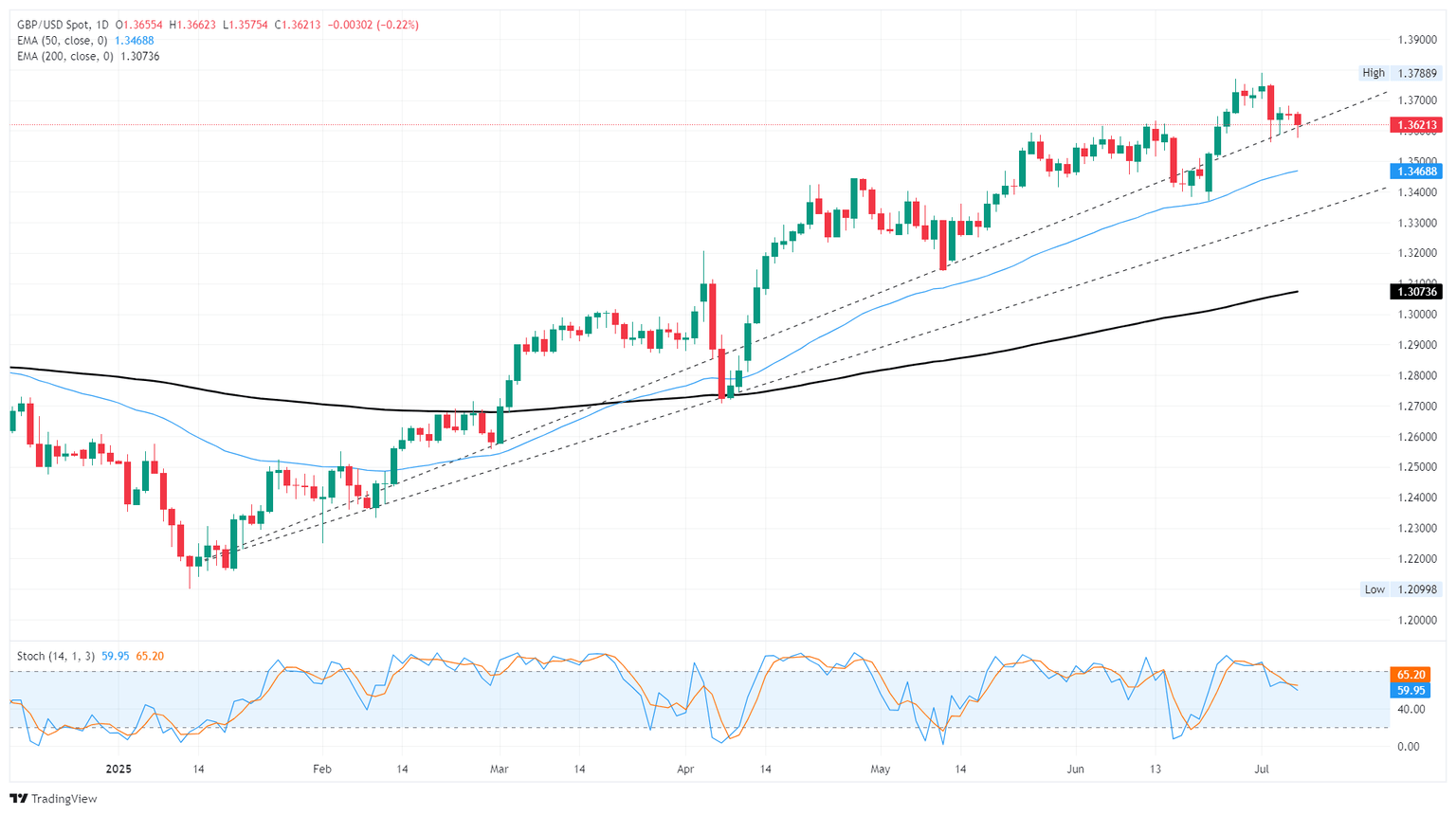

Pound Sterling Price News and Forecast: GBP/USD appreciates as US Dollar weakens following Trump’s tariff news

GBP/USD rises toward 1.3650 after Trump’s tariff hikes on 14 countries

GBP/USD edges higher after two days of losses, trading around 1.3630 during the Asian hours on Tuesday. The pair appreciates as the US Dollar (USD) loses ground as traders adopt caution after US President Donald Trump announced updated tariff rates on 14 countries that have yet to secure trade deals with Washington.

The Trump administration announced levies of 25% on goods from Japan and South Korea, with threatens to escalate tariffs if the two nations retaliate. The US also imposed 25% rates on Malaysia, Kazakhstan and Tunisia, while South Africa would see a 30% tariff and Laos and Myanmar would face a 40% levy. Other nations hit with levies included Indonesia with a 32% rate, Bangladesh with 35%, and Thailand and Cambodia with duties of 36%. President Trump has also signed an executive order delaying the implementation of new tariffs from July to August 1, giving negotiators more time to reach agreements, per Bloomberg. Read more...

GBP/USD pauses losses as Trump’s tariff threats increase risk aversion

GBP/USD shed some weight on Monday, trimming further into the low side and adding onto near-term losses as Pound Sterling bulls take a breath. Losses were contained in early-week trading; however, a fresh bout of tariff threats from US President Donald Trump has crimped investor risk appetite, curbing topside market flows and sparking a fresh risk-off push into the US Dollar.

The Trump administration hit the ground running this week, pushing back its own self-imposed July 9 deadline for the restart of wide-ranging reciprocal tariffs that were initially announced and then immediately delayed in early April. Despite yet another pivot on “firm” deadlines for tariffs from the Trump team, President Trump has announced a fresh batch of additional tariffs, adding double-digit tariff levels to take effect on April 1 alongside the suspended reciprocal tariffs. Read more...

GBP/USD holds above key level despite rate divergence and trade war jitters

The Pound Sterling (GBP) is virtually unchanged during the North American session, but it remains above a key technical level, following a solid US jobs report in the United States (US) last week. This, along with the likelihood of further tax hikes by the UK government, is exerting pressure on Cable. At the time of writing, the GBP/USD exchange rate is 1.3638.

Last week, the US revealed that the Nonfarm Payroll figures exceeded estimates of 110K, coming in at 147K, while the Unemployment Rate ticked lower. Additionally, wages remain steady, and the number of Americans filing for unemployment benefits has dipped. Read more...

Author

FXStreet Team

FXStreet