Pound Sterling Price News and Forecast: GBP/USD challenges the immediate resistance near 1.3014

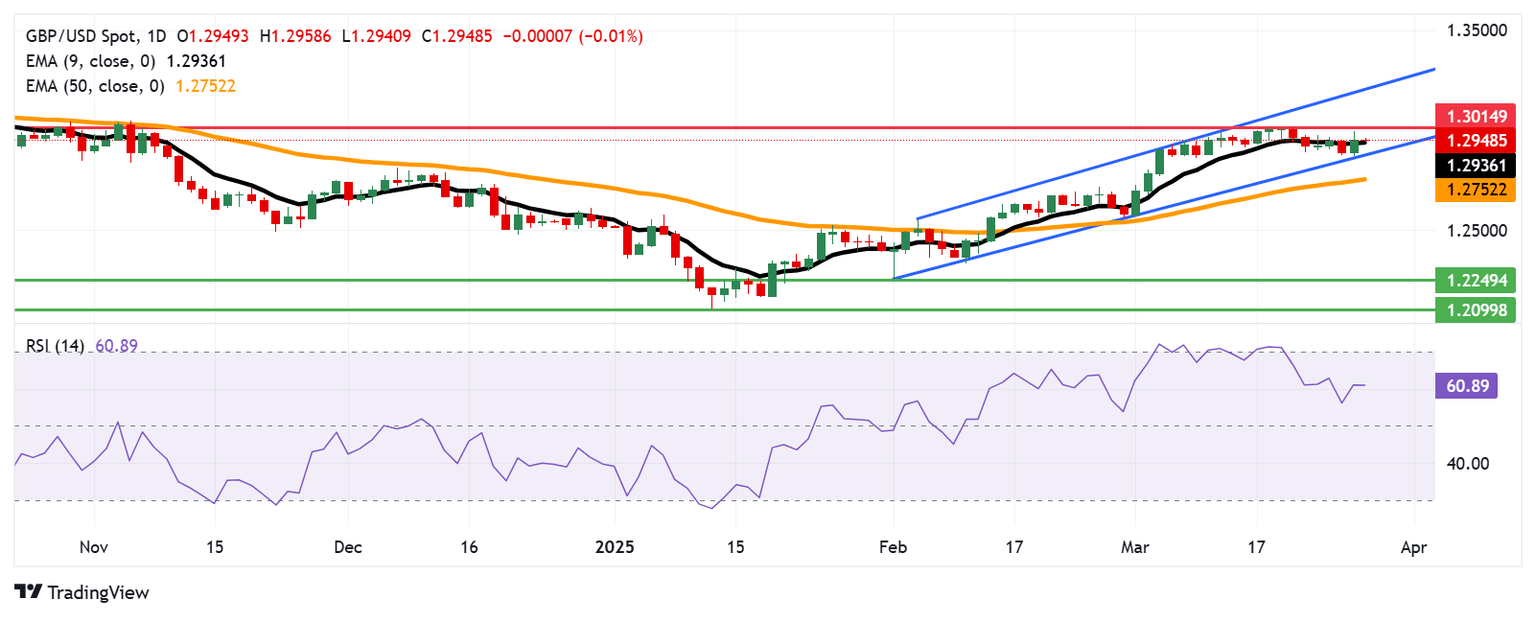

GBP/USD Price Forecast: Hovers around 1.2950 near nine-day EMA

The GBP/USD pair holds steady after gains in the previous session, hovering around 1.2950 during Friday's Asian trading hours. The technical analysis of the daily chart suggests a sustained bullish outlook, with the pair consolidating within an ascending channel pattern.

The 14-day Relative Strength Index (RSI) stays above 50, signaling strong bullish momentum. Furthermore, the GBP/USD pair rebounds above the nine-day Exponential Moving Average (EMA), reinforcing a bullish outlook for short-term price movement. Read more...

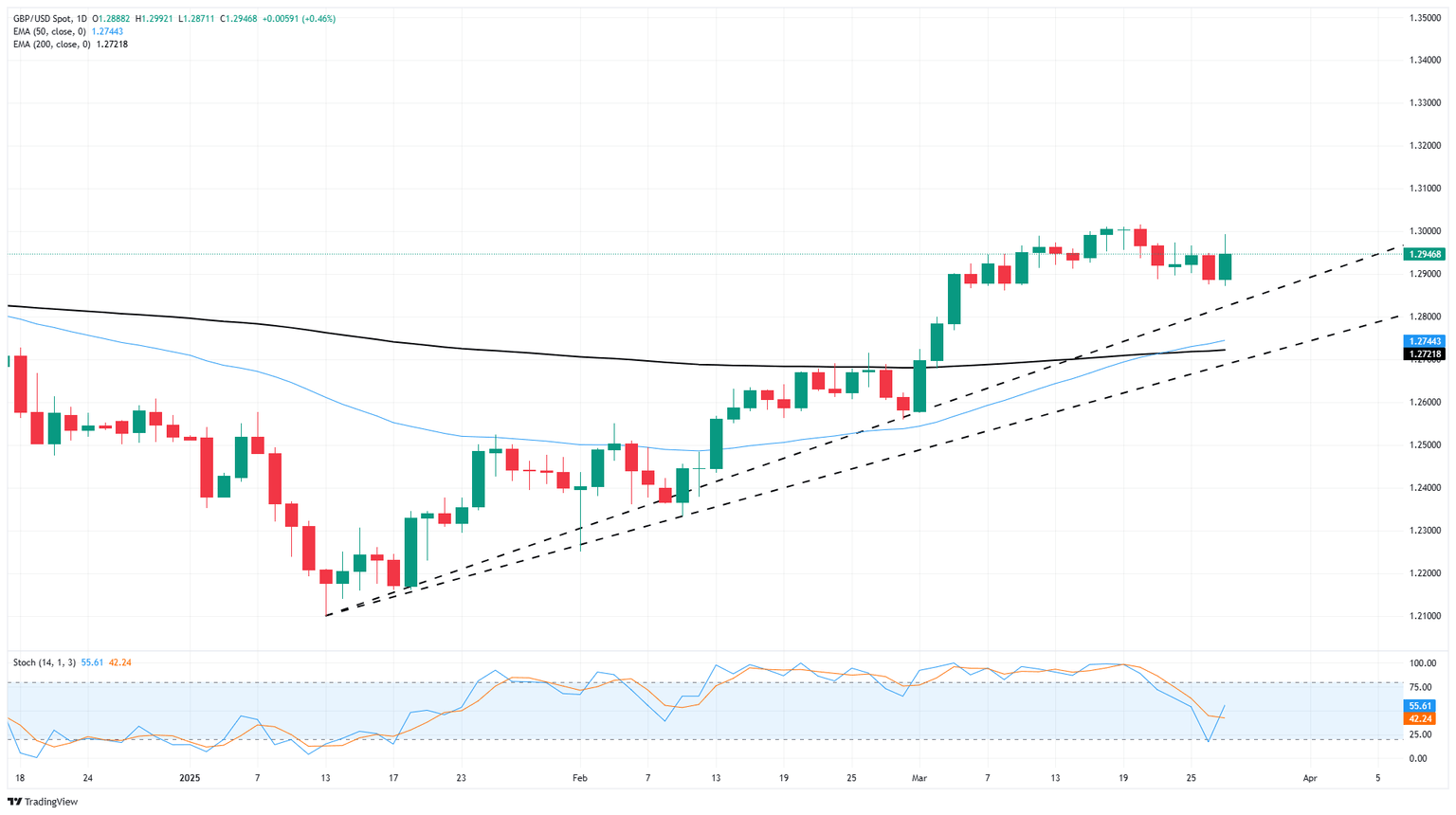

GBP/USD attempts another rebound, but technical ceiling remains

GBP/USD found the gas pedal on Thursday, rallying one-half of one percent and climbing back over 1.2900. The 1.3000 major price handle remains out of reach for Pound bidders, but the fight against a downside pullback resumes.

UK Prime Minister Kier Starmer warned on Thursday that while US tariffs will be “crippling” to the UK economy, policymakers remain committed to fighting back against US President Donald Trump’s lopsided approach to global trade policy. PM Starmer’s comments matched similar intonations from Canadian Prime Minister Mark Carney as most of the US’s former trading partners turn increasingly hostile on trade talks with the Trump administration. Read more...

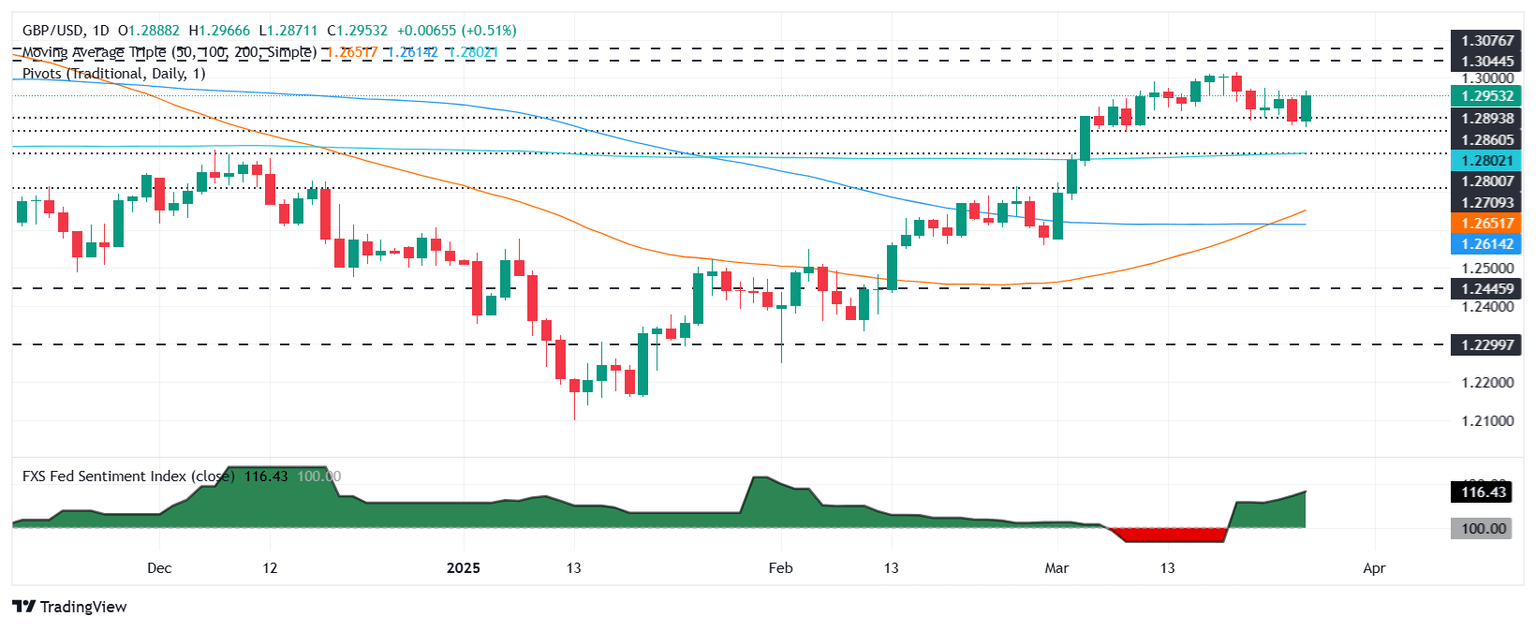

GBP/USD climbs despite Trump’s auto tariffs, markets bet on UK exemption

The Pound Sterling (GBP) rises during the North American session against the Greenback even though US President Donald Trump enacted automotive tariffs on all cars made outside the United States (US). Initially, risk appetite deteriorated, but it has improved. Therefore, high-beta currencies like the Sterling advance, with GBP/USD trading near 1.2930, up 0.35%.

On Wednesday, Trump announced 25% duties on imported automobiles, effective April 2. He said that he would announce additional tariffs next week. Read more...

Author

FXStreet Team

FXStreet