GBP/USD Price Forecast: Clings to gains, struggles near 1.3100

The Pound Sterling clung to minimal gains against the Greenback on Thursday, even though UK

economic data revealed that business activity remains solid. At the time of writing, the GBP/USD trades at 1.3097, up by 0.10%.

Read More...

Pound Sterling surrenders intraday gains as flash US PMI beats estimates

The Pound Sterling (GBP) surrenders its entire intraday gains and dips below 1.3100 against the US Dollar (USD) in Thursday’s early New York session. The GBP/USD pair struggles to extend its winning streak to a sixth trading session on Thursday as the flash United States (US) S&P Global Composite PMI data for August came in better-than-expected.

Read More...

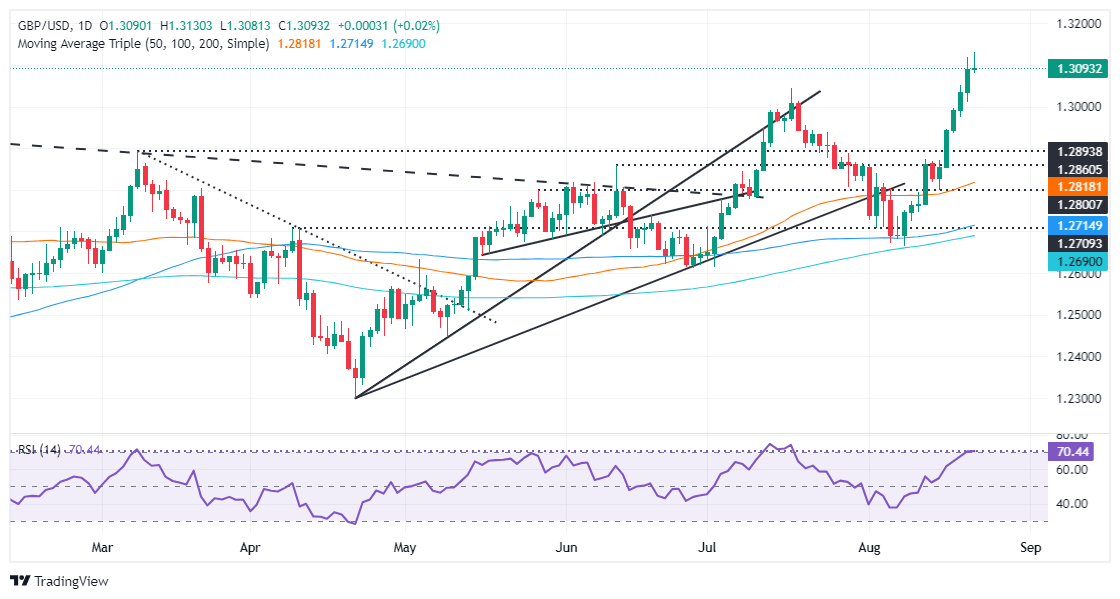

GBP/USD Price Prediction: Consolidates below 1.3100 and YTD peak, bullish potential intact

The

GBP/USD pair oscillates in a narrow band during the Asian session on Thursday and remains within striking distance of its highest level since July 2023, around the 1.3120 area touched the previous day. Spot prices currently trade around the 1.3085 region, nearly unchanged for the day, as traders now look to the flash PMIs from the UK and the US for short-term opportunities.

Read More...