Pound Sterling Price News and Forecast: GBP ticks higher ahead of BoE policy decision, UK employment

Pound Sterling ticks higher ahead of BoE policy decision, UK Employment

The Pound Sterling (GBP) is slightly higher against its major peers, with investors focusing on the Bank of England’s (BoE) interest rate decision on Thursday. Traders are increasingly confident that the BoE will keep borrowing rates steady at 4.5%, with a 7-2 vote split.

BoE Monetary Policy Committee (MPC) members Catherine Mann and Swati Dhingra are expected to support an interest rate cut. Both officials voted for a larger-than-usual interest rate reduction of 50 basis points (bps) in the February policy meeting, while others favored a usual cut of 25 bps. Read more...

GBP/USD Forecast: Pound Sterling could extend uptrend once it stabilizes above 1.3000

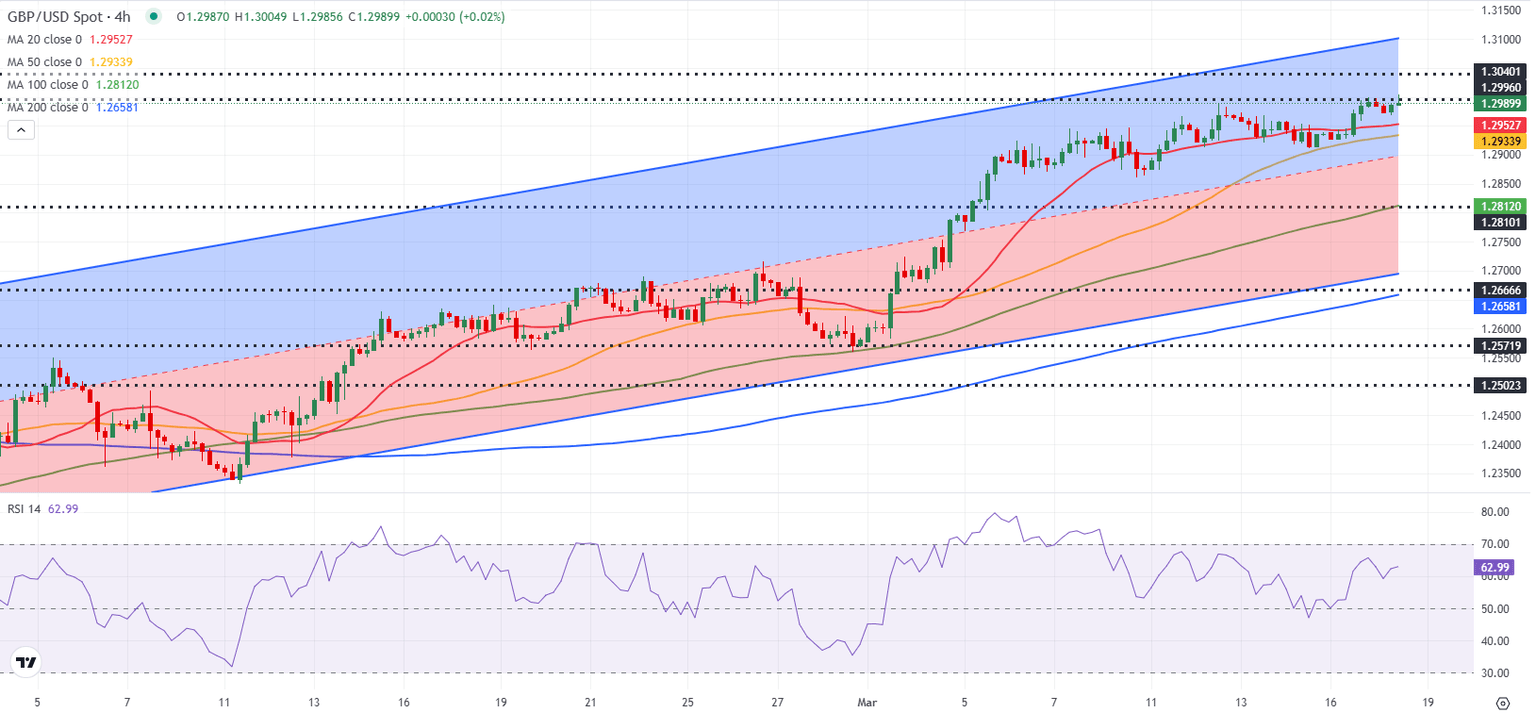

After rising more than 0.4% on Monday, GBP/USD continued to edge higher and touched its strongest level since early November above 1.3000 on Tuesday before going into a consolidation phase. The pair's short-term technical outlook shows that the bullish bias remains unchanged.

The positive shift seen in risk mood following a bullish opening in Wall Street made it difficult for the US Dollar (USD) to find demand and helped GBP/USD post daily gains on Monday. In the meantime, the data published by the US Census Bureau showed that Retail Sales rose by 0.2% on a monthly basis in February, missing the market expectation for an increase of 0.7% by a wide margin. Read more...

Author

FXStreet Team

FXStreet