Pound Sterling Price News and Forecast: GBP/USD Bearish pressure builds up as geopolitical tensions escalate

GBP/USD Forecast: Bearish pressure builds up as geopolitical tensions escalate

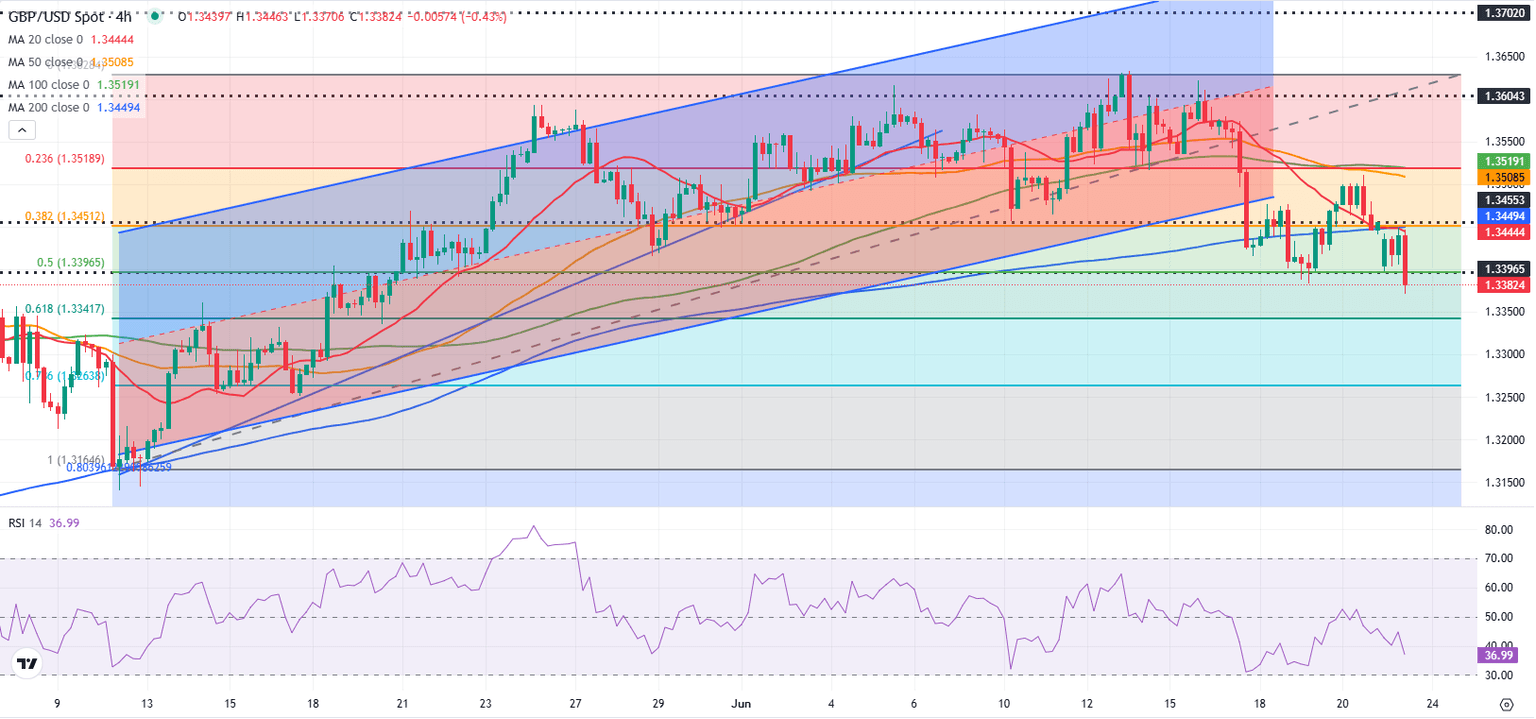

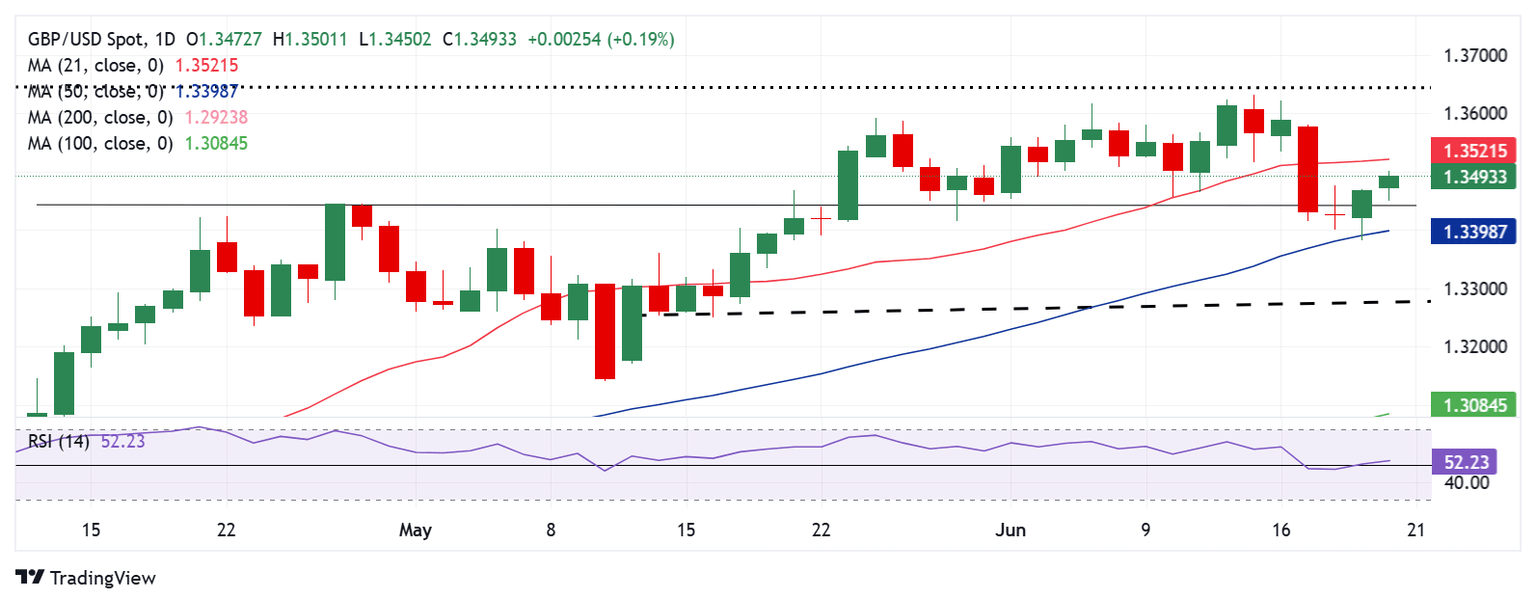

After losing nearly 1% in the previous week, GBP/USD stays under bearish pressure on Monday and trades at its lowest level in a month below 1.3400. In case safe-haven flows continue to dominate the action in financial markets in the second half of the day, the pair could continue to stretch lower.

The negative shift seen in risk sentiment helps the US Dollar (USD) outperform its rivals and weighs on GBP/USD on Monday. Market participants grow increasingly worried about a widening and deepening conflict in the Middle East following the United States' decision to strike three nuclear facilities in Iran over the weekend. Read more...

GBP/USD Weekly Outlook: Powell, Bailey comments to drive Pound Sterling moves after rollercoaster week

The Pound Sterling (GBP) staged a late recovery against the US Dollar (USD) after the GBP/USD pair corrected sharply to monthly lows below 1.3400. The price action around the GBP/USD pair in the past week was mainly dictated by the ongoing developments surrounding the Israel-Iran geopolitical escalation even as trade uncertainties continued to linger.

The US Dollar received a double booster shot amid reviving safe-haven demand, courtesy of the Middle East conflict, and the hawkish hold decision by the US Federal Reserve (Fed). Read more...

Author

FXStreet Team

FXStreet