Pound Sterling Price News and Forecast: GBP/USD bulls embarking on a correction of strong weekly downtrend

BOE Quick Analysis: GBP/USD buying opportunity? Three reasons see upside from here

A dovish hike – the Bank of England has delivered a cautious increase of interest rates, similar to what investors had expected from the Federal Reserve. One dovish dissenter – Jon Cunliffe who preferred to leave rates unchanged – and a subtle change in tone are genuine reasons to sell sterling. The bank previously said that further modest tightening is likely to be appropriate, and now it says it may be appropriate. One dovish dissenter out of nine and that single word do not go the full length to explain the 100-pip downfall of GBP/USD. Read more...

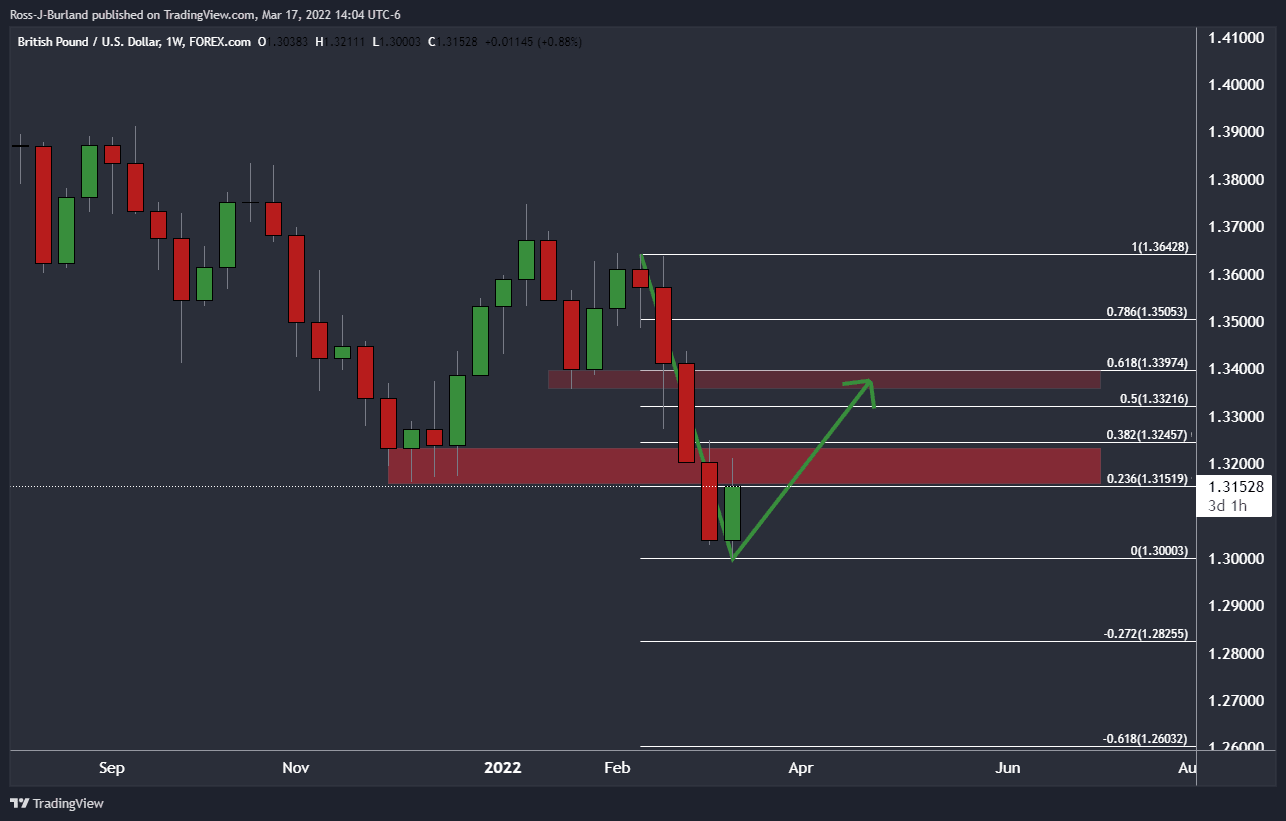

GBP/USD bulls embarking on a correction of strong weekly downtrend

GBP/USD is back to trading around flat the day as the US dollar firms within a bearish phase. GBP/USD has traveled with a 1.3087 and 1.3210 range and at 1.3150 currently, the price is 0.03% in the green. The drivers in markets are central banks and the Ukraine crisis. Markets have been momentarily distracted from the calamity of the Russian invasion by the Federal Reserve and Bank of England central bank meetings. The US dollar has been unwound and the pound has been thrown around by mixed sentiment on the outcomes of both meetings and subsequent reactions in global financial markets. Read more...

GBP/USD stalls after BoE hikes rates

GBP/USD found little support after the BoE raised its bank rate by 25 bps to 0.75% on Thursday. Within the forty-five minutes after the announcement, the pair shed c. 0.90% of its value to touch an intra-day low of 1.30876 before retracing only some if its losses later in the day. Maybe part of the knee-jerk reaction lower in GBP/USD could be attributed to typical “buy the rumor sell the fact” behavior. Bond market investors and economists had placed near certainly on Thursday’s 25 bps hike. Read more...

Author

FXStreet Team

FXStreet