GBP/USD climbs despite Trump’s auto tariffs, markets bet on UK exemption

- Sterling gains 0.35% as high-beta currencies benefit from improved sentiment despite initial tariff shock.

- Trump enacts 25% auto tariffs effective April 2; UK says talks underway to secure exemption.

- US data mixed with jobless claims are near estimates, GDP has been revised up, and home sales are still in decline.

The Pound Sterling (GBP) rises during the North American session against the Greenback even though US President Donald Trump enacted automotive tariffs on all cars made outside the United States (US). Initially, risk appetite deteriorated, but it has improved. Therefore, high-beta currencies like the Sterling advance, with GBP/USD trading near 1.2930, up 0.35%.

GBP/USD rises as risk appetite rebounds, while UK seeks carve-out from new US trade measures

On Wednesday, Trump announced 25% duties on imported automobiles, effective April 2. He said that he would announce additional tariffs next week.

This triggered a reaction worldwide, including in the United Kingdom (UK). Finance Minister Rachel Reeves said they are working with the White House to secure an exemption from US auto tariffs.

Data from the Society of Motor Manufacturers and Traders revealed that the US is Britain’s second-largest car export market after the European Union (EU).

Aside from this, US economic data revealed that the number of Americans applying for unemployment benefits rose below estimates of 225K, increasing by 224K in the week ending March 22. Other data showed that the GDP for the last quarter of 2024 was confirmed at 2.3% QoQ, up from 1.9%, slightly below estimates of 2.4%, and Pending Home Sales dipped 3.6% YoY in February, though improved compared to January’s 5.2% plunge.

Ahead this week, the UK economic docket will feature Retail Sales data. Across the pond, investors eye speeches by Federal Reserve (Fed) officials alongside the release of the Fed’s favorite inflation gauge, the Personal Consumption Expenditures (PCE) Price Index.

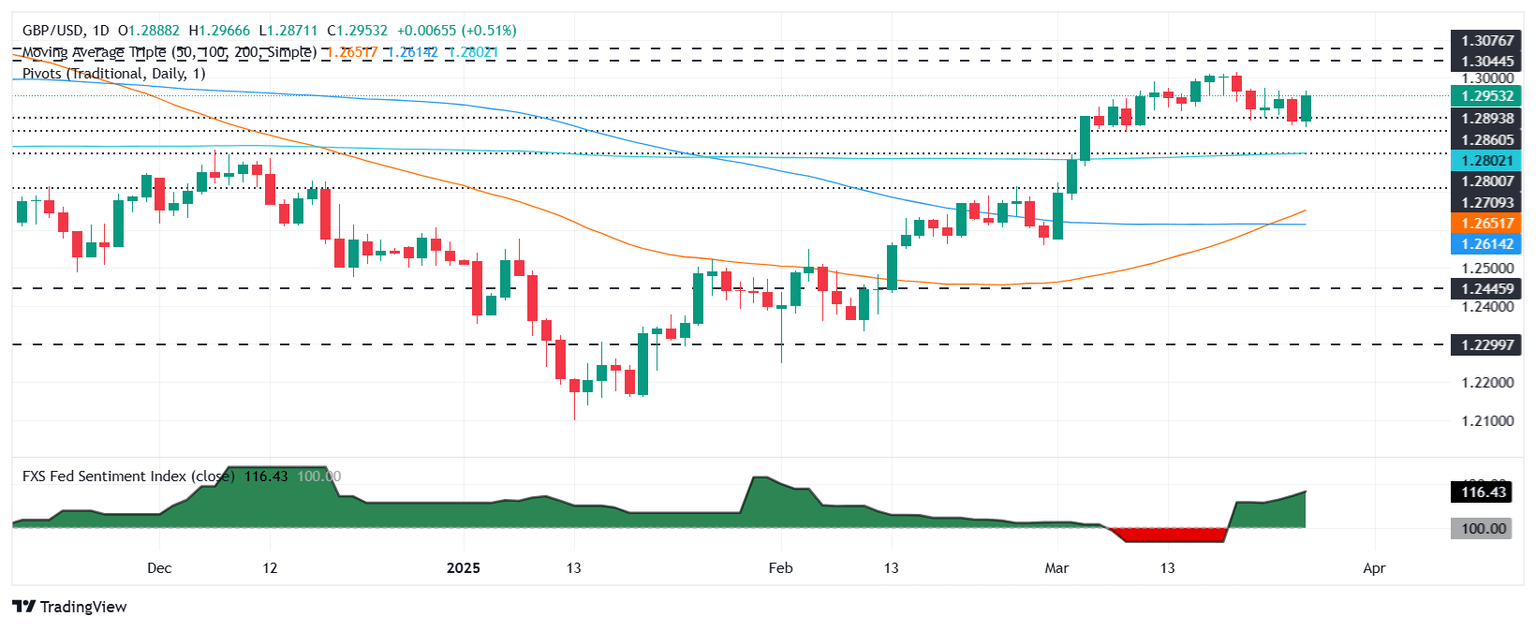

GBP/USD Price Forecast: Technical outlook

Even though GBP/USD resumed its uptrend, it remains shy of cracking the current week’s peak of 1.2973, which could set the pair to challenge the 1.3000 figure. Price action suggests buyers are losing some steam, as it continues to print back-to-back lower lows, but a daily close above the 1.2950 would be crucial for buyers if they would like to test higher prices.

The Relative Strength Index (RSI) is bullish and aims up but lies below the latest, indicating a lack of strength of buyers.

On the flip side, if GBP/USD drops below 1.2900, it paves the path to challenge the 200-day Simple Moving Average (SMA) at 1.2801.

British Pound PRICE This week

The table below shows the percentage change of British Pound (GBP) against listed major currencies this week. British Pound was the strongest against the Japanese Yen.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.25% | -0.25% | 1.09% | -0.28% | -0.48% | -0.16% | -0.03% | |

| EUR | -0.25% | -0.60% | 0.29% | -0.49% | -0.74% | -0.37% | -0.24% | |

| GBP | 0.25% | 0.60% | 1.33% | -0.51% | -0.17% | 0.25% | 0.27% | |

| JPY | -1.09% | -0.29% | -1.33% | -1.36% | -1.56% | -1.20% | -1.10% | |

| CAD | 0.28% | 0.49% | 0.51% | 1.36% | -0.13% | 0.12% | 0.26% | |

| AUD | 0.48% | 0.74% | 0.17% | 1.56% | 0.13% | 0.39% | 0.53% | |

| NZD | 0.16% | 0.37% | -0.25% | 1.20% | -0.12% | -0.39% | 0.20% | |

| CHF | 0.03% | 0.24% | -0.27% | 1.10% | -0.26% | -0.53% | -0.20% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.