GBP/USD Price Forecast: Clings to gains, struggles near 1.3100

- GBP/USD hovers below 1.3100, with price action suggesting buyer caution amid Fed rate cut uncertainty.

- A break above 1.3100 could target the YTD high of 1.3130, with further gains towards 1.3200.

- A close below 1.3100 for a second day may trigger a pullback, potentially testing the 1.3010 level and the August 13 peak at 1.2872.

The Pound Sterling clung to minimal gains against the Greenback on Thursday, even though UK economic data revealed that business activity remains solid. At the time of writing, the GBP/USD trades at 1.3097, up by 0.10%.

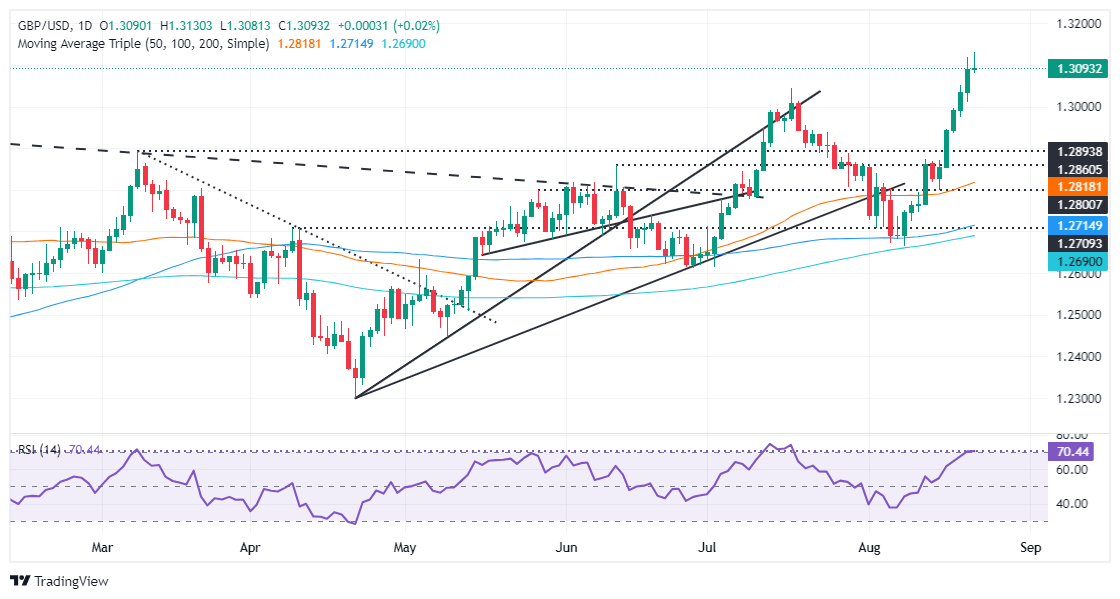

GBP/USD Price Forecast: Technical outlook

After breaching the 1.3100 figure, the GBP/USD retreated somewhat, yet it remains hovering below the latter. Price action during the last couple of days hints that buyers remain reluctant to open fresh bets that the Pound will extend its gains amidst uncertainty on the Fed's interest rate cuts.

If GBP/USD climbs past 1.3100 and clears the year-to-date (YTD) high of 1.3130, expect a challenge of the 1.3200 mark.

On the other hand, if the pair registers a close below 1.3100 for the second straight day, it could pave the way for a pullback and threaten to challenge the August 20 low of 1.3010. If surpassed, the next demand area would be the August 13 peak of 1.2872.

GBP/USD Price Action – Daily Chart

British Pound PRICE Today

The table below shows the percentage change of British Pound (GBP) against listed major currencies today. British Pound was the strongest against the Japanese Yen.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.35% | -0.03% | 0.75% | 0.04% | 0.50% | 0.29% | 0.07% | |

| EUR | -0.35% | -0.38% | 0.37% | -0.33% | 0.16% | -0.08% | -0.28% | |

| GBP | 0.03% | 0.38% | 0.75% | 0.06% | 0.54% | 0.30% | 0.09% | |

| JPY | -0.75% | -0.37% | -0.75% | -0.78% | -0.23% | -0.46% | -0.66% | |

| CAD | -0.04% | 0.33% | -0.06% | 0.78% | 0.47% | 0.24% | 0.03% | |

| AUD | -0.50% | -0.16% | -0.54% | 0.23% | -0.47% | -0.22% | -0.44% | |

| NZD | -0.29% | 0.08% | -0.30% | 0.46% | -0.24% | 0.22% | -0.22% | |

| CHF | -0.07% | 0.28% | -0.09% | 0.66% | -0.03% | 0.44% | 0.22% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.