Jackson Hole Symposium on Friday, in which he surprisingly delivered a dovish interest rate guidance.

Pound Sterling Price Today

The table below shows the percentage change of British Pound (GBP) against listed major currencies today. British Pound was the weakest against the New Zealand Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.11% | 0.38% | 0.21% | 0.04% | 0.01% | -0.08% | 0.07% | |

| EUR | -0.11% | 0.28% | 0.09% | -0.06% | -0.03% | -0.18% | -0.04% | |

| GBP | -0.38% | -0.28% | -0.26% | -0.34% | -0.32% | -0.41% | -0.32% | |

| JPY | -0.21% | -0.09% | 0.26% | -0.10% | -0.20% | -0.26% | -0.06% | |

| CAD | -0.04% | 0.06% | 0.34% | 0.10% | -0.05% | -0.10% | 0.01% | |

| AUD | -0.01% | 0.03% | 0.32% | 0.20% | 0.05% | -0.14% | -0.01% | |

| NZD | 0.08% | 0.18% | 0.41% | 0.26% | 0.10% | 0.14% | 0.14% | |

| CHF | -0.07% | 0.04% | 0.32% | 0.06% | -0.01% | 0.00% | -0.14% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

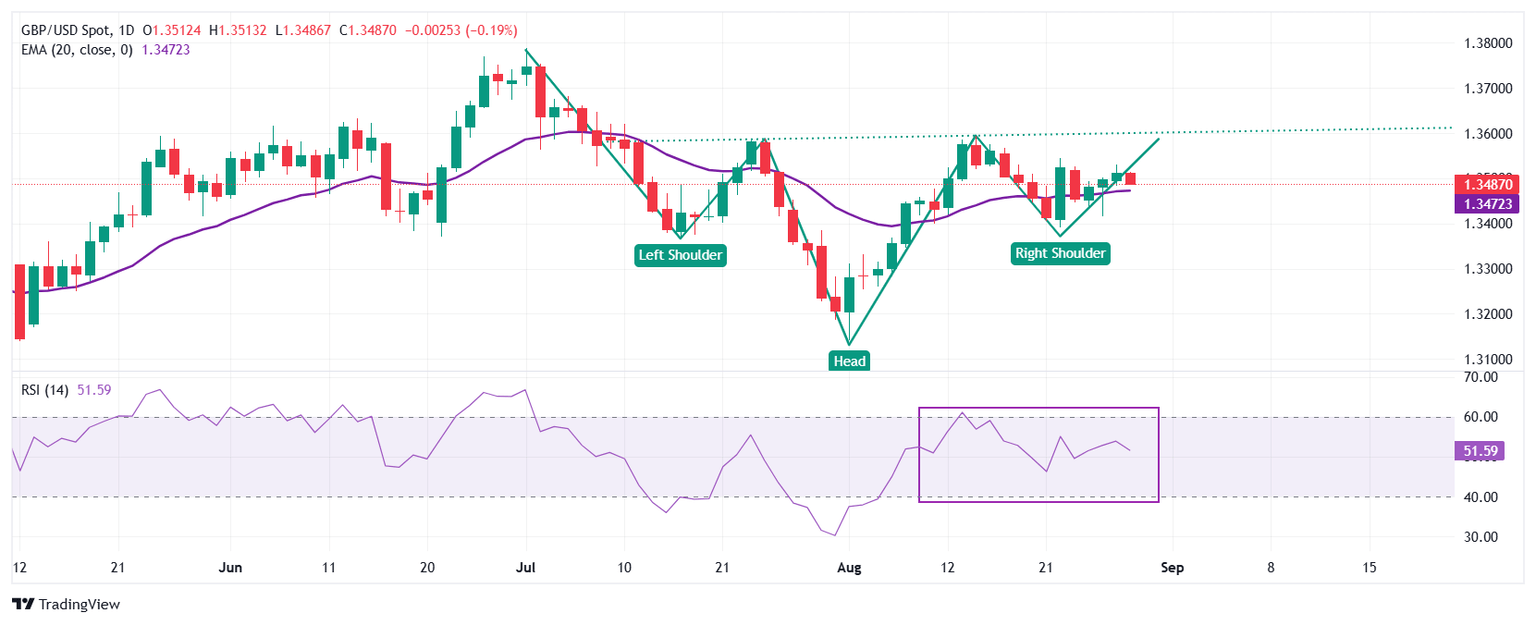

Technical Analysis: Pound Sterling forms inverse Head and Shoulder pattern

The Pound Sterling falls to near 1.3470 against the US Dollar on Friday. The overall trend of the GBP/USD pair remains sideways as it stays close to the 20-day Exponential Moving Average (EMA), which trades around 1.3468.

The Cable is also forming an inverse Head and Shoulder (H&S) chart pattern on the daily chart, which leads to a bullish reversal after a corrective or downside move. The neckline of the H&S pattern is placed around 1.3580.

The 14-day Relative Strength Index (RSI) oscillates inside the 40.00-60.00 range, suggesting a sharp volatility contraction.

Looking down, the August 11 low of 1.3400 will act as a key support zone. On the upside, the July 1 high near 1.3790 will act as a key barrier.

Inflation FAQs

Inflation measures the rise in the price of a representative basket of goods and services. Headline inflation is usually expressed as a percentage change on a month-on-month (MoM) and year-on-year (YoY) basis. Core inflation excludes more volatile elements such as food and fuel which can fluctuate because of geopolitical and seasonal factors. Core inflation is the figure economists focus on and is the level targeted by central banks, which are mandated to keep inflation at a manageable level, usually around 2%.

The Consumer Price Index (CPI) measures the change in prices of a basket of goods and services over a period of time. It is usually expressed as a percentage change on a month-on-month (MoM) and year-on-year (YoY) basis. Core CPI is the figure targeted by central banks as it excludes volatile food and fuel inputs. When Core CPI rises above 2% it usually results in higher interest rates and vice versa when it falls below 2%. Since higher interest rates are positive for a currency, higher inflation usually results in a stronger currency. The opposite is true when inflation falls.

Although it may seem counter-intuitive, high inflation in a country pushes up the value of its currency and vice versa for lower inflation. This is because the central bank will normally raise interest rates to combat the higher inflation, which attract more global capital inflows from investors looking for a lucrative place to park their money.

Formerly, Gold was the asset investors turned to in times of high inflation because it preserved its value, and whilst investors will often still buy Gold for its safe-haven properties in times of extreme market turmoil, this is not the case most of the time. This is because when inflation is high, central banks will put up interest rates to combat it. Higher interest rates are negative for Gold because they increase the opportunity-cost of holding Gold vis-a-vis an interest-bearing asset or placing the money in a cash deposit account. On the flipside, lower inflation tends to be positive for Gold as it brings interest rates down, making the bright metal a more viable investment alternative.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.